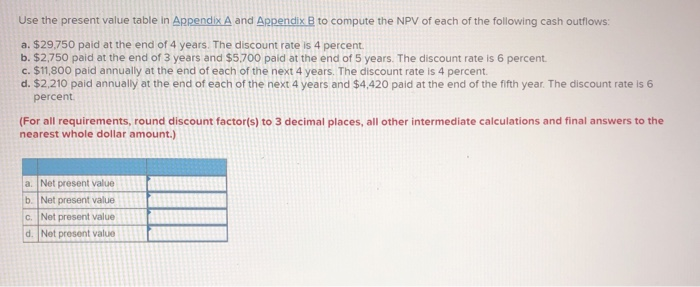

Question: Use the present value table in Appendix A and Appendix B to compute the NPV of each of the following cash outflows: a. $29,750 paid

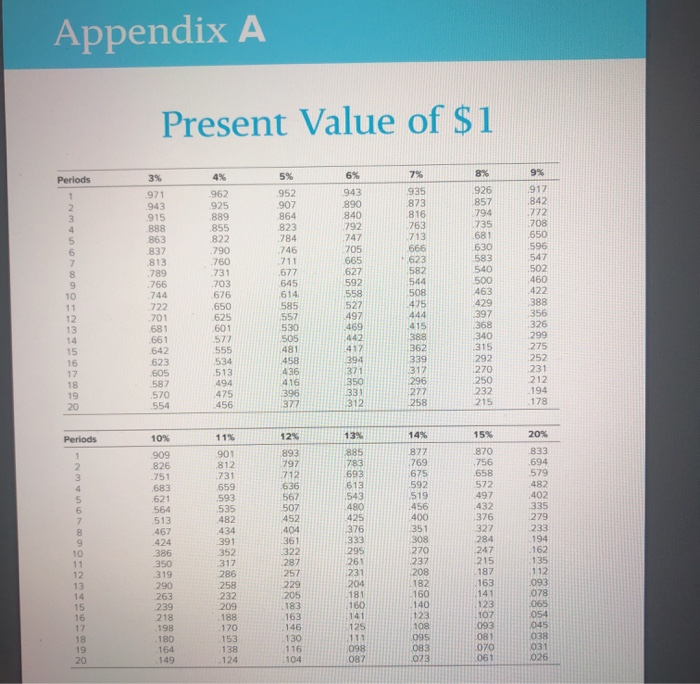

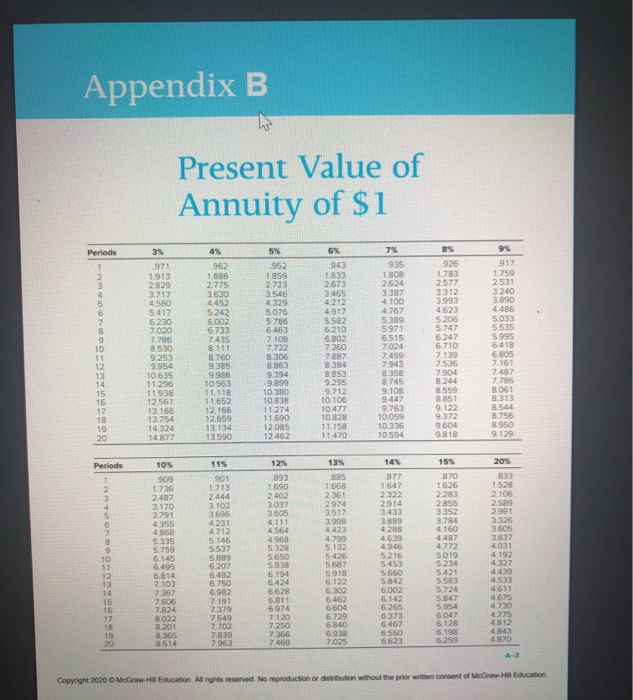

Use the present value table in Appendix A and Appendix B to compute the NPV of each of the following cash outflows: a. $29,750 paid at the end of 4 years. The discount rate is 4 percent b. $2,750 paid at the end of 3 years and $5,700 paid at the end of 5 years. The discount rate is 6 percent c. $11,800 paid annually at the end of each of the next 4 years. The discount rate is 4 percent d. $2,210 paid annually at the end of each of the next 4 years and $4,420 paid at the end of the fifth year. The discount rate is 6 percent (For all requirements, round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount.) a. Net present value b. Net present value c. Net present value d. Net present value Appendix A Present Value of $1 6% 9% 3% Periods 8% 926 857 794 2 3 4 943 890 840 792 747 705 665 627 6 592 4% 962 925 889 855 822 790 760 731 .703 676 .650 625 .601 577 555 534 513 494 475 456 917 842 772 708 650 596 547 502 460 422 5% 952 907 864 823 784 746 711 677 645 614 585 557 530 505 481 458 436 416 396 377 971 943 915 888 863 837 .813 789 1766 .744 722 701 681 661 642 623 605 587 570 554 7% 935 873 816 763 713 666 623 582 544 508 475 444 415 388 362 339 312 296 277 258 10 11 12 13 14 15 16 17 18 19 20 388 558 527 497 469 442 417 394 371 350 331 1735 681 630 583 540 500 463 429 397 368 340 315 292 270 250 232 215 356 326 299 275 252 231 212 194 178 312 10% 11% Periods 12% 13% 20% 14% 1 885 2 3 7 8 9 10 11 12 13 14 15 909 826 .751 683 621 564 513 467 424 386 350 319 290 263 239 218 901 812 731 659 593 535 482 434 391 352 317 286 258 232 209 188 170 153 138 124 893 797 712 636 567 507 452 404 361 322 287 257 229 205 183 163 146 130 116 104 783 693 613 543 480 425 376 333 295 261 231 204 181 160 877 1769 675 592 519 456 400 351 308 270 237 208 182 160 15% .870 .756 .658 572 497 432 376 327 284 247 215 187 163 141 123 107 093 08 070 061 833 .694 579 482 402 335 279 233 194 162 135 112 093 078 065 054 045 038 031 026 140 141 198 17 18 19 20 180 164 149 125 11 098 087 123 108 095 083 073 Appendix B Present Value of Annuity of $1 Periods 3% 5% 8% 9% 1 2 5 6 8 9 10 11 12 13 14 15 16 17 18 19 20 971 1.913 2.829 3.717 4 5 5.417 6.230 7020 7.786 8.530 9.253 9954 10.635 11.296 11.938 12561 13.166 13.754 14 324 4% 962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7435 8.111 8.760 9.385 9986 10.563 11.118 11 652 12.166 12.659 13.134 13590 952 1859 2723 3546 4.329 5:076 5.796 6463 7108 7.722 8.306 8.863 9394 .9.899 10.30 10.838 11.274 11.690 12.085 12.462 6% 943 1833 2.673 3 465 4212 4.917 5.582 6210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10 828 11.158 11.470 7% 935 1808 2624 3.387 4 100 4.767 5389 5.971 6.515 7024 7.499 7.943 8358 8.745 9.108 9447 9.763 10 059 10.336 10.594 926 1.783 2577 3312 3993 4.623 5.200 5.747 6.247 6.710 7.139 7536 7.904 8.244 8.559 8851 9.122 917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8061 8.313 8.544 8.756 8.950 9.129 9.604 9.818 Periods 10% 13% 14% 11% 901 1.713 2 444 2 3 4 5 9 10 11 12 13 14 15 16 909 1.736 2.487 3.170 3.791 4355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8022 8 201 8.365 8514 3.102 3.696 4.231 4712 5.146 5.537 5889 6 207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 12 893 1.690 2.402 3037 3.605 4111 4.564 4.968 5.328 5.650 5.938 5.194 6.424 6628 6.811 6.974 7.120 7.250 7.366 7.469 885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.587 5.918 6.122 6302 6.462 6.604 6.729 6 840 6.938 7.025 377 1547 2322 2914 3.433 3.889 4.288 4.639 4946 5216 5.453 5660 5842 6002 6.142 6.265 6.373 6.467 6550 6.623 15% 870 1.626 2.283 2855 3352 3.784 4.160 4.487 4.772 5.019 5234 5.421 5.583 5.724 5847 5.954 6.047 6.128 6.198 6.259 20% 833 1.528 2.106 2589 2.991 3326 3605 3.837 4031 4.192 4.327 4 439 4.533 4.611 4.675 4.730 4.775 4812 4.843 4870 18 19 20 Copyright 2020 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts