Question: Use the template provided to complete a capital budgeting analysis of the decision to purchase the existing consulting business. Depreciation is $20,000 per year so

Use the template provided to complete a capital budgeting analysis of the decision to purchase the existing consulting business.

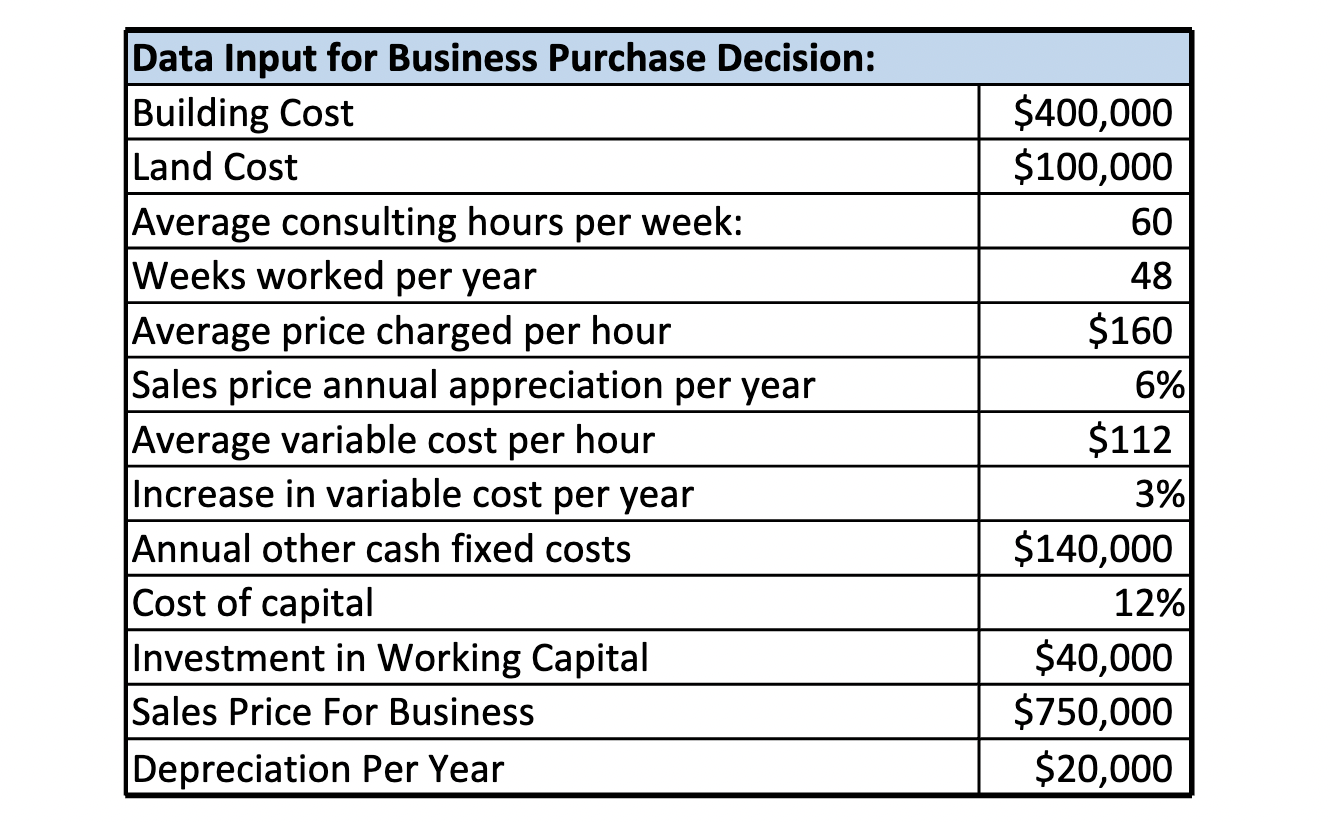

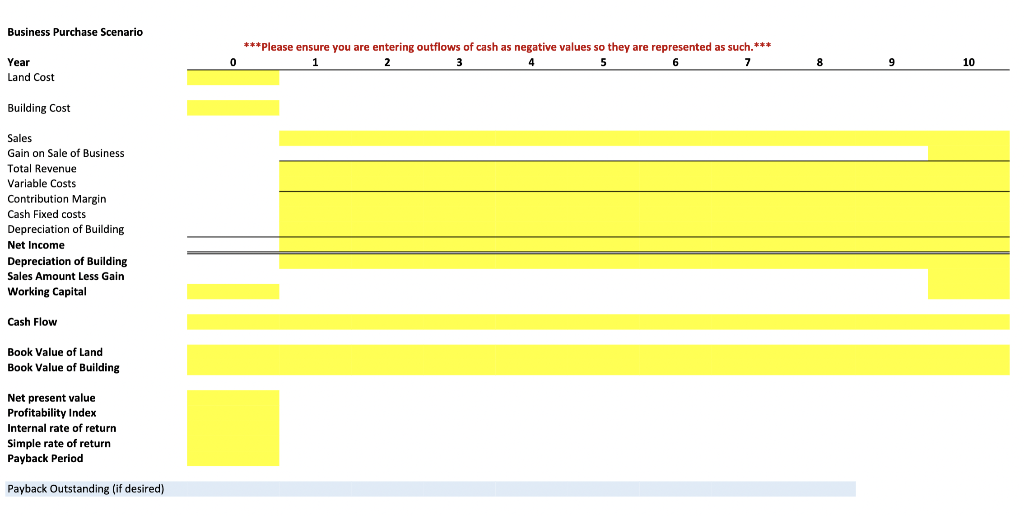

Depreciation is $20,000 per year so no calculation is needed for depreciation. Each owner will bill 30 hours per week for 48 weeks. There will be no other employees. Zhejia \& Hank plan to sell the business for 1.5 times what they paid for the building and the land at the end of the 10th year ($750,000). Neither the land nor the building will appreciate in value during the 10 year period. The gain on the sale of the business will equal the sales price minus the book value of the land and the building. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|l|}{ Data Input for Business Purchase Decision: } \\ \hline Building Cost & $400,000 \\ \hline Land Cost & $100,000 \\ \hline Average consulting hours per week: & 60 \\ \hline Weeks worked per year & 48 \\ \hline Average price charged per hour & $160 \\ \hline Sales price annual appreciation per year & 6% \\ \hline Average variable cost per hour & $112 \\ \hline Increase in variable cost per year & 3% \\ \hline Annual other cash fixed costs & $140,000 \\ \hline Cost of capital & 12% \\ \hline Investment in Working Capital & $40,000 \\ \hline Sales Price For Business & $750,000 \\ \hline Depreciation Per Year & $20,000 \\ \hline \end{tabular} Business Purchase Scenario Building Cost Sales Gain on Sale of Business Total Revenue Variable Costs Contribution Margin Cash Fixed costs Depreciation of Building Net Income Depreciation of Building Sales Amount Less Gain Working Capital Cash Flow Book Value of Land Book Value of Building Net present value Profitability Index Internal rate of return Simple rate of return Payback Period Payback Outstanding (if desired) Depreciation is $20,000 per year so no calculation is needed for depreciation. Each owner will bill 30 hours per week for 48 weeks. There will be no other employees. Zhejia \& Hank plan to sell the business for 1.5 times what they paid for the building and the land at the end of the 10th year ($750,000). Neither the land nor the building will appreciate in value during the 10 year period. The gain on the sale of the business will equal the sales price minus the book value of the land and the building. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|l|}{ Data Input for Business Purchase Decision: } \\ \hline Building Cost & $400,000 \\ \hline Land Cost & $100,000 \\ \hline Average consulting hours per week: & 60 \\ \hline Weeks worked per year & 48 \\ \hline Average price charged per hour & $160 \\ \hline Sales price annual appreciation per year & 6% \\ \hline Average variable cost per hour & $112 \\ \hline Increase in variable cost per year & 3% \\ \hline Annual other cash fixed costs & $140,000 \\ \hline Cost of capital & 12% \\ \hline Investment in Working Capital & $40,000 \\ \hline Sales Price For Business & $750,000 \\ \hline Depreciation Per Year & $20,000 \\ \hline \end{tabular} Business Purchase Scenario Building Cost Sales Gain on Sale of Business Total Revenue Variable Costs Contribution Margin Cash Fixed costs Depreciation of Building Net Income Depreciation of Building Sales Amount Less Gain Working Capital Cash Flow Book Value of Land Book Value of Building Net present value Profitability Index Internal rate of return Simple rate of return Payback Period Payback Outstanding (if desired)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts