Question: Use these inputs for Problems 1 3 through 1 9 : You manage a risky portfolio with an expected rate of return of (

Use these inputs for Problems through : You manage a risky portfolio with an expected rate of return of and a

standard deviation of The Tbill rate is

Your client chooses to invest of a portfolio in your fund and in an essentially riskfree money market fund. What are the expected value and standard deviation of the rate of return on his portfolio?

Suppose that your risky portfolio includes the following investments in the given proportions:

What are the investment proportions of your client's overall portfolio, including the position in Tbills?

Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall portfolio will have an expected rate of return of

a What is the proportion y

b What are your client's investment proportions in your three stocks and the Tbill fund?

c What is the standard deviation of the rate of return on your client's portfolio?

Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio's standard deviation will not exceed

a What is the investment proportion, y

b What is the expected rate of return on the complete portfolio? CFA Problem

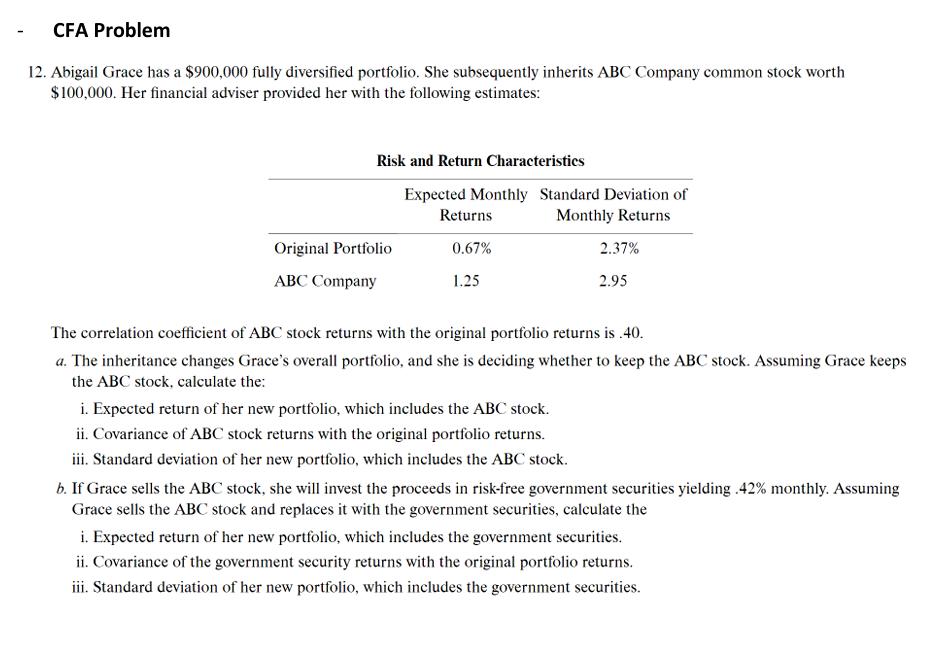

Abigail Grace has a $ fully diversified portfolio. She subsequently inherits ABC Company common stock worth $ Her financial adviser provided her with the following estimates:

Risk and Return Characteristics

The correlation coefficient of ABC stock returns with the original portfolio returns is

a The inheritance changes Grace's overall portfolio, and she is deciding whether to keep the ABC stock. Assuming Grace keeps the ABC stock, calculate the:

i Expected return of her new portfolio, which includes the ABC stock.

ii Covariance of ABC stock returns with the original portfolio returns.

iii. Standard deviation of her new portfolio, which includes the ABC stock.

b If Grace sells the ABC stock, she will invest the proceeds in riskfree government securities yielding monthly. Assuming Grace sells the ABC stock and replaces it with the government securities calculate the

i Expected return of her new portfolio, which includes the government securities

ii Covariance of the government security returns with the original portfolio returns.

iii. Standard deviation of her new portfolio, which includes the government securities

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock