Use the Loren Inc case study to answer the following questions:

1) Does it make sense to have multiple sources for materials such as this? Why?

2) Do you believe the one bid policy at Loren Inc to be a wise one?

3) Why is supply assurance important? Does it matter more than price in this scenario? Why or why not?

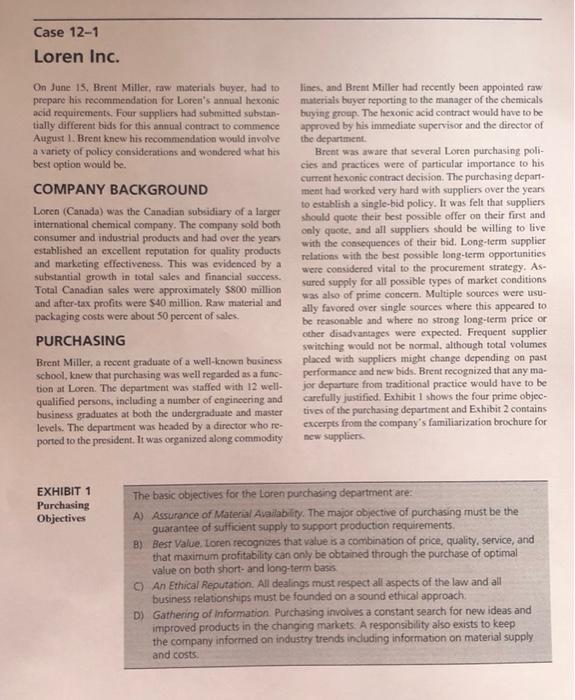

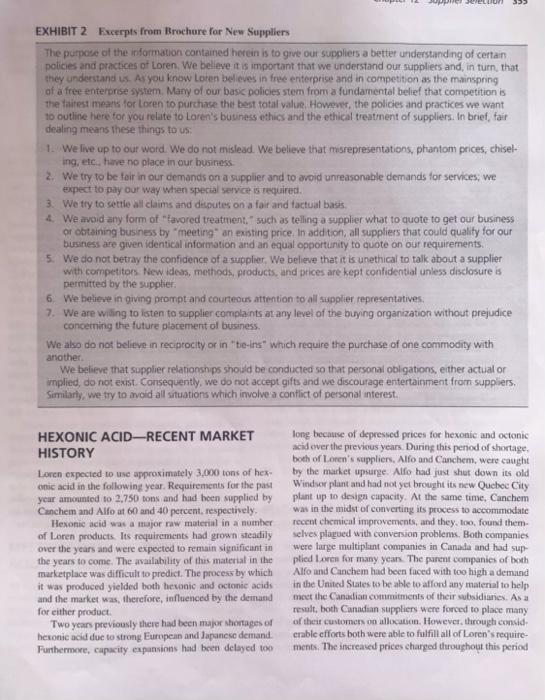

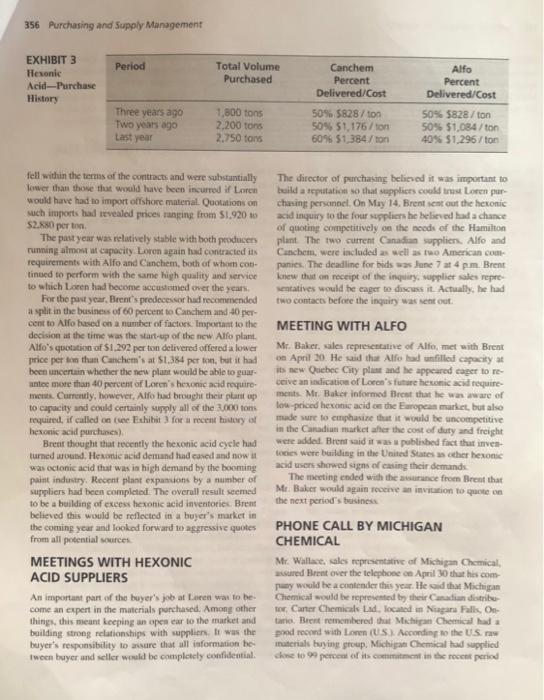

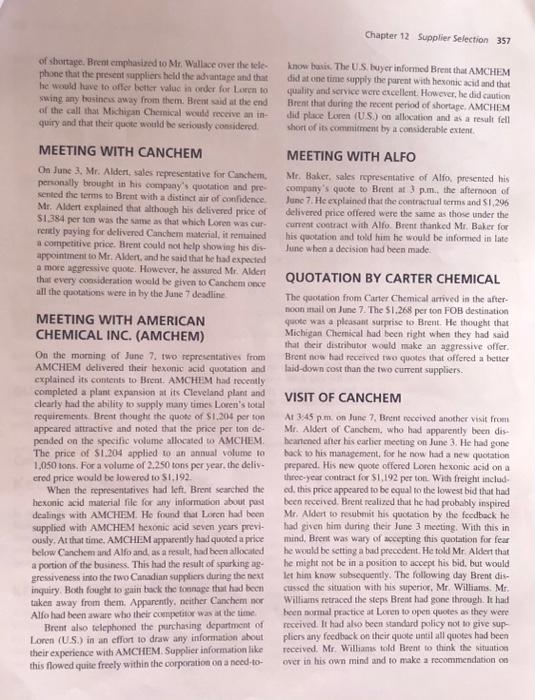

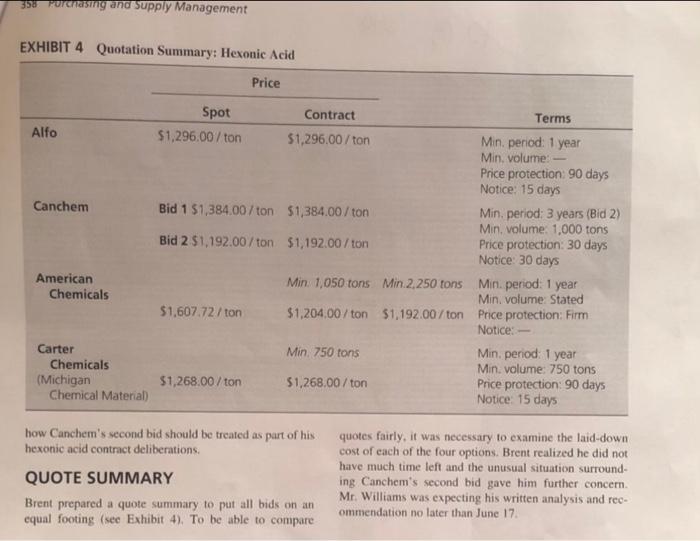

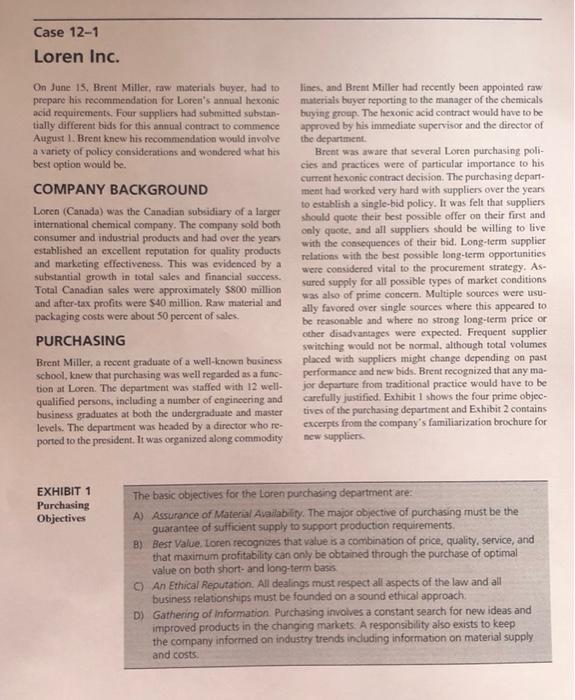

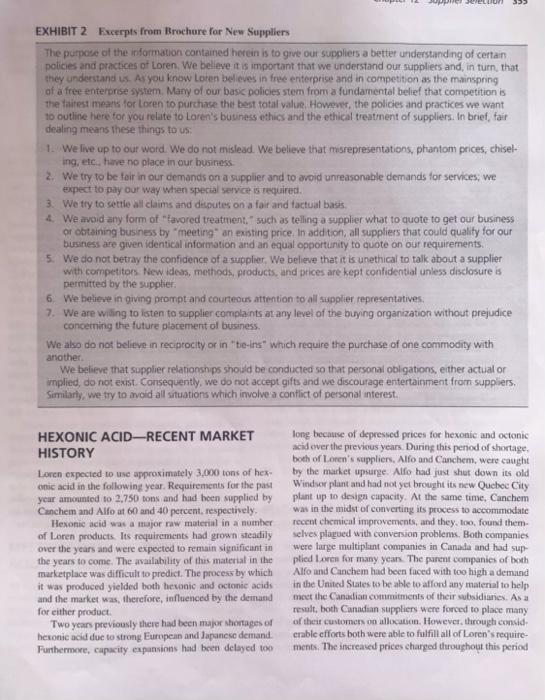

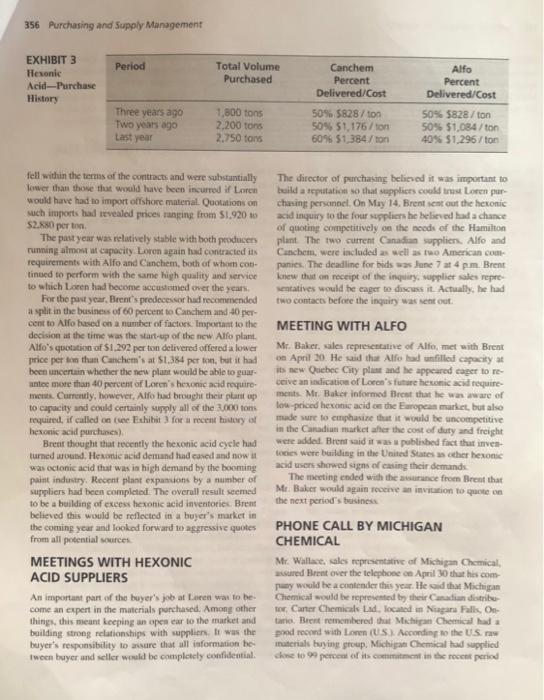

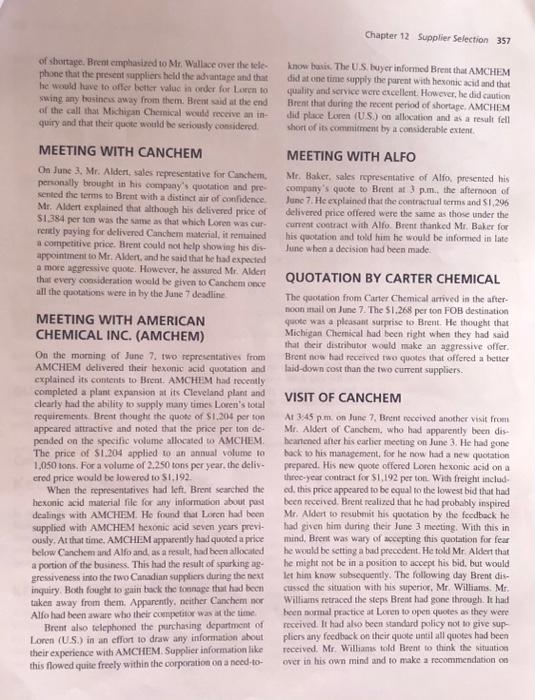

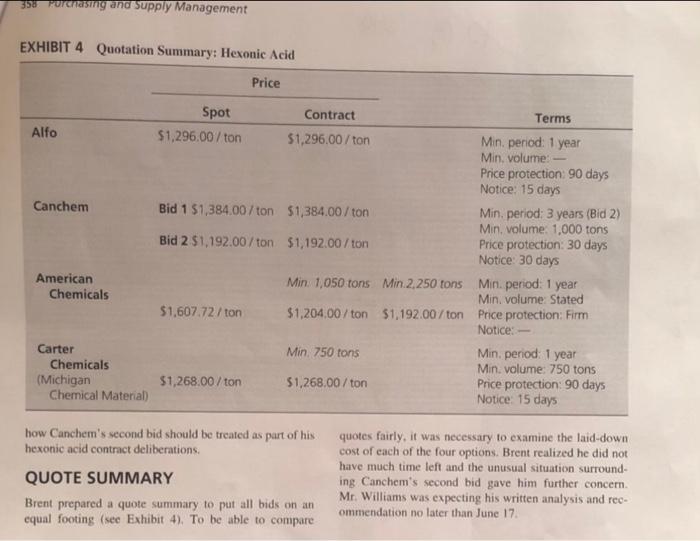

Case 12-1 Loren Inc. On June 15. Brent Miller, raw materials buyer, had to prepare his recommendation for Loren's annual hexonic acid requirements. Four suppliers had submitted substan- tially different bids for this annual contract to commence August 1, Brent knew his recommendation would involve a variety of policy considerations and wondered what his best option would be COMPANY BACKGROUND Loren (Canada) was the Canadian subsidiary of a larger international chemical company. The company sold both consumer and industrial products and had over the years established an excellent reputation for quality products and marketing effectiveness. This was evidenced by a substantial growth in total sales and financial success. Total Canadian sales were approximately $800 million and after-tax profits were $40 million, Raw material and packaging costs were about 50 percent of sales, PURCHASING Brent Miller, a recent graduate of a well-known business school, knew that purchasing was well regarded as a func- tion at Loren. The department was staffed with 12 well- qualified persons, including a number of engineering and business graduates at both the undergraduate and master levels. The department was headed by a director who re- ported to the president. It was organized along commodity lines, and Brent Miller had recently been appointed raw materials buyer reporting to the manager of the chemicals buying group. The hexonic acid contract would have to be approved by his immediate supervisor and the director of the department Brent was aware that several Loren purchasing poli- cies and practices were of particular importance to his current hexonic contract decision. The purchasing depart- ment had worked very hard with suppliers over the years to establish a single-bid policy. It was felt that suppliers should quote their best possible offer on their first and only quote, and all suppliers should be willing to live with the consequences of their bid. Long-term supplier relations with the best possible long-term opportunities were considered vital to the procurement strategy. As- sured supply for all possible types of market conditions was also of prime concern. Multiple sources were usu- ally favored over single sources where this appeared to be reasonable and where to strong long-term price or other disadvantages were expected. Frequent supplier switching would not be normal, although total volumes placed with suppliers might change depending on past performance and new bids. Brent recognized that any ma- jor departure from traditional practice would have to be carefully justified. Exhibit 1 shows the four prime objec- tives of the purchasing department and Exhibit 2 contains excerpts from the company's familiarization brochure for new suppliers EXHIBIT 1 Purchasing Objectives The basic objectives for the Loren purchasing department are: A) Assurance of Material Availability. The major objective of purchasing must be the guarantee of sufficient supply to support production requirements B) Best Value. Loren recognizes that value is a combination of price, quality service, and that maximum profitability can only be obtained through the purchase of optimal value on both short and long-term basis O An Ethical Reputation. All dealings must respect all aspects of the law and all business relationships must be founded on a sound ethical approach D) Gathering of information Purchasing involves a constant search for new ideas and improved products in the changing markets. A responsibility also exists to keep the company informed on industry trends including information on material supply and costs EXHIBIT 2 Excerpts from Brochure for New Suppliers The purpose of the information contained herein is to give our suppliers a better understanding of certain policies and practices of Loren. We believe it is important that we understand our suppliers and, in turn, that they understand us. As you know Loren believes in free enterprise and in competition as the mainspring of a free enterprise system. Many of our basic policies stem from a fundamental belief that competition is the faitest means for Loren to purchase the best total value. However, the policies and practices we want to outline here for you relate to Loren's business ethics and the ethical treatment of suppliers. In brief, fair dealing means these things to us: 1. We live up to our word. We do not mislead. We believe that misrepresentations, phantom prices, chisel- ing, etc. have no place in our business 2. We try to be fair in our demands on a supplier and to avoid unreasonable demands for services: we expect to pay our way when special service is required. 3. We try to settle all claims and disputes on a fair and factual basis. 4. We avoid any form of "lavored treatment, such as telling a supplier what to quote to get our business or obtaining business by meeting an existing price. In addition, all suppliers that could qualify for our business are given identical information and an equal opportunity to quote on our requirements. 5. We do not betray the confidence of a supplier. We believe that it is unethical to talk about a supplier with competitors New ideas, methods, products, and prices are kept confidential unless disclosure is permitted by the supplier 6. We believe in giving prompt and courteous attention to all supplier representatives 7. We are willing to listen to supplier complaints at any level of the buying organization without prejudice conceming the future placement of business, We also do not believe in reciprocity or in "tie-ins which require the purchase of one commodity with another We believe that supplier relationships should be conducted so that personal obligations, either actual or implied, do not exist. Consequently, we do not accept gifts and we discourage entertainment from suppliers, Similarly, we try to avoid all situations which involve a conflict of personal interest. HEXONIC ACID-RECENT MARKET HISTORY Loren expected to use approximately 3,000 tons of hex onic acid in the following year. Requirements for the past year amounted to 2,750 tons and had hoen supplied by Canchem and Alfo at 60 and 40 percent, respectively, Hexonic acid was a major raw material in a number of Loren products. Its requirements had grown steadily over the years and were expected to remain significant in the years to come. The availability of this material in the marketplace was difficult to predict. The process by which it was produced yielded both hexonic and octonic acids and the market was, therefore, influenced by the demand for either product Two years previously there had been major shortages of hexonic acid due to strong European and Japanese demand. Furthermore, capacity expansions had been delayed 100 Jong because of depressed prices for hexonic and octonic acid over the previous years. During this period of shortage. both of Loren's suppliers, Alfo and Canchem, were caught by the market upsurge. Alo had just shut down its old Windsor plant and had not yet brought its new Quebec City plant up to design capacity. At the same time, Canchem was in the midst of converting its process to accommodate recent chemical improvements, and they too found them selves plagued with conversion problems. Both companies were large multiplant companies in Canada and had sup plied Loren for many years. The parent companies of both Alfo and Canchem had been faced with too high a demand in the United States to be able to afford any material to help meet the Canadian commitments of their subsidiaries. As a result, both Canadian suppliers were forced to place many of their customers on allocation. However, through consid erable efforts both were able to fulfill all of Loren's require ments. The increased prices charged throughout this period 356 Purchasing and Supply Management Period EXHIBIT 3 Hexonic Acid-Purchase History Total Volume Purchased Canchem Percent Delivered/Cost Alfo Percent Delivered Cost 50% 5828/ton 50% $1,084 /ton 40% $1.296/ton Three years ago Two years ago Last year 1,800 tons 2,200 tons 2.750 tons 5055828/ton 50% 51,176/ton 6096 51.384 / ton The director of purchasing believed it was important to build a reputation so that suppliers could trust Loren par chasing personnel On May 14. Brent set out the heronic acid inquiry to the four suppliers he believed had a chance of quoting competitively on the needs of the Hamilton plant. The two current Canadian suppliers. Alfo and Canchem, were included as well as to American con panies. The deadline for bids was Jone 7 at 4 pm Brent knew that on receipt of the inquiry, supplier sales repre sentatives would be eager to discuss it. Actually, he had two contacts before the inquiry was sent of fell within the terms of the contracts and were substantially lower than those that would have been incurred if Loren would have had to import offshore material. Quotations on such imports had revealed prices ranging from $1.920 10 52.880 per on The past year was relatively stable with both producers running almost a capacity. Loron again had contracted its requirements with Alfo and Cinchem, both of whom con tinued to perform with the same high quality and service to which Loren had become accustomed over the years For the past year, Brent's predecessor had recommended a split in the business of 60 percent to Canchem and 40 per cent to Alfo based on a number of factors. Important to the decision at the time was the start-up of the new Alfo plant Alfo's quotation of $1.292 per ton delivered offered a lower price per lo thun Cachem's at 51,384 per ton, but it had been uncertain whether the new plant would be able to guar ante more than 40 percent of Loren's hexonic acid require mon. Currently, however, Alfotud brought their plant up to capacity and could certainly supply all of the 3,000 tons required. if called on (see Exhibit 3 for a recent history of hexotic acid purchases) Brent thought that recently the hexonic acid cycle had turned around. Hexonic acid demand had cared and now was octonic acid that was in high demand by the booming paint industry. Recent plant expansions by a number of suppliers had been completed. The overall result seemed to be a building of excess hexonic acid inventories. Brent believed this would be reflected in a buyer's market in the coming year and looked forward to aggressive quotes from all potential sources MEETINGS WITH HEXONIC ACID SUPPLIERS An important part of the buyer's job at Loren was to be come an expert in the materials purchased. Among other things, this meant keeping an open car to the market and building strong relationships with suppliers. It was the buyer's responsibility to ensure that all information be I won buyer and seller would be completely confidential MEETING WITH ALFO Mr. Baker, sales representative of Alf, met with Brent on April 20. He said that Alfo had unfilled capacity at is new Quebec City plant and he appeared caper to re- ceive an indication of Loren's future heronic acid require ments Mr Baker informed Brent that he was aware of low-priced hexonic acid on the European market, but also made sure to emphasize that it would be uncompetitive in the Canadian market fer the cost of duty and freight were added. Brent said it was published fact that inven toces were building in the United States as other heronic acid users showed signs of easing their demands The meeting ended with the ance from Brent that Mr. Baker would again rive invitation to quote the next period's business PHONE CALL BY MICHIGAN CHEMICAL Mr. Wallace, sales representative of Michigan Chemical, assured Brnt over the telephone on April that his com pay would be a contender this year. He said that Michigan Chemical would be represented by the Canadian distribe tor, Carter Chemicals Lid, located in Niagara Falls, O taneBrent remembered that Michigan Chemical had a pood record with Loren (US According to the US. materials buying group, Michigan Chemical had supplied chose to 99 percent of its own in the recent period Chapter 12 Supplier Selection 357 of shortage. Brent emphasized to Mr. Wallace over the tele phone that the present suppliers held the advantage and that he would have to offer better value in order for Lorento swing any business away from them. Brent said at the end of the call that Michigan Chemical would receive an in- quiry and that their quote would be seriously considered MEETING WITH CANCHEM On June 3. Mr. Aldert, sales representative for Canchem, personally brought in his company's quotation and pre- sented the terms to Brent with a distinct air of confidence Mr. Aldert explained that although his delivered price of $1,384 per ton was the same as that which Loren was cut- rently paying for delivered Canchem material, it remained a competitive price. Brent could not help showing his dis appointment to Mr. Aldert, and he said that he had expected a more aggressive quote. However, he assured Mr. Aldert that every coasideration would be given to Canchem once all the quotations were in by the June 7 deadline know basis. The U.S. buyer informed Brent that AMCHEM did at one time supply the parent with hexonic acid and that quality and service were excellent. However, he did caution Brent that during the recent period of shortage. AMCHEM did place Loren (US) on allocation and as a result fell short of its commitment by a considerable extent MEETING WITH ALFO Mr. Baker, sales representative of Alfo, presented his company's quote to Brent at 3p.m., the afternoon of June 7. He explained that the contractual terms and SI 296 delivered price offered were the same as those under the current contract with Alfo. Brent thanked Mr. Baker for his quotation and told him he would be informed in late June when a decision had been made. QUOTATION BY CARTER CHEMICAL The quotation from Carter Chemical arrived in the after- noon mail on June 7. The S1.268 per ton FOB destination quote was a pleasant surprise to Brent. He thought that Michigan Chemical had been right when they had said that their distributor would make an aggressive offer Bront now had received two quotes that offered a better laid-down cost than the two current suppliers MEETING WITH AMERICAN CHEMICAL INC. (AMCHEM) On the morning of June 7. two representatives from AMCHEM delivered their hexonic acid quotation and explained its contents to Brent. AMCHEM had recently completed a plant expansion at its Cleveland plant and clearly had the ability to supply many times Loren's total requirements Brent thought the quote of $1.204 per ton appeared attractive and noted that the price per ton de pended on the specific volume allocated to AMCHEM The price of $1.204 applied to an annual volume to 1,050 tons. For a volume of 2.250 tons per year, the deliv erod price would be lowered to SI,192 When the representatives had left. Brent searched the hexonic acid material file for any information about pasi dealings with AMCHEM. He found that Loren had been supplied with AMCHEM hexonic acid seven years previ ously. At that time, AMCHEM apparently had quoted a price below Canchem and Alfo and as a result, had been allocated a portion of the business. This had the result of sparking ag gressiveness into the two Canadian suppliers during the next inquiry. Both fought to gain back the tonnage that had been taken away from them. Apparently, neither Canchem nor Alo had been aware who their competitor was at the time Brent also telephoned the purchasing department of Loren (US) in an effort to draw any information about their experience with AMCHEM. Supplier information like this flowed quite freely within the corporation on a need-to- VISIT OF CANCHEM At 3:45 pm on June 7, Brent received another visit from Mr. Aldert of Canchem. who had apparently been dis- heartened after his earlier meeting on June 3. He had gone hack to his management, for he now had a new quotation prepared. His new quote offered Loren hexonic acid on a three-year contract for $1.192 per ton. With freight includ. cd, this price appeared to be equal to the lowest bid that had been received. Brent realized that he had probably inspired Mr. Aldert to resubmit his quotation by the feedback he had given him during their lunc 3 meeting. With this in mind, Brent was wary of accepting this quotation for fear he would be setting a bad precedent. He told Mr. Aldert that he might not be in a position to accept his bid, but would let him know subsequently. The following day Brent dis- cussed the situation with his superior, Mr. Williams. Mr. Williams retraced the steps Brent had gone through. It had been normal practice at Loren to open quotes as they were received. It had also been standard policy not to give sup- pliers any feedback on their quote until all quotes had been received. Mr. Willians told Brent to think the situation Over in his own mind and to make a recommendation on 350 POTCST and Supply Management EXHIBIT 4 Quotation Summary: Hexonic Acid Price Spot Contract Terms Alfo $1,296.00/ton 51,296.00/ton Min. period: 1 year Min. volume: - Price protection: 90 days Notice: 15 days Canchem Bid 1 51,384.00/ton $1,384.00/ton Min. period: 3 years (Bid 2) Min. volume 1,000 tons Bid 2 $1,192.00/ton $1,192.00/ton Price protection: 30 days Notice: 30 days American Min. 1,050 tons Min 2,250 tons Min. period: 1 year Chemicals Min. volume: Stated $1,607.72 / ton $1,204,00/ton $1,192.00/ton Price protection: Firm Notice: - Carter Min. 750 tons Min. period: 1 year Chemicals Min. volume: 750 tons (Michigan $1,268.00/ton $1,268.00/ton Price protection: 90 days Chemical Material) Notice: 15 days how Canchem's second bid should be treated as part of his hexonic acid contract deliberations. QUOTE SUMMARY Brent prepared a quote summary to put all bids on an equal footing (see Exhibit 4). To be able to compare quotes fairly, it was necessary to examine the laid down cost of each of the four options. Brent realized he did not have much time left and the unusual situation surround- ing Canchem's second bid gave him further concern. Mr. Williams was expecting his written analysis and rec- ommendation no later than June 17