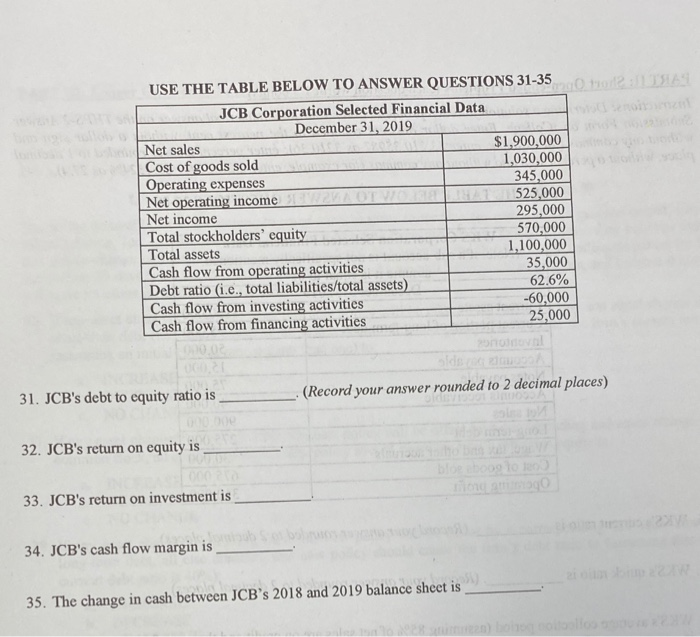

Question: USE THE TABLE BELOW TO ANSWER QUESTIONS 31-350 120 12:31 JCB Corporation Selected Financial Data December 31, 2019 Net sales $1,900,000 Cost of goods sold

USE THE TABLE BELOW TO ANSWER QUESTIONS 31-350 120 12:31 JCB Corporation Selected Financial Data December 31, 2019 Net sales $1,900,000 Cost of goods sold 1,030,000 Operating expenses 345,000 Net operating income 525,000 Net income 295,000 Total stockholders' equity 570,000 Total assets 1,100,000 Cash flow from operating activities 35,000 Debt ratio (i.e., total liabilities/total assets) 62.6% Cash flow from investing activities -60,000 Cash flow from financing activities 25,000 Loooo 31. JCB's debt to equity ratio is (Record your answer rounded to 2 decimal places) 32. JCB's return on equity is ago 33. JCB's return on investment is 34. JCB's cash flow margin is 35. The change in cash between JCB's 2018 and 2019 balance sheet is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts