Question: Use the rate-of-return data for the stock and bond funds presented above but now assume that the probability of each scenario is as follows: severe

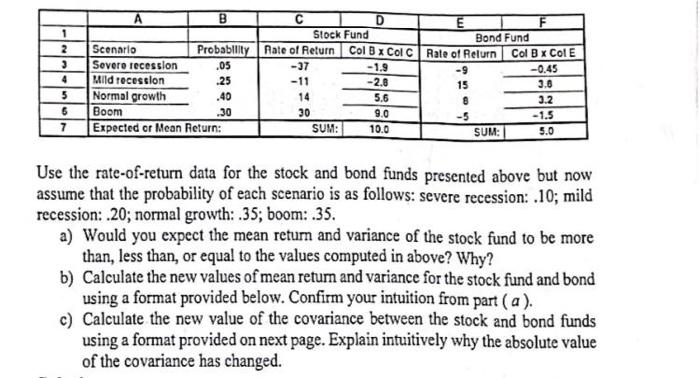

Use the rate-of-return data for the stock and bond funds presented above but now assume that the probability of each scenario is as follows: severe recession: .10; mild recession: .20; normal growth: .35 ; boom: .35 . a) Would you expect the mean return and variance of the stock fund to be more than, less than, or equal to the values computed in above? Why? b) Calculate the new values of mean retum and variance for the stock fund and bond using a format provided below. Confirm your intuition from part (a). c) Calculate the new value of the covariance between the stock and bond funds using a format provided on next page. Explain intuitively why the absolute value of the covariance has changed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts