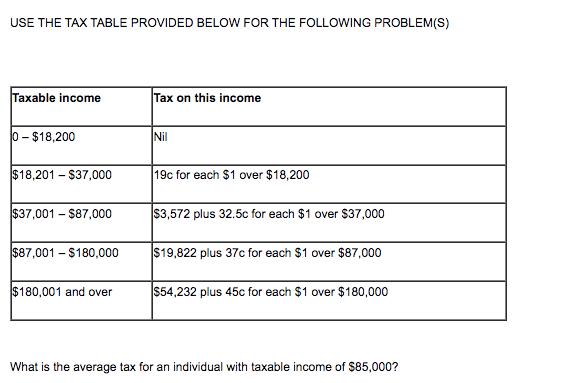

Question: USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S) Taxable income Tax on this income 0-$18,200 Nil $18,201 $37,000 19c for each $1

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S) Taxable income Tax on this income 0-$18,200 Nil $18,201 $37,000 19c for each $1 over $18,200 $37,001 - $87,000 $3,572 plus 32.5c for each $1 over $37,000 $87,001-$180,000 $19,822 plus 37c for each $1 over $87,000 $180,001 and over $54,232 plus 45c for each $1 over $180,000 What is the average tax for an individual with taxable income of $85,000?

Step by Step Solution

There are 3 Steps involved in it

To calculate the average tax for an individual with a taxable income of 850... View full answer

Get step-by-step solutions from verified subject matter experts