Question: Use the values from the image below, unless or until stated otherwise in any part of the question. Problem 1 EUR rate= -1%, US rate

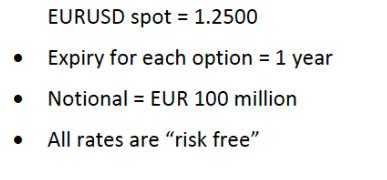

Use the values from the image below, unless or until stated otherwise in any part of the question.

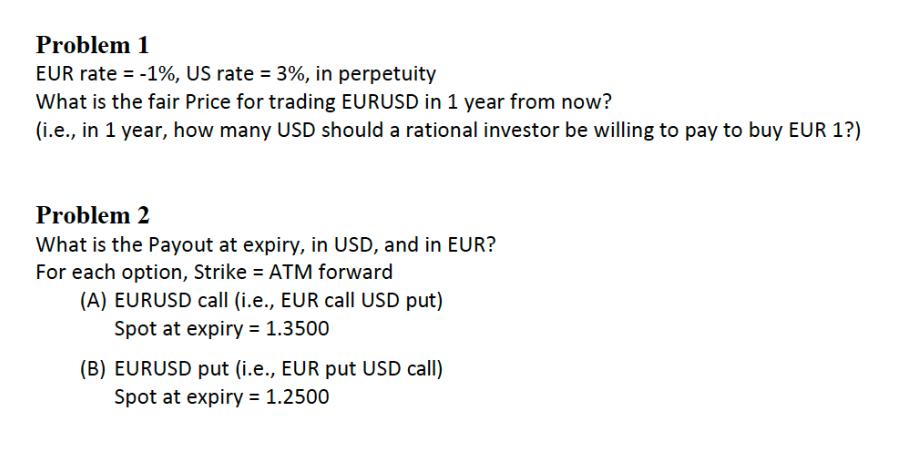

Problem 1 EUR rate= -1%, US rate = 3%, in perpetuity What is the fair Price for trading EURUSD in 1 year from now? (i.e., in 1 year, how many USD should a rational investor be willing to pay to buy EUR 1?) Problem 2 What is the Payout at expiry, in USD, and in EUR? For each option, Strike = ATM forward (A) EURUSD call (i.e., EUR call USD put) Spot at expiry = 1.3500 (B) EURUSD put (i.e., EUR put USD call) Spot at expiry = 1.2500

Step by Step Solution

There are 3 Steps involved in it

Problem 1 To find the fair price for trading EURUSD in one year from now we can use the interest rate parity theory which states that the difference i... View full answer

Get step-by-step solutions from verified subject matter experts