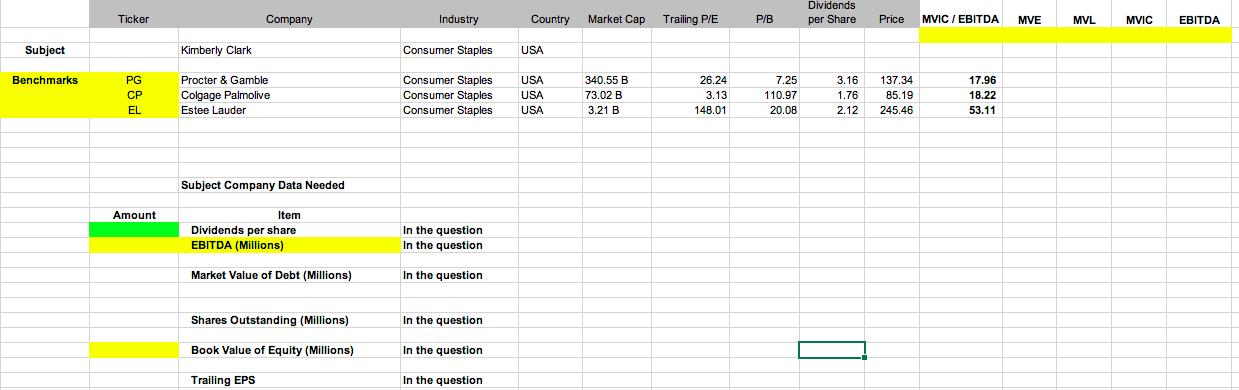

Question: Use the relevant information contained on the pricing multiples tab. Assume for the subject company that EBITDA is $2,730 million, Market Value of debt $5,493.76

Use the relevant information contained on the pricing multiples tab. Assume for the subject company that EBITDA is $2,730 million, Market Value of debt $5,493.76 Millions, and common Shares outstanding are 335.14 Million. Price the shares of the subject company using the MVIC/EBITDA multiple under the market approach. Do not use the $ sign and price to the nearest whole cent.

Subject Benchmarks Ticker PG CP EL Amount Company Kimberly Clark Procter & Gamble Colgage Palmolive Estee Lauder Subject Company Data Needed Item Dividends per share EBITDA (Millions) Market Value of Debt (Millions) Shares Outstanding (Millions) Book Value of Equity (Millions) Trailing EPS Industry Consumer Staples Consumer Staples Consumer Staples Consumer Staples In the question In the question In the question In the question In the question In the question Country USA USA USA USA Market Cap Trailing P/E 340.55 B 73.02 B 3.21 B 26.24 3.13 148.01 P/B 7.25 110.97 20.08 Dividends per Share 3.16 1.76 2.12 Price MVIC / EBITDA 137.34 85.19 245.46 17.96 18.22 53.11 MVE MVL MVIC EBITDA

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Refer the calculations below 1 Price under PE multiple approach EPS X PE Multiple Accordingl... View full answer

Get step-by-step solutions from verified subject matter experts