Question: Use the NPV method to determine whether Vargas Products should invest in the following projects: Project A Costs $265,000 and offers eight annual net cash

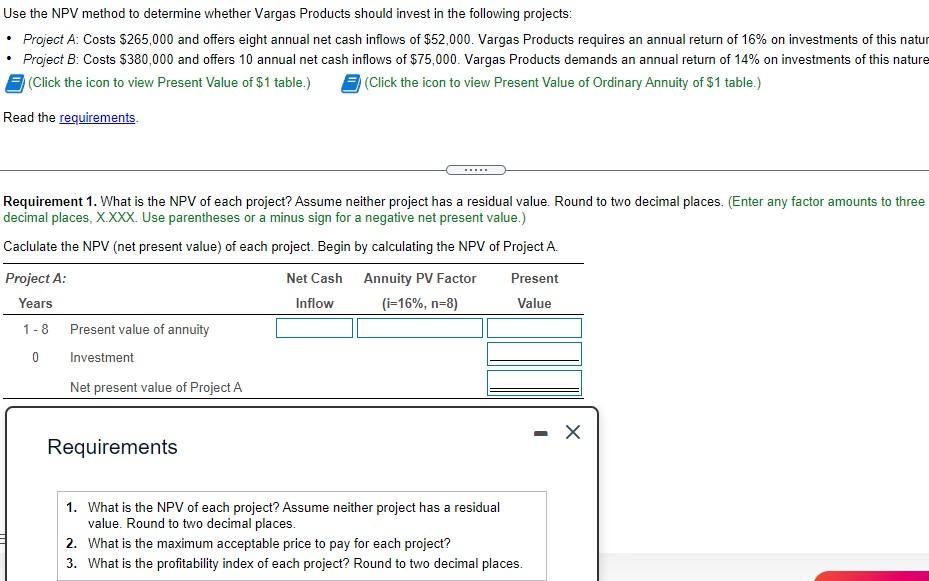

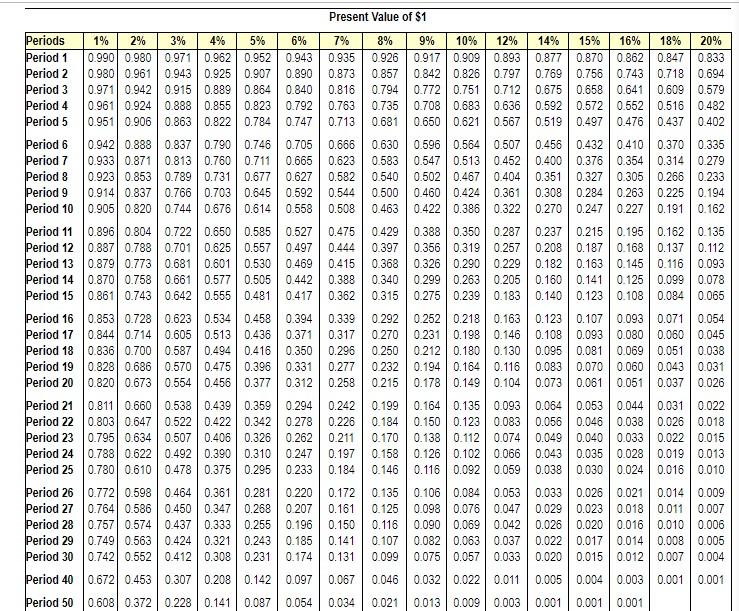

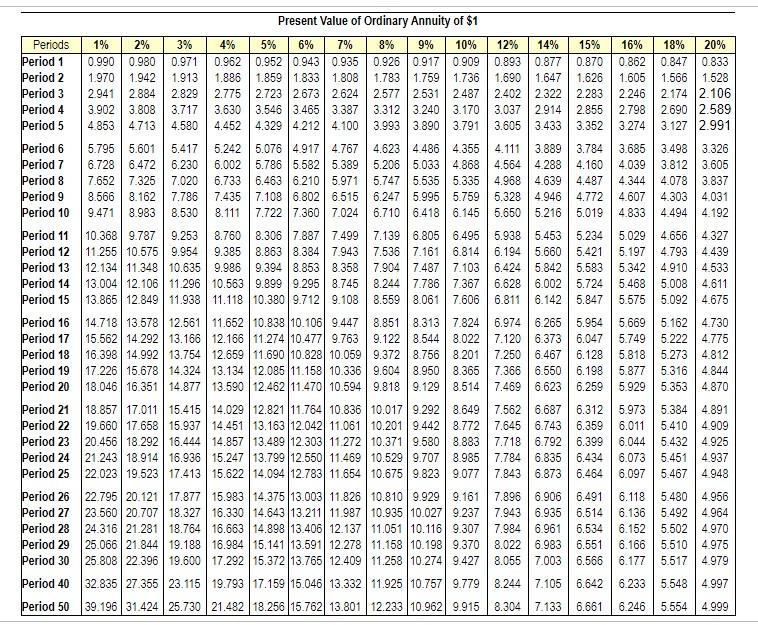

Use the NPV method to determine whether Vargas Products should invest in the following projects: Project A Costs $265,000 and offers eight annual net cash inflows of $52,000. Vargas Products requires an annual return of 16% on investments of this natur Project B: Costs $380,000 and offers 10 annual net cash inflows of $75,000. Vargas Products demands an annual return of 14% on investments of this nature (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. R. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=16%, n=8) Value 1 - 8 Present value of annuity Investment Net present value of Project A 0 - Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places. Present Value of $1 9% 6% 0.943 0.890 0.840 0.792 0.747 7% 0.935 0.873 0.816 0.763 0.713 8% 0.926 0.857 0.794 0.735 0.681 10% 0.917 | 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 12% 14% 15% 16% 18% 20% 0.893 0.877 0.870 0.862 0.847 0.833 0.797 0.769 0.756 0.743 0.718 0.694 0.712 0.675 0.658 0.641 0.609 0.579 0.636 0.592 0.572 0.552 0.516 0.482 0.567 0.519 0.497 0.476 0.437 0.402 0.705 0.665 0.627 0.592 0.558 0.666 0.623 0.582 0.544 0.508 0.630 0.583 0.540 0.500 0.463 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.527 0.497 0.469 0.442 0.417 0.475 0.444 0.415 0.388 0.362 0.429 0.397 0.368 0.340 0.315 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.287 0.237 0.215 0.195 0.162 0.135 0.257 0.208 0.187 0.168 0.137 0.112 0.229 0.182 0.163 0.145 0.116 0.093 0.205 0.160 0.141 0.125 0.099 0.078 0.183 0.140 0.123 0.108 0.084 0.065 Periods 1% 2% 3% 4% 5% Period 1 0.990 0.980 0.971 0.962 0.952 Period 2 0.980 0.961 0.943 0.925 0.907 Period 3 0.971 0.942 0.915 0.889 0.864 Period 4 0.961 0.924 0.888 0.855 0.823 Period 5 0.951 0.906 0.863 0.822 0.784 Period 6 0.942 0.888 0.837 0.790 0.746 Period 7 0.933 0.871 0.813 0.7600.711 Period 8 0.923 0.853 0.789 0.731 0.677 Period 9 0.914 0.837 0.766 0.703 0.645 Period 10 0.905 0.820 0.744 0.676 0.614 Period 11 0.896 0.804 0.722 0.650 0.585 Period 12 0.887 0.788 0.701 0.625 0.557 Period 13 0.879 0.773 0.681 0.601 0.530 Period 14 0.870 0.7580.661 0.577 0.505 Period 15 0.861 0.743 0.642 0.555 0.481 Period 16 0.853 0.728 0.623 0.534 0.458 Period 17 0.844 0.714 0.605 0.513 0.436 Period 18 0.836 0.700 0.587 0.494 0.416 Period 19 0.828 0.686 0.570 0.475 0.396 Period 20 0.820 0.673 0.554 0.456 0.377 Period 21 0.811 0.660 0.538 0.439 0.359 Period 22 0.803 0.647 0.522 0.422 0.342 Period 23 0.795 0.63 0.507 0.406 0.326 Period 24 0.788 0.622 0.492 0.390 0.310 Period 25 0.780 0.610 0.478 0.375 0.295 Period 26 0.772 0.598 0.464 0.361 0.281 Period 27 0.764 0.586 0.450 0.347 0.268 Period 28 0.757 0.574 0.437 0.333 0.255 Period 29 0.749 0.563 0.424 0.321 0.243 Period 30 0.742 0.552 0.412 0.308 0.231 Period 40 0.672 0.453 0.307 0.208 0.142 Period 50 0.608 0.372 0.228 0.141 0.087 0.394 0.371 0.350 0.331 0.312 0.339 0.317 0.296 0.277 0.258 0.292 0.270 0.250 0.232 0.215 0.252 0.218 0.163 0.123 0.1070.093 0.071 0.054 0.231 0.198 0.146 0.108 0.093 0.080 | 0.060 0.045 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.294 0.278 0.262 0.247 0.233 0.242 0.226 0.211 0.197 0.184 0.199 0.184 0.170 0.158 0.146 0.220 0.207 0.196 0.185 0.174 0.172 0.161 0.150 0.141 0.131 0.135 0.125 0.116 0.107 0.099 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 0.116 0.092 0.059 0.038 0.030 0.024 0.0160.010 0.106 0.084 0.053 0.033 0.026 0.021 0.014 0.009 0.098 0.076 0.047 0.029 0.023 0.018 0.0110.007 0.090 0.069 0.042 0.026 0.0200.0160.010 0.006 0.082 0.063 0.037 0.022 0.017 | 0.014 0.008 0.005 0.075 0.057 0.033 0.0200.015 0.012 0.007 0.004 0.032 0.022 0.011 0.005 0.004 0.003 0.001 0.001 0.097 0.067 0.046 0.054 0.034 0.021 0.013 0.009 0.003 0.001 0.001 0.001 16% 12% 14% 15% 0.893 0.877 0.870 1.690 1.647 1.626 2.402 2.322 2.283 3.037 2.914 2.855 3.605 3.433 3.352 0.862 1.605 2.246 2.798 3.274 18% 20% 0.847 0.833 1.566 1.528 2.174 2.106 2.690 2.589 3.127 2.991 Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.9412.884 2.829 2.775 2.723 2.673 2624 2.577 2.531 2487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4.329 4.212 4 100 3.993 3.890 3.791 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.4864.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.9955.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 | 9.954 9.385 8.863 8.384 7.943 7.536 7.161 | 6.814 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 13.004 12.106 | 11.296 | 10.563 9.899 9.295 8.745 8.244 7.786 7.367 13.865 12.849 11.938 11.118 10.3809.712 9.108 8.559 8.061 7.606 4.111 3.889 3.784 4.564 4.288 4.160 4.9684.639 4.487 5.328 4.946 4.772 5.6505.216 5.019 3.685 3.498 3.326 4.039 3.812 3.605 4.344 4.0783.837 4.607 4.303 4.031 4.833 4.4944 192 5.938 5.453 5.234 6.194 5.660 5.421 6.424 5.842 5.583 6.628 6.002 5.724 6.811 6.142 5.847 5.029 5.197 5.342 5.468 5.575 4.656 4.327 4.793 4.439 4.910 4.533 5.008 4.611 5.092 4.675 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 6.9746.265 5.954 7.1206.373 6.047 7.250 6.467 6.128 7.366 6.550 6.198 7.469 6.623 6.259 5.669 5.749 5.818 5.877 5.929 5.1624.730 5.222 4.775 5.273 4.812 5.3164.844 5.353 4.870 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 15.562 14.292 13.166 12.166 11.274 10.4771 9.763 9.122 8.5448.022 16.398 14.992 | 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 17.226 15.678 14.32413.134 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.0179.292 8.649 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.2019.442 8.772 20.45618.292 16.444 14.857 13.489 12.303) 11.272 10.371 9.5808.883 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.7078.985 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 22.795 20. 121 17.877 15.983 14.375 13.003 11.826 10.8109.929 9.161 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 24.316 21.28118.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 25.808 22 396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 7.562 6.687 6.312 7.645 6.743 6.359 7.718 6.792 6.399 7.784 6.835 6.434 7.8436.873 6.464 5.973 6.011 6.044 6.073 6.097 5.384 4.891 5.410 4.909 5.432 4.925 5.451 4.937 5.467 4.948 7.896 6.906 6.491 7.943 6.935 6.514 7.984 6.961 6.534 8.0226.983 6.551 8.055 7.003 6.566 6.118 5.480 4956 6.136 5.492 4.964 6.1525.5024970 6.166 5.510 4975 6.177 5.517 4.979 8.244 7.105 6.642 6.233 5.5484997 32.835 27 355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 39.19631.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 8.304 7.133 6.661 6.246 5.554 4.999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts