Question: Use the QUESTION INFORMATION below to answer the next 2 questions [ Questions 1 4 - 1 5 ] . Blank amortization tables and present

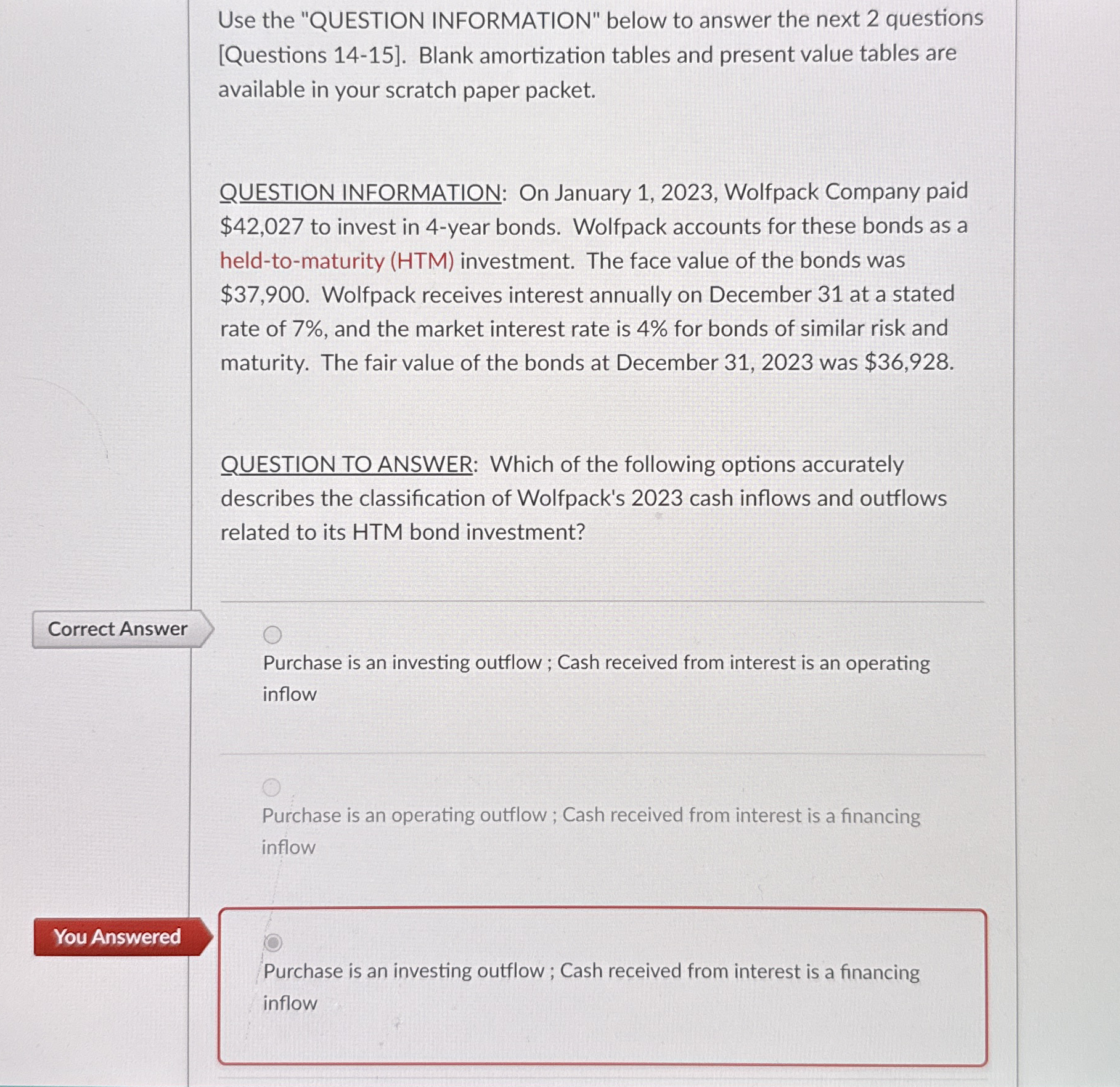

Use the "QUESTION INFORMATION" below to answer the next questions Questions Blank amortization tables and present value tables are available in your scratch paper packet.

QUESTION INFORMATION: On January Wolfpack Company paid $ to invest in year bonds. Wolfpack accounts for these bonds as a heldtomaturity HTM investment. The face value of the bonds was $ Wolfpack receives interest annually on December at a stated rate of and the market interest rate is for bonds of similar risk and maturity. The fair value of the bonds at December was $

QUESTION TO ANSWER: Which of the following options accurately describes the classification of Wolfpack's cash inflows and outflows related to its HTM bond investment?

Correct Answer

Purchase is an investing outflow ; Cash received from interest is an operating inflow

Purchase is an operating outflow ; Cash received from interest is a financing inflow

Purchase is an investing outflow ; Cash received from interest is a financing inflow

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock