Question: Use the information provided below to prepare the following pro forma statements: 4.1 Statement of Comprehensive Income for the year ended 31 December 2023

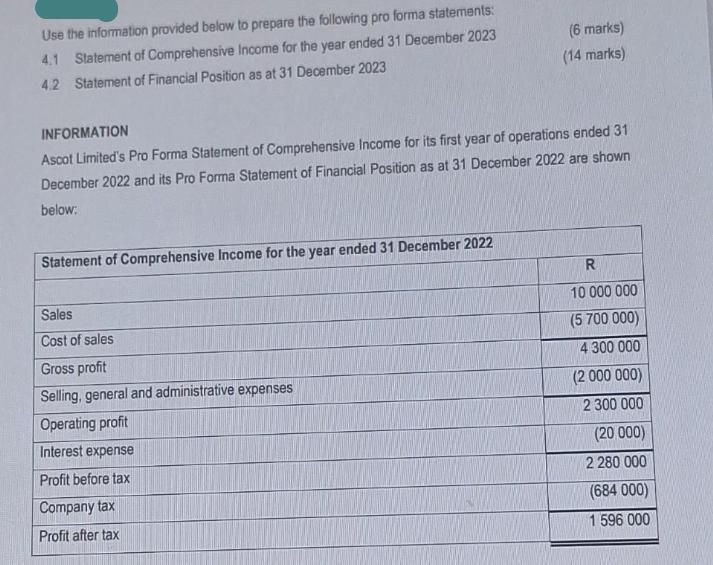

Use the information provided below to prepare the following pro forma statements: 4.1 Statement of Comprehensive Income for the year ended 31 December 2023 4.2 Statement of Financial Position as at 31 December 2023 INFORMATION Ascot Limited's Pro Forma Statement of Comprehensive Income for its first year of operations ended 31 December 2022 and its Pro Forma Statement of Financial Position as at 31 December 2022 are shown below: Statement of Comprehensive Income for the year ended 31 December 2022 Sales Cost of sales Gross profit Selling, general and administrative expenses Operating profit Interest expense Profit before tax (6 marks) (14 marks) Company tax Profit after tax R 10 000 000 (5 700 000) 4 300 000 (2 000 000) 2 300 000 (20 000) 2 280 000 (684 000) 1 596 000 Statement of Financial Position as at 31 December 2022 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Accounts receivable Cash EQUITY AND LIABILITIES Equity Non-current liabilities Loan Current liabilities Accounts payable 1. 2. 3. 4. R 2 200 000 2 200 000 4 700 000 2 000 000 900 000 1 800 000 6 900 000 Additional information for 2023 is as follows: Sales for the year ended 31 December 2023 are expected to total R12 000 000. Company tax is calculated at 30% of the pre-tax profit. Seventy percent (70%) of the profit after tax will be paid out in dividends. The amount of external funding required (non-current liabilities) must be calculated (balancing 5. 6 000 000 300 000 300 000 600 000 600 000 6 900 000 figure). Except for the above (additional information 1 to 4) the pro forma financial statements must be prepared using the percentage-of-sales method.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts