Question: Use the spreadsheet to help format the answer please! 1. Ahmed and Ali are partners in a small business. Their partnership agreement states that net

Use the spreadsheet to help format the answer please!

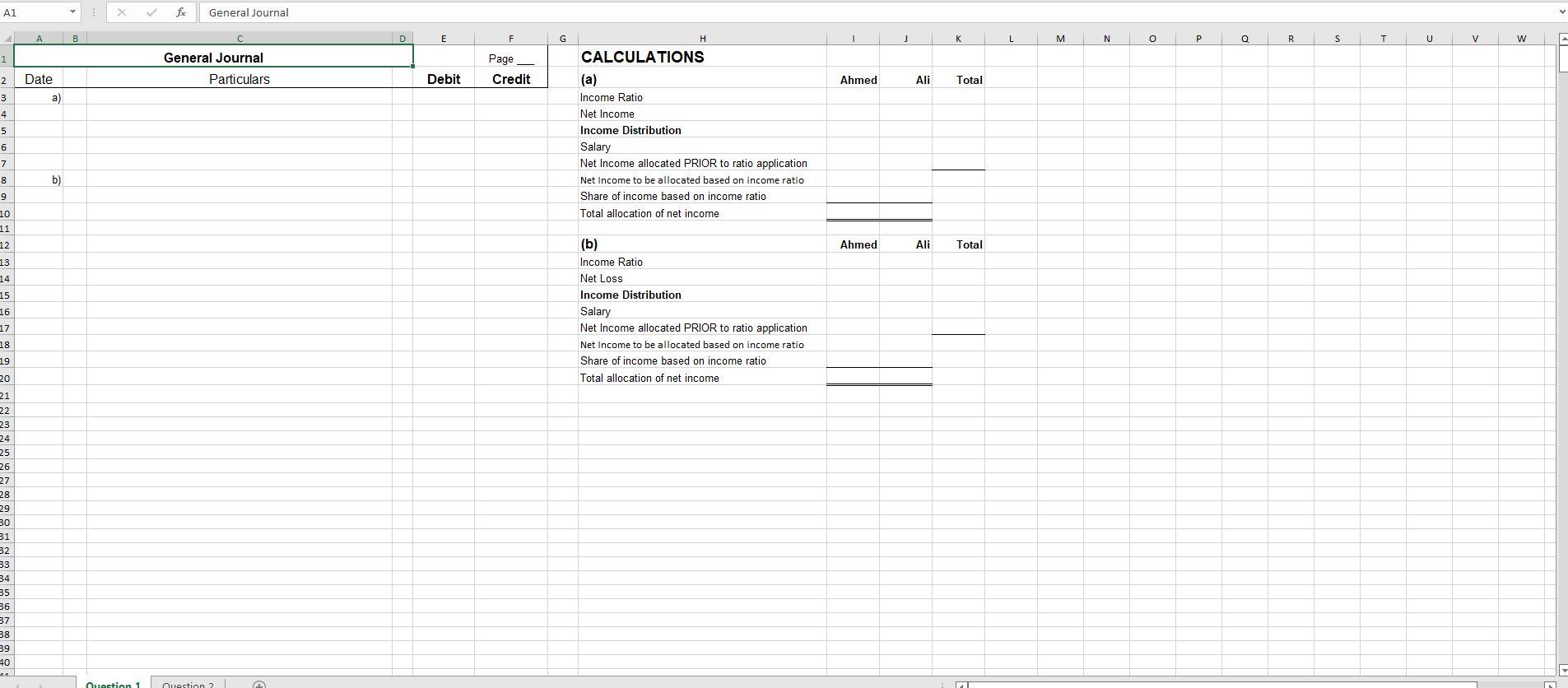

1. Ahmed and Ali are partners in a small business. Their partnership agreement states that net income is divided based on annual salaries of $40 000 for Ahmed and $50 000 for Ali, and an income ratio of 3:2. Calculate the net income allocation and record the journal entry, based on the following unrelated situations:

(a) net income of $200 000

(b) net loss of $8 000.

A1 A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 w A Date a) b) B Question 1 fix General Journal Particulars General Journal Question ? O D E Debit Page Credit H CALCULATIONS (a) Income Ratio Net Income Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income (b) Income Ratio Net Loss Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income T Ahmed Ahmed J K Ali Total Ali Total FT I M N O P 0 R S T U v W A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts