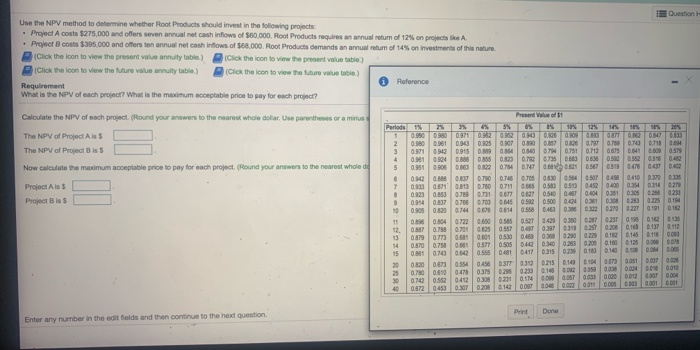

Question: IN Question Use the NPV method to determine whether Root Products should invest in the following projects Project Acosts $275,000 and offers seven annual net

IN Question Use the NPV method to determine whether Root Products should invest in the following projects Project Acosts $275,000 and offers seven annual net cash flows of $60,000. Root Products requires an annual rebum of 12% on projecte Project costs $395.000 and offers ton annual net cash inflows of $68,000. Root Products demands an annual return of 14% on investments of this nature (Click the loon to view the present value annuity table.) Click the icon to view the present value table (Click the loon to view the future value annuity table) (Click the icon to view the future value table) Reference Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of each project. (Round your answers to the nearest whole dollar. Use parenthesis or a minus The NPV of Project Ais The NPV of Project Biss Now calculate the maximum acceptable price to pay for each project. (Round your answers to the nearest whole Project Ais Project Biss Present of Periods 15 7 3 65 105 12 0.950 0.971 0.2 0.2 0. 0.980 0.961 0.96 0.925 F0.30 0.067 0.026 0.79 0.750 0.100718 04 3 0.991 0.915 0.09 0.4 74.751 0712 0679 0.8410600 0.59 4 0.31 0.94 0.8 0.855 0.823007350.600 0.5 0.582 0598 5 0.951 0.500 0.363 0.02 OTH D.147 0.01 OST 0.47 0.0 8 012 GB ORT 0.750 0.76 SOF 0.410 0.00 7 0330 051 0813 0.780 0.711 0.885 0.50 050 0.000 024 014 8 0853 0789 0.731 0.540 0.461 0. 091 0.305 0200 0.230 9 034 0.537 0706 0645 6502 0.500 0.44 0.361 0.30 0263 90 0905 02 043 0.29 D1 11 0.804 0722 0550055 0.527 0.420 0.350 021 0.23 0.95 D1 12 0.887 0.750 0.701 0.025 05570 0.397 0.3 0.27 0.20 0.101 112 13 0.89 0.773 0.51 0.001 0.53 0.4690.36 0.280 0229 0.145 0.00 14 0.870 0.750 0.001 0.57 0.505 0.442 0.340 0.253 0.208 0.100 0.125 0.000000 15 0.981 070 142 0555 0.681 0.315 0.23 0.18 0.140 20 0.873 0.540.450 DITTO 215 0.14 0.14 0.3 0.051 DOT DAN 25 0.750 0.85 0.478 0.375 0.25 0.23 0.102 11500038 0.0040000010 30 010 0.552 0412 0.308 0231 0.00 OOST 0033 0.000 000 0.004 40 0.62 0453 O 0.200 0 0.0 ad 0.005 0.001 DO! 0.14 DOS Print Done Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts