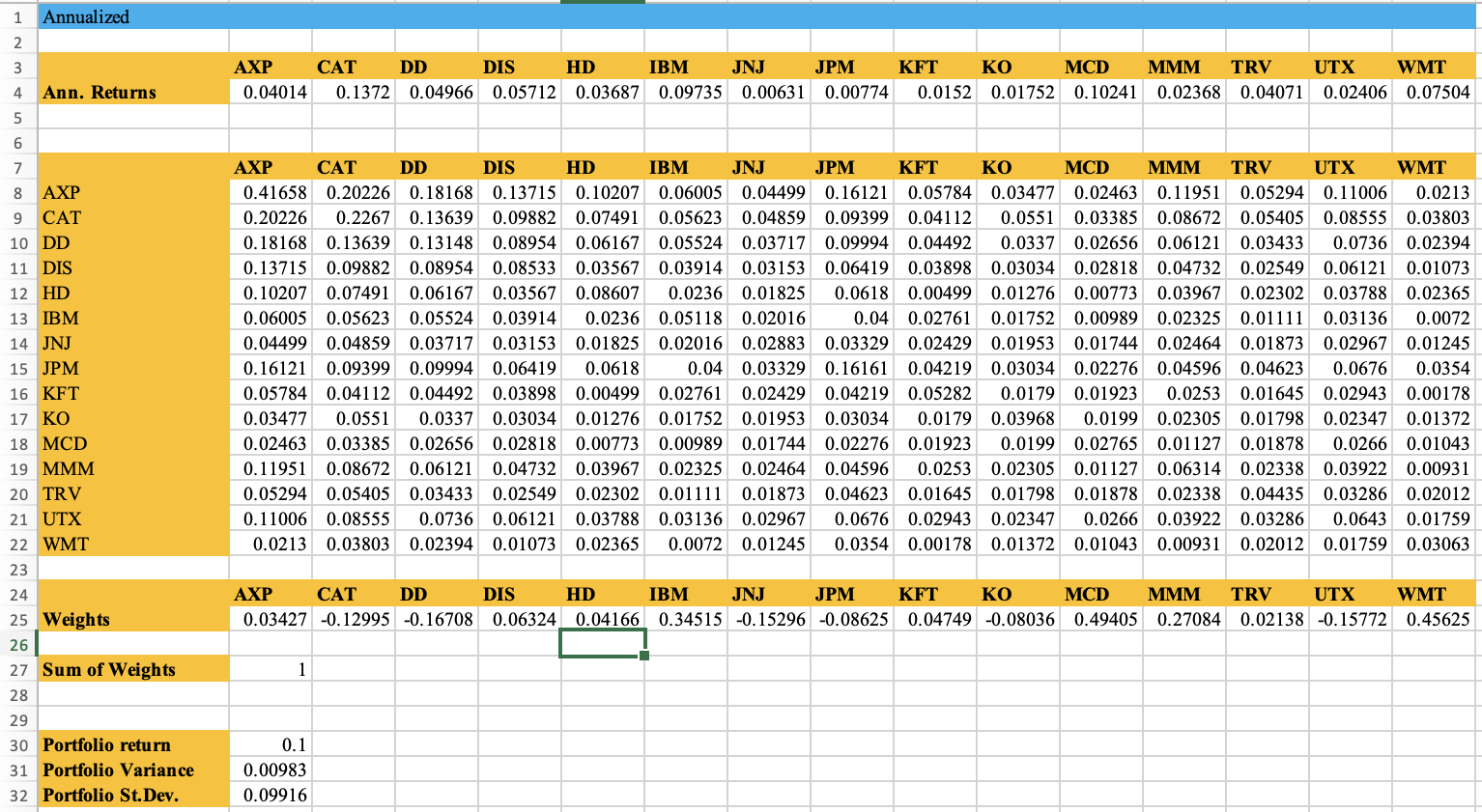

Question: Use the provided template file that has the annual expected return for each stock and the annual variance-covariance matrix, choose some random initial values for

- Use the provided template file that has the annual expected return for each stock and the annual variance-covariance matrix, choose some random initial values for the weight in each stock (make sure all the weights sum up to 1) and use the returns, variance-covariance matrix and the weights to calculate portfolio expected return, portfolio variance and portfolio standard deviation (using the matrix formulas in class). Answers all parts of the question.

a) Use a solver to find the minimum variance portfolio of these stocks that offers a return of at least 5%. Assume short sales are not allowed. What is the optimal portfolio? How much do you invest in each stock? What is the expected portfolio return and variance?

b) Use a solver to find the minimum variance portfolio of these stocks that offers a return of at least 5%. Assume short sales are allowed. What is the optimal portfolio? How much do you invest in each stock? What is the expected portfolio return and variance?

c) Assume that you are trying to solve part a again but now there is an additional constraint. You cannot put more than 15% on any single stock. How does the solution change?

Based on the infomration from the picuture solve the question, show all steps. SHOW ALL WORK PLEASE. I have been struggling on this question all day long.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts