Question: Use the template to determine the future value at the end of five years for a deposit of $10,000 in an investment earning 4% compounded

Use the template to determine the future value at the end of five years for a deposit of $10,000 in an investment earning 4% compounded semiannually. Enter as a positive number with two decimal places (i.e., to the penny) but without the dollar sign

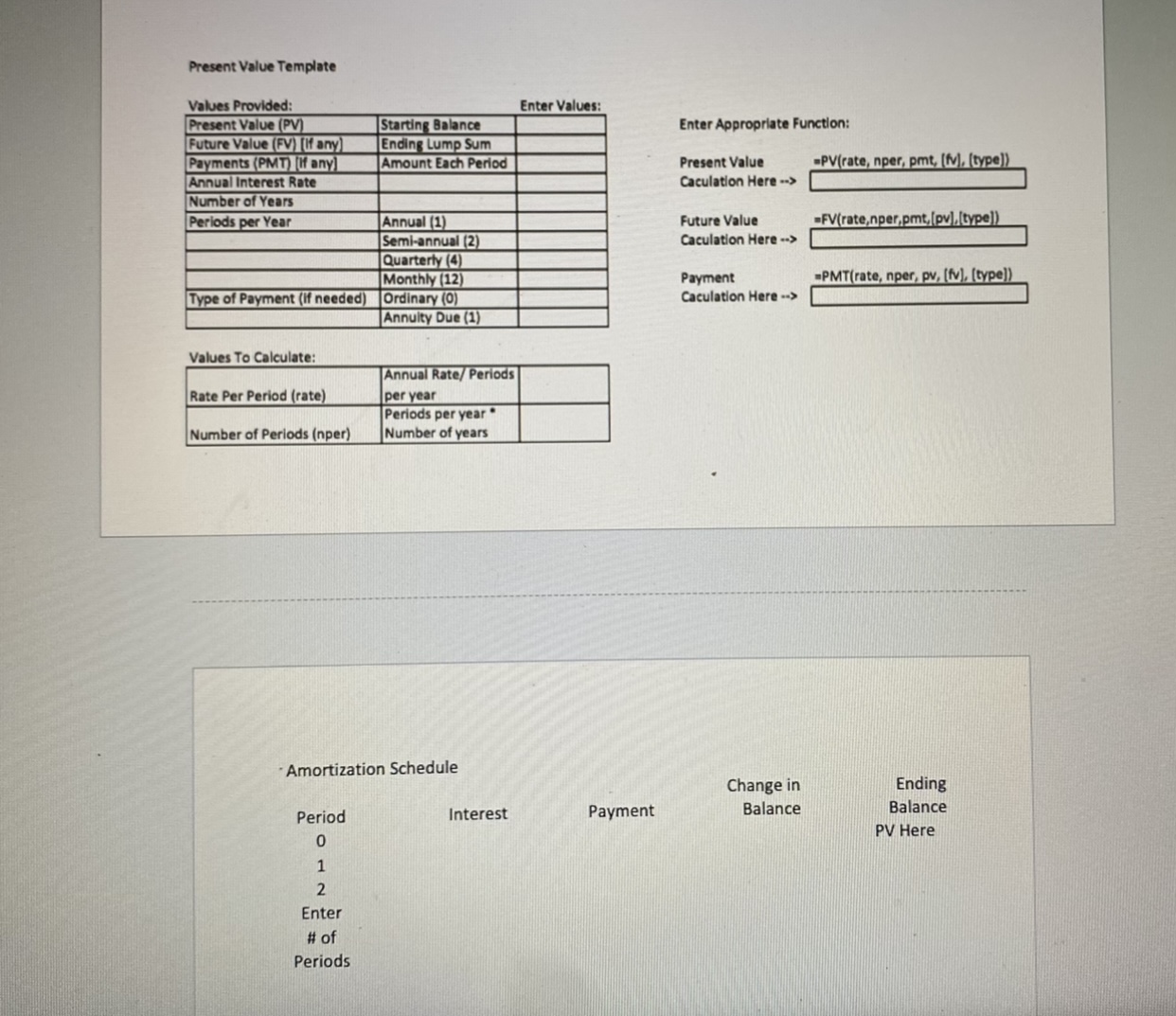

Present Value Template Enter Values: Enter Appropriate Function: Present Value Caculation Here --> -PV(rate, nper, pmt, [1]. (type)) Values Provided: Present Value (PV) Starting Balance Future Value (FV) [If any) Ending Lump Sum Payments (PMT) If any) Amount Each Period Annual Interest Rate Number of Years Periods per Year Annual (1) Semi-annual (2) Quarterly (4) Monthly (12) Type of Payment (If needed) Ordinary (0) Annuity Due (1) =FV(rate,nper,pmt, (pv).[type]) Future Value Caculation Here --> PMT(rate, nper, pv, (fv), (type]) Payment Caculation Here --> Values To Calculate: Rate Per Period (rate) Annual Rate/Periods per year Periods per year Number of years Number of Periods (nper) Amortization Schedule Change in Balance Ending Balance PV Here Interest Payment Period 0 1 2 Enter # of Periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts