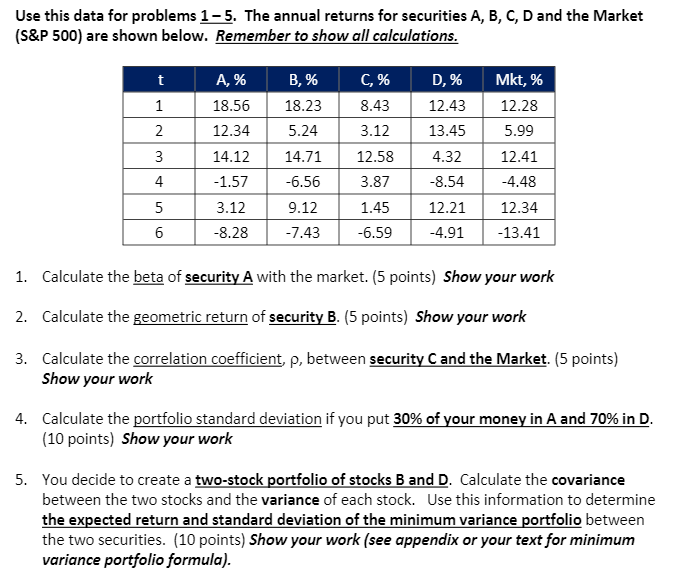

Question: Use this data for problems 1-5. The annual returns for securities A, B, C, D and the Market (S&P 500) are shown below. Remember to

Use this data for problems 1-5. The annual returns for securities A, B, C, D and the Market (S&P 500) are shown below. Remember to show all calculations. t 1 2 3 A, % 18.56 12.34 14.12 B, % 18.23 5.24 14.71 -6.56 C% 8.43 3.12 12.58 D, % 12.43 13.45 4.32 -8.54 12.21 -4.91 Mkt, % 12.28 5.99 12.41 -4.48 12.34 -13.41 4 -1.57 3.87 5 9.12 3.12 -8.28 1.45 -6.59 6 -7.43 1. Calculate the beta of security A with the market. (5 points) Show your work 2. Calculate the geometric return of security B. (5 points) Show your work 3. Calculate the correlation coefficient, p, between security C and the Market. (5 points) Show your work 4. Calculate the portfolio standard deviation if you put 30% of your money in A and 70% in D. (10 points) Show your work 5. You decide to create a two-stock portfolio of stocks B and D. Calculate the covariance between the two stocks and the variance of each stock. Use this information to determine the expected return and standard deviation of the minimum variance portfolio between the two securities. (10 points) Show your work (see appendix or your text for minimum variance portfolio formula). Use this data for problems 1-5. The annual returns for securities A, B, C, D and the Market (S&P 500) are shown below. Remember to show all calculations. t 1 2 3 A, % 18.56 12.34 14.12 B, % 18.23 5.24 14.71 -6.56 C% 8.43 3.12 12.58 D, % 12.43 13.45 4.32 -8.54 12.21 -4.91 Mkt, % 12.28 5.99 12.41 -4.48 12.34 -13.41 4 -1.57 3.87 5 9.12 3.12 -8.28 1.45 -6.59 6 -7.43 1. Calculate the beta of security A with the market. (5 points) Show your work 2. Calculate the geometric return of security B. (5 points) Show your work 3. Calculate the correlation coefficient, p, between security C and the Market. (5 points) Show your work 4. Calculate the portfolio standard deviation if you put 30% of your money in A and 70% in D. (10 points) Show your work 5. You decide to create a two-stock portfolio of stocks B and D. Calculate the covariance between the two stocks and the variance of each stock. Use this information to determine the expected return and standard deviation of the minimum variance portfolio between the two securities. (10 points) Show your work (see appendix or your text for minimum variance portfolio formula)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts