Question: Use the trial balance and additional information to Complete question B (complete the income statement) ILUSIVE Exercises 1. The general ledger trial balance of the

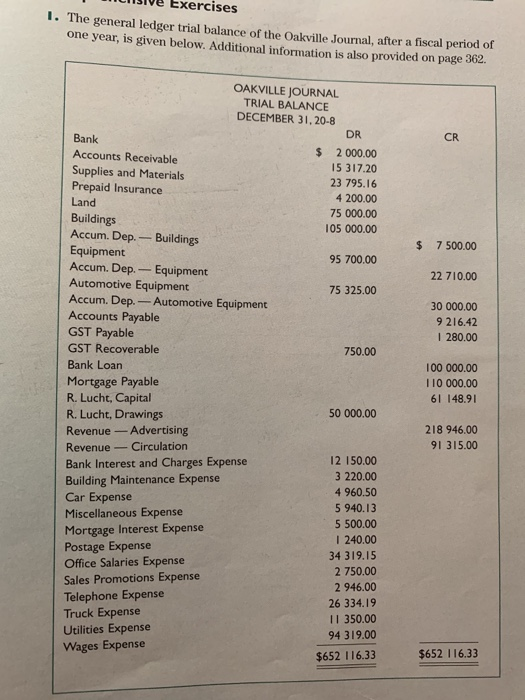

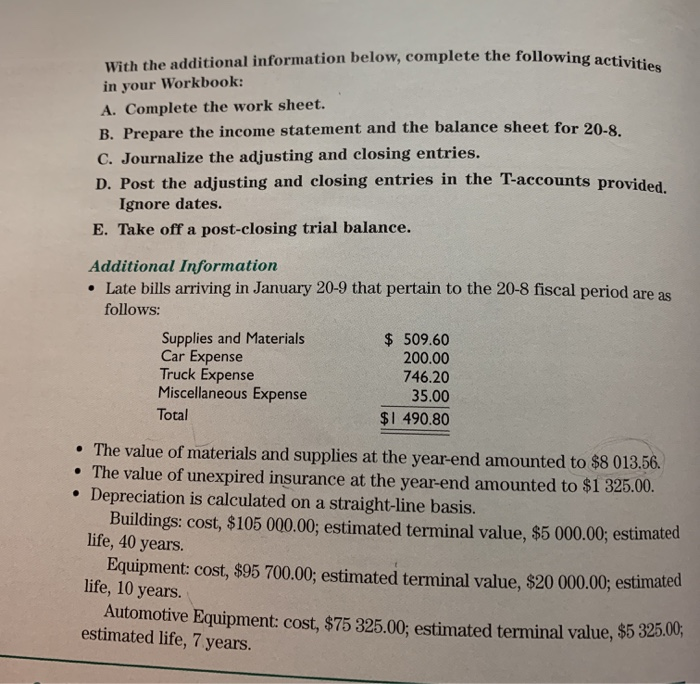

ILUSIVE Exercises 1. The general ledger trial balance of the Oakville Journal, after a fiscal period of one year, is given below. Additional information is also provided on page 362 $ 7 500.00 22 710.00 30 000.00 9 216.42 1 280.00 OAKVILLE JOURNAL TRIAL BALANCE DECEMBER 31, 20-8 Bank DR Accounts Receivable $ 2 000.00 Supplies and Materials 15 317.20 Prepaid Insurance 23 795.16 Land 4 200.00 Buildings 75 000.00 105 000.00 Accum. Dep. - Buildings Equipment 95 700.00 Accum. Dep. - Equipment Automotive Equipment 75 325.00 Accum. Dep. - Automotive Equipment Accounts Payable GST Payable GST Recoverable 750.00 Bank Loan Mortgage Payable R. Lucht, Capital R. Lucht, Drawings 50 000.00 Revenue - Advertising Revenue Circulation Bank Interest and Charges Expense 12 150.00 Building Maintenance Expense 3 220.00 Car Expense 4 960.50 5 940.13 Miscellaneous Expense 5 500.00 Mortgage Interest Expense I 240.00 Postage Expense 34 319.15 Office Salaries Expense 2 750.00 Sales Promotions Expense 2 946.00 Telephone Expense 26 334.19 Truck Expense 11 350.00 Utilities Expense 94 319.00 Wages Expense $652 116.33 100 000.00 110 000.00 61 148.91 218 946.00 91 315.00 $652 116.33 With the additional information below, complete the following acti in your Workbook: A. Complete the work sheet. B. Prepare the income statement and the balance sheet for 20-8 C. Journalize the adjusting and closing entries. D. Post the adjusting and closing entries in the T-accounts provide Ignore dates. E. Take off a post-closing trial balance. Additional Information Late bills arriving in January 20-9 that pertain to the 20-8 fiscal period are as follows: Supplies and Materials $ 509.60 Car Expense 200.00 Truck Expense 746.20 Miscellaneous Expense 35.00 Total $1 490.80 The value of materials and supplies at the year-end amounted to $8 013.56. The value of unexpired insurance at the year-end amounted to $1 325.00. Depreciation is calculated on a straight-line basis. Buildings: cost, $105 000.00; estimated terminal value, $5 000.00; estimated life, 40 years. Equipment: cost, $95 700.00; estimated terminal value, $20 000.00; estimated life, 10 years. Automotive Equipment: cost, $75 325.00: estimated terminal value, $5320,00 estimated life, 7 years. Date Name ANSWERS TO CHAPTER 9 REVIEW EXERCISES Exercise 1 (cont.) Comprehensive Exercise Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts