Question: A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the

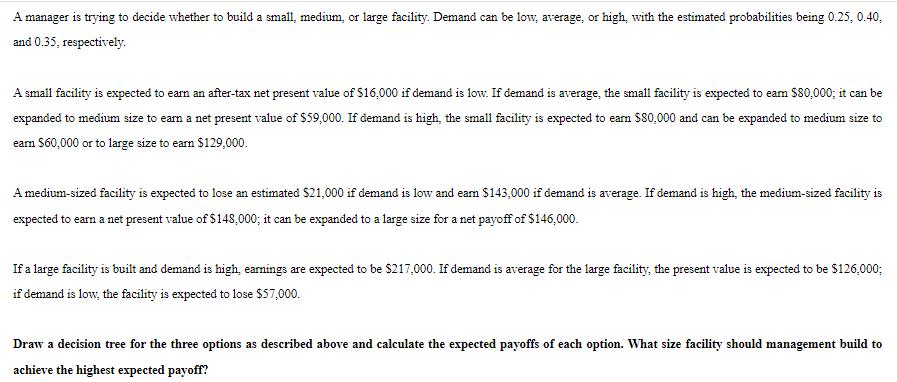

A manager is trying to decide whether to build a small, medium, or large facility. Demand can be low, average, or high, with the estimated probabilities being 0.25, 0.40, and 0.35, respectively. A small facility is expected to earn an after-tax net present value of $16,000 if demand is low. If demand is average, the small facility is expected to earn $80,000; it can be expanded to medium size to earn a net present value of $59,000. If demand is high, the small facility is expected to earn $80,000 and can be expanded to medium size to earn $60,000 or to large size to earn $129,000. A medium-sized facility is expected to lose an estimated $21,000 if demand is low and earn $143,000 if demand is average. If demand is high, the medium-sized facility is expected to earn a net present value of $148,000; it can be expanded to a large size for a net payoff of $146,000. If a large facility is built and demand is high, earnings are expected to be $217,000. If demand is average for the large facility, the present value is expected to be $126,000; if demand is low, the facility is expected to lose $57,000. Draw a decision tree for the three options as described above and calculate the expected payoffs of each option. What size facility should management build to achieve the highest expected payoff?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Answer To solve this problem well construct a decision tree to represent the decisionmaking process ... View full answer

Get step-by-step solutions from verified subject matter experts