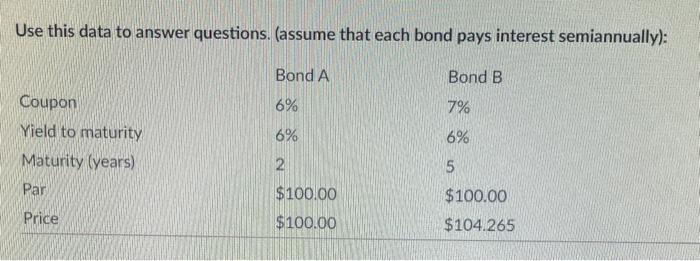

Question: Use this data to answer questions. (assume that each bond pays interest semiannually): Bond A Bond B 6% 7% Coupon Yield to maturity Maturity (years)

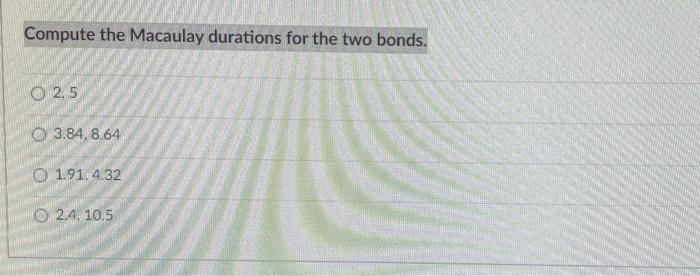

Use this data to answer questions. (assume that each bond pays interest semiannually): Bond A Bond B 6% 7% Coupon Yield to maturity Maturity (years) 6% 6% 5 2 $100.00 Par Price $100.00 $104.265 $100.00 Compute the Macaulay durations for the two bonds. 02.5 3.84, 8.64 1.91.4.32 2.4. 10.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts