Question: Use the NPV method to determine wheGher Smith Products should invest in the followng projocts: - Projoct A Costs $270,000 and offers seven annual net

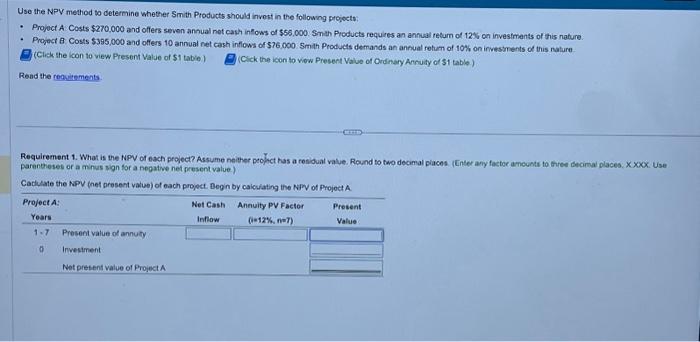

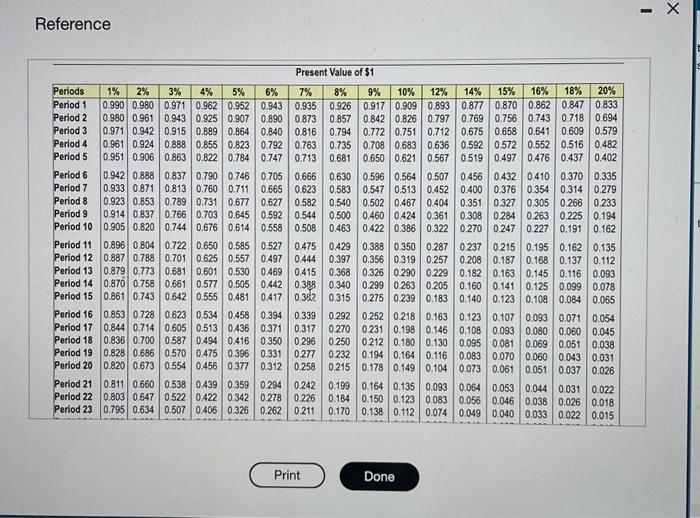

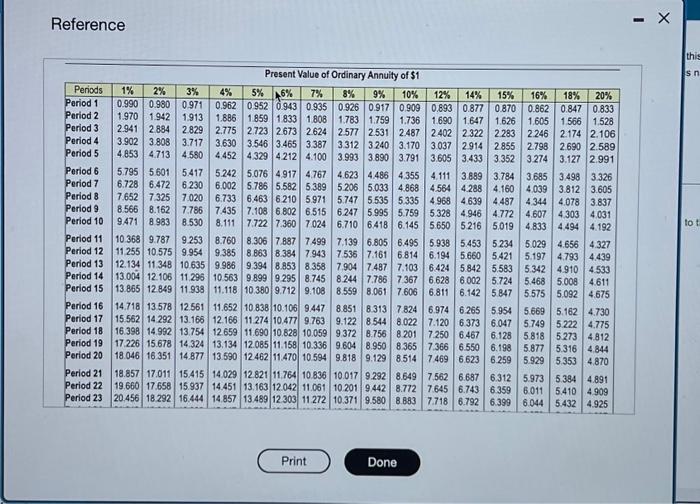

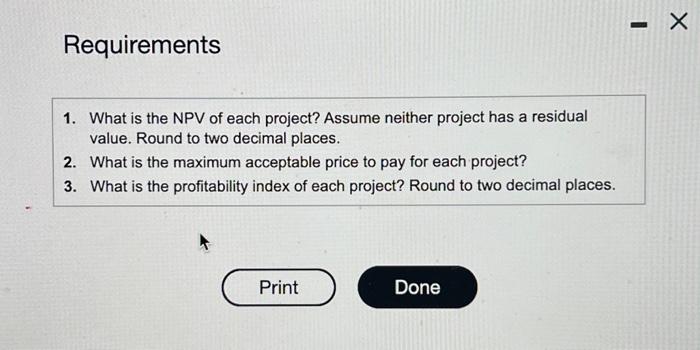

Use the NPV method to determine wheGher Smith Products should invest in the followng projocts: - Projoct A Costs $270,000 and offers seven annual net cash infows of $56,000. Smath Products requires an annual retum of 12% on investments of this nature - Propect 8 Costs $395,000 and offers 10 annual net cash inflows of $76,000.5 Smith Produets demands an annual retum of 10% on irvestments of this nature (Click the icon to view Present Value of $1 tabie) (Cick the icon to viow Present Value of Oridnary Arnuty of 31 table) Rend the reakitements Requirement 1. What is the NPV of each project? Assume neither peopet has a renioual value. Round to two decimal places ([nhter any factor ancunts to three becimal places. X. xxox. Use parentheses or a minus sign for a negatwe net present value.) Cadluate the KPV (het present valuo) of each propect. Begn by caiculating the Nipl of Project A Reference Reference Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts