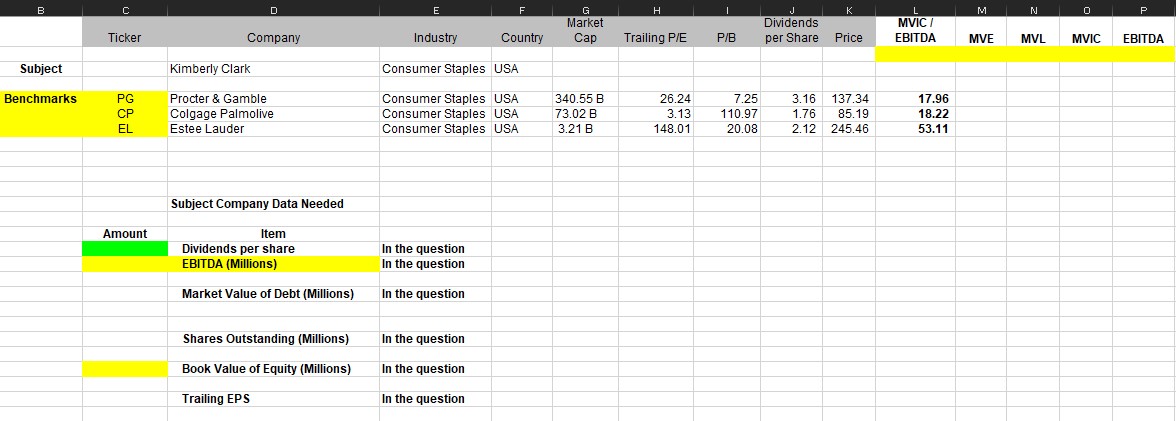

Question: Use the relevant information contained on the pricing multiples tab. Assume for the subject company that EBITDA is $2,730 million, Market Value of debt $5,943.76

Use the relevant information contained on the pricing multiples tab. Assume for the subject company that EBITDA is $2,730 million, Market Value of debt $5,943.76 Millions, and common Shares outstanding are 335.14 Million. Price the shares of the subject company using the MVIC/EBITDA multiple under the market approach. Do not use the $ sign and price to the nearest whole cent.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts