Question: Use the textbook way to solve the problem! Chapter 18 18-10. The adjusted present value of a project equals the net present value of the

Use the textbook way to solve the problem!

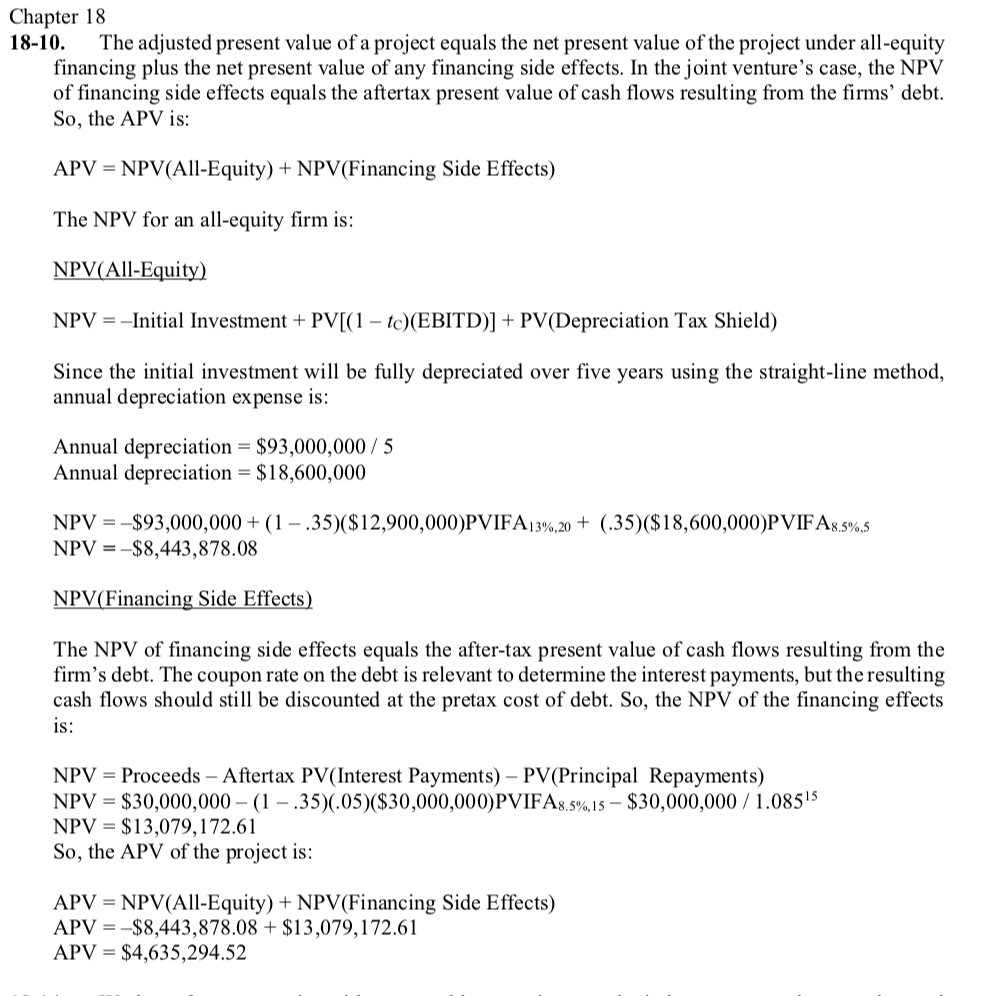

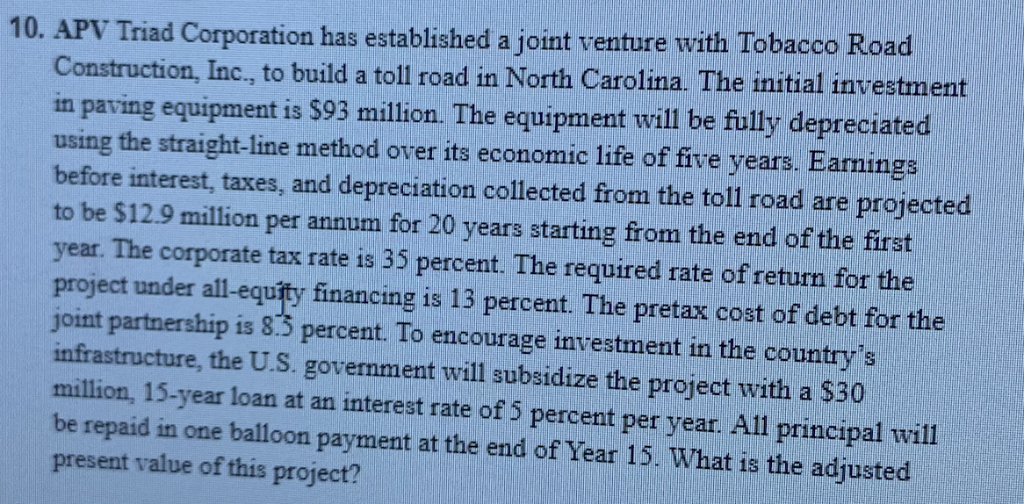

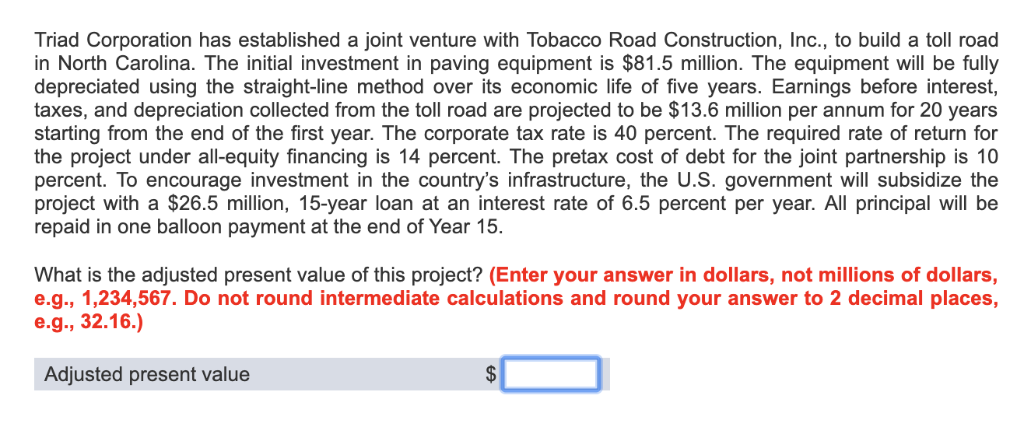

Chapter 18 18-10. The adjusted present value of a project equals the net present value of the project under all-equity financing plus the net present value of any financing side effects. In the joint venture's case, the NPV of financing side effects equals the aftertax present value of cash flows resulting from the firms' debt So, the APV is: APV - NPV(All-Equity) + NPV(Financing Side Effects) The NPV for an all-equity firm is: PV(All-Equity) NPV --Initial Investment + PVI1 - tc)(EBITD)]+PV(Depreciation Tax Shield) Since the initial investment will be fully depreciated over five years using the straight-line method, annual depreciation expense is Annual depreciation - $93,000,000/5 Annual depreciation - $18,600,000 NPV-$93,000,000+ (1-35)($12,900,000)PVIFA13%,20+ (35)($18,600,000)PVIFA8.5%,5 NPV --$8,443,878.08 NPV(Financing Side Effects The NPV of financing side effects equals the after-tax present value of cash flows resulting from the firm's debt. The coupon rate on the debt is relevant to determine the interest payments, but the resulting cash flows should still be discounted at the pretax cost of debt. So, the NPV of the financing effects 1S. NPV -Proceeds - Aftertax PV(Interest Payments) - PV(Principal Repayments) NPV-$30,000,000-(1-35)(.05)($30,000,000) PVI FA8.5%, 15-$30,000,000 / 1 . 08515 NPV- $13,079,172.61 So, the APV of the project is: APV NPV(All-Equity) + NPV(Financing Side Effects) APV--$8,443,878.08 + $13,079,172.61 APV- $4,635,294.52 10. APV Triad Corporation has established a joint venture with Tobacco Road Construction, Inc., to build a toll road in North Carolina. The initial investment in paving equipment is $93 million. The equipment will be fully depreciated using the straight-line method over its economic life of five years. Eanings before interest, taxes, and depreciation collected from the toll road are projected to be $12.9 million per annum for 20 years starting from the end of the first year. The corporate tax rate is 35 percent. The required rate of return for the project under all-equity financing is 13 percent. The pretax cost of debt for the joint partnership is 8.5 percent. To encourage investment in the country's infrastructure, the U.S. government will subsidize the project with a $30 milion, 15-year loan at an interest rate of 5 percent per year. All principal will be repaid in one balloon payment at the end of Year 15. What is the adjusted present value of this project? Triad Corporation has established a joint venture with Tobacco Road Construction, Inc., to build a toll road in North Carolina. The initial investment in paving equipment is $81.5 million. The equipment will be fully depreciated using the straight-line method over its economic life of five years. Earnings before interest taxes, and depreciation collected from the toll road are projected to be $13.6 million per annum for 20 years starting from the end of the first year. The corporate tax rate is 40 percent. The required rate of return for the project under all-equity financing is 14 percent. The pretax cost of debt for the joint partnership is 10 percent. To encourage investment in the country's infrastructure, the U.S. government will subsidize the project with a $26.5 million, 15-year loan at an interest rate of 6.5 percent per year. All principal will be repaid in one balloon payment at the end of Year 15. What is the adjusted present value of this project? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to 2 decimal places, e.g, 32.16) Adjusted present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts