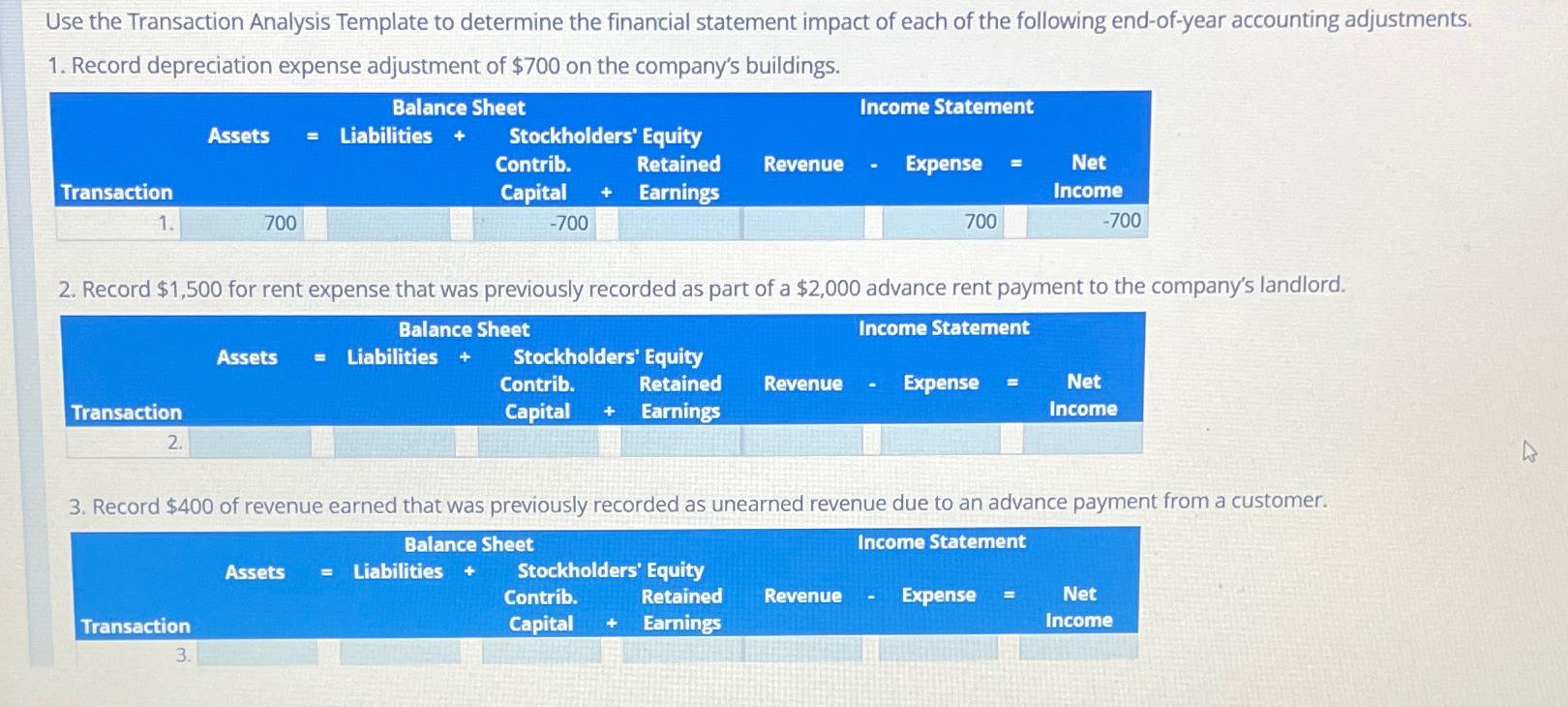

Question: Use the Transaction Analysis Template to determine the financial statement impact of each of the following end-of-year accounting adjustments. 1. Record depreciation expense adjustment

Use the Transaction Analysis Template to determine the financial statement impact of each of the following end-of-year accounting adjustments. 1. Record depreciation expense adjustment of $700 on the company's buildings. Balance Sheet Transaction 1. Transaction 2. Assets = Liabilities + Transaction 700 3. Stockholders' Equity Contrib. Retained Capital + Earnings -700 Revenue Stockholders' Equity Contrib. Retained Capital + Earnings 2. Record $1,500 for rent expense that was previously recorded as part of a $2,000 advance rent payment to the company's landlord. Income Statement Balance Sheet Assets = Liabilities + Revenue Income Statement - Stockholders' Equity Contrib. Retained Revenue Capital + Earnings Expense 700 - Expense 3. Record $400 of revenue earned that was previously recorded as unearned revenue due to an advance payment from a customer. Income Statement Balance Sheet Assets = Liabilities + Net Income -700 Expense = Net Income Net Income

Step by Step Solution

There are 3 Steps involved in it

Here are the entries for the accounting adjustments in the transaction analysis template 1 Record ... View full answer

Get step-by-step solutions from verified subject matter experts