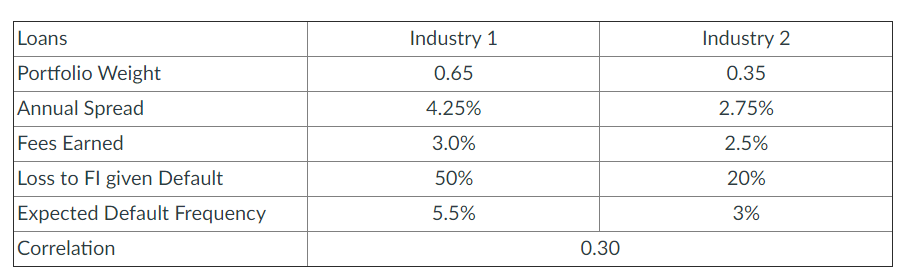

Question: Use the table to answer the question. A financial institution has outstanding loans to two industries: Industry 1 and Industry 2. What is the Sharpe

Loans Portfolio Weight Annual Spread Fees Earned Loss to FI given Default Expected Default Frequency Correlation Industry 1 0.65 4.25% 3.0% 50% 5.5% 0.30 Industry 2 0.35 2.75% 2.5% 20% 3%

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

To calculate the Sharpe Ratio for the portfolio we first need to find the expected return and standa... View full answer

Get step-by-step solutions from verified subject matter experts