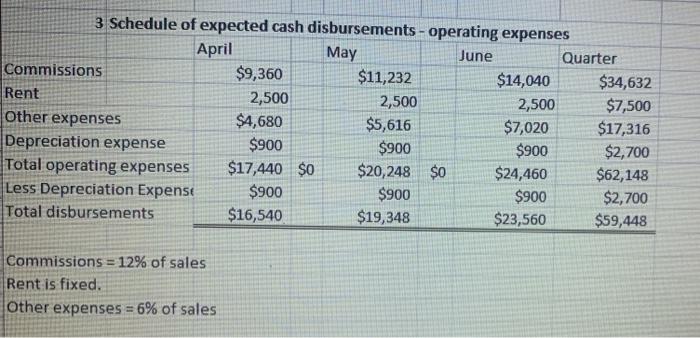

Question: Use the informations given from the first picture to solve problem below. 3 Schedule of expected cash disbursements-operating expenses April May June Quarter Commissions $9,360

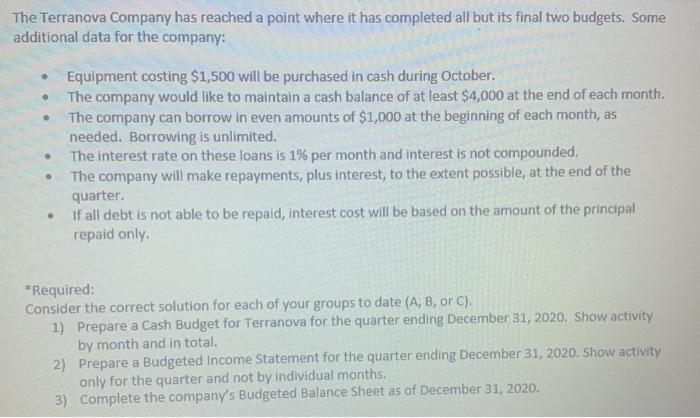

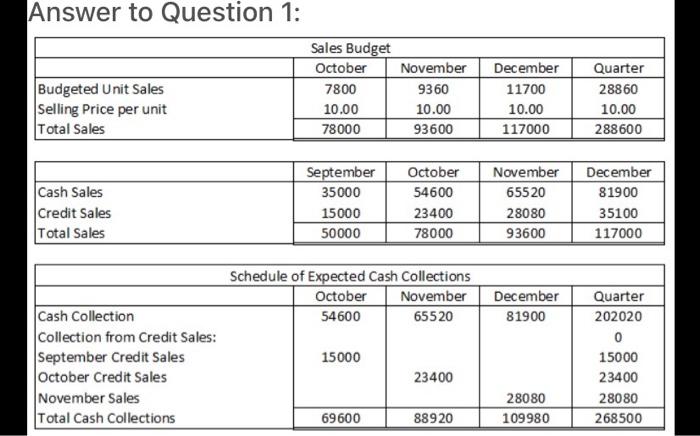

3 Schedule of expected cash disbursements-operating expenses April May June Quarter Commissions $9,360 $11,232 $14,040 $34,632 Rent 2,500 2,500 2,500 $7,500 Other expenses $4,680 $5,616 $7,020 $17,316 Depreciation expense $900 $900 $900 $2,700 Total operating expenses $17,440 $0 $20,248 $0 $24,460 $62,148 Less Depreciation Expense $900 $900 $900 $2,700 Total disbursements $16,540 $19,348 $23,560 $59,448 Commissions = 12% of sales Rent is fixed. other expenses = 6% of sales The Terranova Company has reached a point where it has completed all but its final two budgets. Some additional data for the company: Equipment costing $1,500 will be purchased in cash during October. The company would like to maintain a cash balance of at least $4,000 at the end of each month. The company can borrow in even amounts of $1,000 at the beginning of each month, as needed. Borrowing is unlimited. The interest rate on these loans is 1% per month and interest is not compounded. The company will make repayments, plus interest, to the extent possible, at the end of the quarter. If all debt is not able to be repaid, interest cost will be based on the amount of the principal repaid only . *Required: Consider the correct solution for each of your groups to date (A, B, or C). 1) Prepare a Cash Budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. 2) Prepare a Budgeted Income Statement for the quarter ending December 31, 2020. Show activity only for the quarter and not by individual months. 3) Complete the company's Budgeted Balance Sheet as of December 31, 2020. Answer to Question 1: Budgeted Unit Sales Selling Price per unit Total Sales Sales Budget October November 7800 9360 10.00 10.00 78000 93600 December 11700 10.00 117000 Quarter 28860 10.00 288600 Cash Sales Credit Sales Total Sales September 35000 15000 50000 October 54600 23400 78000 November 65520 28080 93600 December 81900 35100 117000 Schedule of Expected Cash Collections October November 54600 65520 December 81900 15000 Cash Collection Collection from Credit Sales: September Credit Sales October Credit Sales November Sales Total Cash Collections Quarter 202020 0 15000 23400 28080 268500 23400 28080 109980 69600 88920 3 Schedule of expected cash disbursements-operating expenses April May June Quarter Commissions $9,360 $11,232 $14,040 $34,632 Rent 2,500 2,500 2,500 $7,500 Other expenses $4,680 $5,616 $7,020 $17,316 Depreciation expense $900 $900 $900 $2,700 Total operating expenses $17,440 $0 $20,248 $0 $24,460 $62,148 Less Depreciation Expense $900 $900 $900 $2,700 Total disbursements $16,540 $19,348 $23,560 $59,448 Commissions = 12% of sales Rent is fixed. other expenses = 6% of sales The Terranova Company has reached a point where it has completed all but its final two budgets. Some additional data for the company: Equipment costing $1,500 will be purchased in cash during October. The company would like to maintain a cash balance of at least $4,000 at the end of each month. The company can borrow in even amounts of $1,000 at the beginning of each month, as needed. Borrowing is unlimited. The interest rate on these loans is 1% per month and interest is not compounded. The company will make repayments, plus interest, to the extent possible, at the end of the quarter. If all debt is not able to be repaid, interest cost will be based on the amount of the principal repaid only . *Required: Consider the correct solution for each of your groups to date (A, B, or C). 1) Prepare a Cash Budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. 2) Prepare a Budgeted Income Statement for the quarter ending December 31, 2020. Show activity only for the quarter and not by individual months. 3) Complete the company's Budgeted Balance Sheet as of December 31, 2020. Answer to Question 1: Budgeted Unit Sales Selling Price per unit Total Sales Sales Budget October November 7800 9360 10.00 10.00 78000 93600 December 11700 10.00 117000 Quarter 28860 10.00 288600 Cash Sales Credit Sales Total Sales September 35000 15000 50000 October 54600 23400 78000 November 65520 28080 93600 December 81900 35100 117000 Schedule of Expected Cash Collections October November 54600 65520 December 81900 15000 Cash Collection Collection from Credit Sales: September Credit Sales October Credit Sales November Sales Total Cash Collections Quarter 202020 0 15000 23400 28080 268500 23400 28080 109980 69600 88920

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts