Question: Use the value in question to solve please. and explain the question step by step, thx. On 1 July 2013 Douglas Ltd acquired all of

Use the value in question to solve please. and explain the question step by step, thx.

On 1 July 2013 Douglas Ltd acquired all of the share capital (cum div)of Nanette Limited for a consideration of $500,000 cash and a brand that was held in their accounts at a book value of $10,000 but now had a fair value of $34,000. At the date of acquisition Nanette's accounts showed a dividend payable of $10,000.

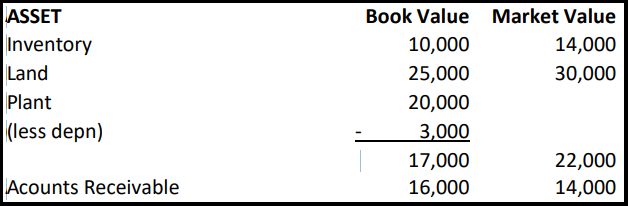

At that date all the identifiable assets and liabilities were recorded at fair value with the exception of:

The inventory was all sold by 30/6/14. The remaining useful life of the plant is 5 years. The accounts receivable were collected by 30/6/14 for $14,000 The land was sold on 30/12/16 for $32000. The plant was on hand still at 30/6/17. At the date of acquisition the equity of Nanette Ltd consisted of:

Share Capital - $380,000

General Reserve - $70,000

Retained Earnings - $62,000

Information from the trial balances of Nanette Ltd and Douglas Ltd at 30 June 2017 is presented overleaf.

Additional Information

1. On 1 Jan 2017 Douglas Ltd sold inventory to Nanette Ltd costing $60,000 for $80,000. Half of this inventory was sold to outside parties for $30,000 by 30/6/17. 2. On 1 Jan 2016 Nanette Ltd sold inventory costing $9000 to Douglas Ltd for $12,000. Douglas Ltd treats the item as equipment and depreciates it at 10% per annum. 3.On 1 July 2016 Nanette sold plant to Douglas for $12,000. The plant had cost Nanette $10,000 on 1 July 2014 and it was being depreciated at 10% per annum. Douglas regards the plant as inventory. The inventory was all sold by 30th July 2016. 4. At 1 July 2016 Douglas Ltd held inventory that it had purchased from Nanette Ltd on 1 June

2016 at a profit of $7000. All inventory was sold by 30 June 2017 5. Douglas Ltd accrues dividends from Nanette Ltd once they are declared. 6. Nanette Ltd has earned $1200 in interest revenue in the 2017 financial year from Douglas Ltd.

7. Nanette Ltd has earned $4800 in service revenue in the 2017 financial year from Douglas Ltd.

8. Assume a tax rate of 30%.

1. Prepare the consolidation worksheet journal entries to eliminate the effects of inter-entity transactions as at 30 June 2017. 2. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2017

\begin{tabular}{lrr|} \hline ASSET & Book Value & Market Value \\ Inventory & 10,000 & 14,000 \\ Land & 25,000 & 30,000 \\ Plant & 20,000 & \\ (less depn) & 3,000 & \\ \cline { 2 - 3 } & 17,000 & 22,000 \\ Acounts Receivable & 16,000 & 14,000 \end{tabular} \begin{tabular}{lrr|} \hline ASSET & Book Value & Market Value \\ Inventory & 10,000 & 14,000 \\ Land & 25,000 & 30,000 \\ Plant & 20,000 & \\ (less depn) & 3,000 & \\ \cline { 2 - 3 } & 17,000 & 22,000 \\ Acounts Receivable & 16,000 & 14,000 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts