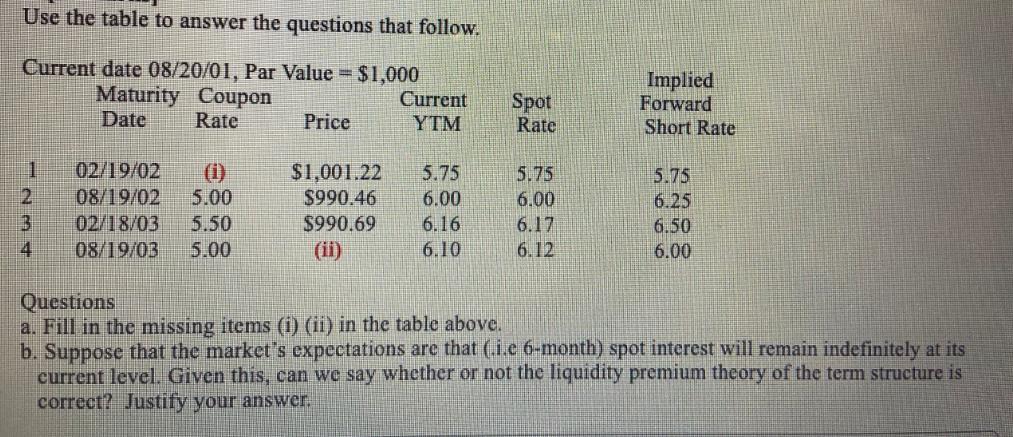

Question: Use the table to answer the questions that follow. Current date 08/20/01, Par Value = $1,000 Maturity Coupon Date Rate 02/19/02 2 08/19/02 5.00

Use the table to answer the questions that follow. Current date 08/20/01, Par Value = $1,000 Maturity Coupon Date Rate 02/19/02 2 08/19/02 5.00 3 02/18/03 5.50 4 08/19/03 5.00 1 Price $1,001,22 $990.46 $990.69 (ii) Current YTM 5.75 6.00 6.16 6.10 Spot Rate 5.75 6.00 6.17 6.12 Implied Forward Short Rate 5.75 6.25 6.50 6.00 Questions a. Fill in the missing items (i) (ii) in the table above. b. Suppose that the market's expectations are that (.i.e 6-month) spot interest will remain indefinitely at its current level. Given this, can we say whether or not the liquidity premium theory of the term structure is correct? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Answer a Missing item i Maturity Date 081902 Coupon Rate 500 Current YTM 600 Missing item ii Coupon ... View full answer

Get step-by-step solutions from verified subject matter experts