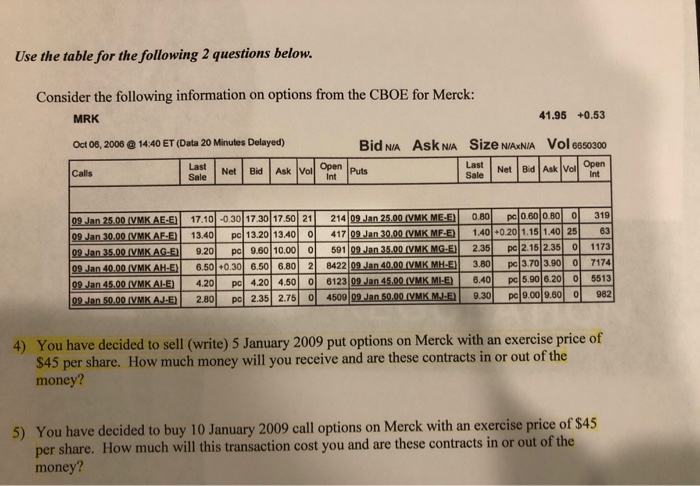

Question: Use the table for the following 2 questions below. Consider the following information on options from the CBOE for Merck: 41.95 +0.53 MRK Oct 08,

Use the table for the following 2 questions below. Consider the following information on options from the CBOE for Merck: 41.95 +0.53 MRK Oct 08, 2006@ 14:40 ET (Data 20 Minutes Delayed) Calls Bid NA Ask NA Size NAXNIA Vol 6650300 Open Last Sale Net Open Puts Last Net Bid Ask Vol Sale Int 00Jan 25.001VMKAES 17 10 -030 | 1730 17.50: 21| 214 09,Jan 25.00 VIIKMES O 80 pe 060 080.0 319 man30.00 VMKAFEJ | 13.401 po 13201134 4109dan 30.00 VMKMEE | 14+021 15 140|251 09 Jan 35.00 (VMK AG- 9.20 pc 9.600.00 59109 Jan 35.00 (VMK MG-E) 2.35 pc 2.15 2.351173 09 -Jan 45.00 VMKAL-E) 4.0 pc 420 4.506123 09 Jan 45,00 (VMKMILE) 6.405906.20 05513 09.1anS0.001VMKAHE) | 2.801 pel 2.35|2.75| 0| 4509 MK MJ-E) 9.30p 9.00 9.80 982 You have decided to sell (write) 5 January 2009 put options on Merck with an exercise price of S45 per share. How much money will you receive and are these contracts in or out of the money? 4) You have decided to buy 10 January 2009 call options on Merck with an exercise price of $45 per share. How much will this transaction cost you and are these contracts in or out of the money? 5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts