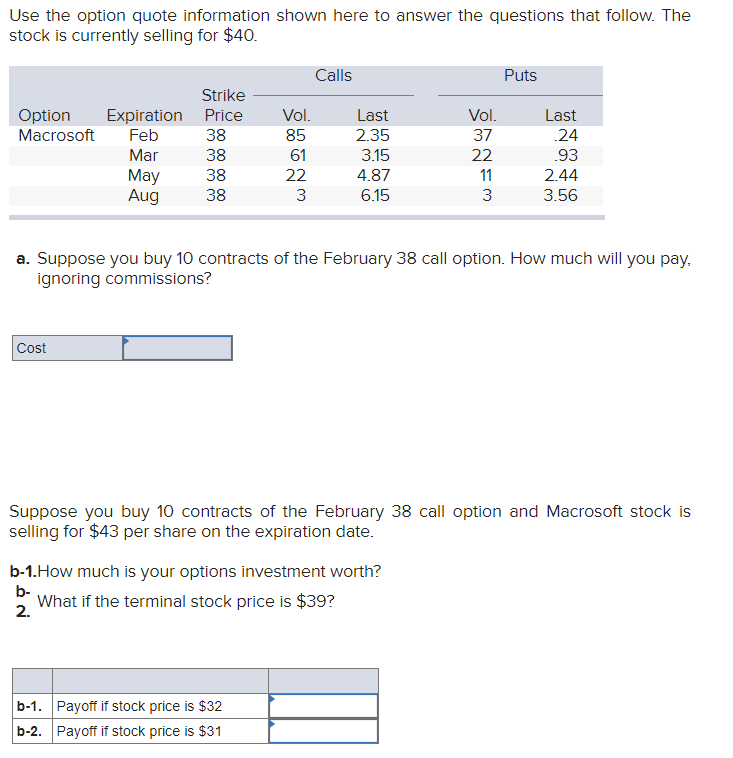

Question: Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $40. Calls Puts Option Macrosoft Strike

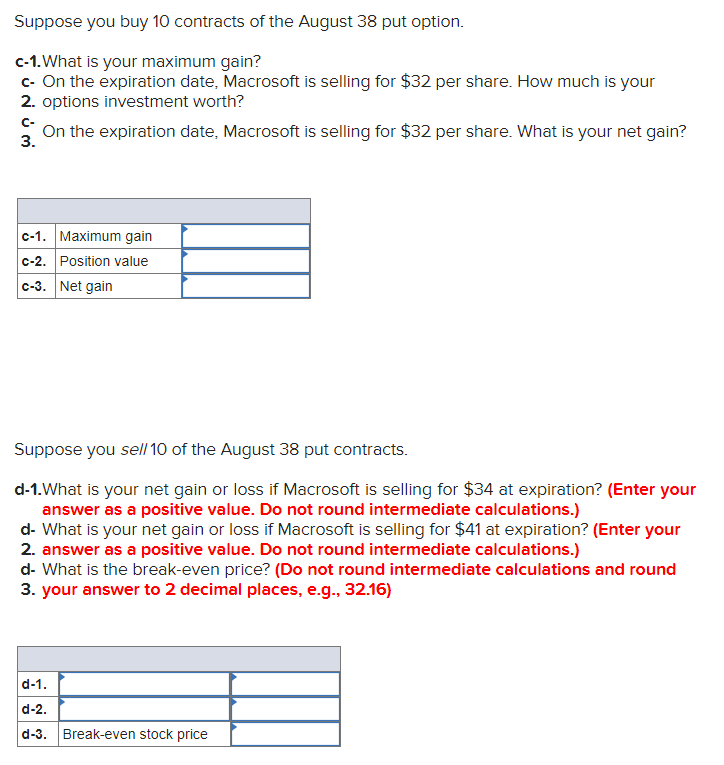

Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $40. Calls Puts Option Macrosoft Strike Expiration Price Feb 38 Mar 38 May 38 Aug 38 Vol. 85 61 22 3 Last 2.35 3.15 4.87 6.15 Vol. 37 22 11 3 Last 24 .93 2.44 3.56 a. Suppose you buy 10 contracts of the February 38 call option. How much will you pay, ignoring commissions? Cost Suppose you buy 10 contracts of the February 38 call option and Macrosoft stock is selling for $43 per share on the expiration date. b-1. How much is your options investment worth? b- What if the terminal stock price is $39? 2. b-1. Payoff if stock price is $32 b-2. Payoff if stock price is $31 Suppose you buy 10 contracts of the August 38 put option. C-1. What is your maximum gain? c- On the expiration date, Macrosoft is selling for $32 per share. How much is your 2. options investment worth? C- 3. On the expiration date, Macrosoft is selling for $32 per share. What is your net gain? C-1. Maximum gain C-2. Position value c-3. Net gain Suppose you sell 10 of the August 38 put contracts. d-1.What is your net gain or loss if Macrosoft is selling for $34 at expiration? (Enter your answer as a positive value. Do not round intermediate calculations.) d- What is your net gain or loss if Macrosoft is selling for $41 at expiration? (Enter your 2. answer as a positive value. Do not round intermediate calculations.) d- What is the break-even price? (Do not round intermediate calculations and round 3. your answer to 2 decimal places, e.g., 32.16) d-1. d-2. d-3. Break-even stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts