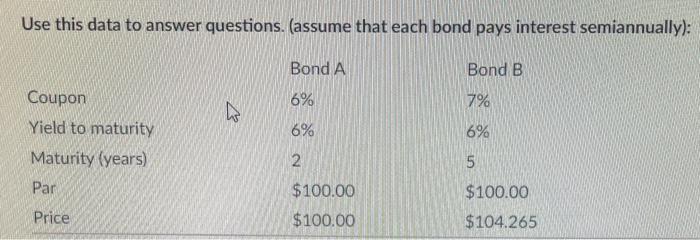

Question: Use this data to answer questions. (assume that each bond pays interest semiannually): Bond A Bond B 6% 7% B Coupon Yield to maturity Maturity

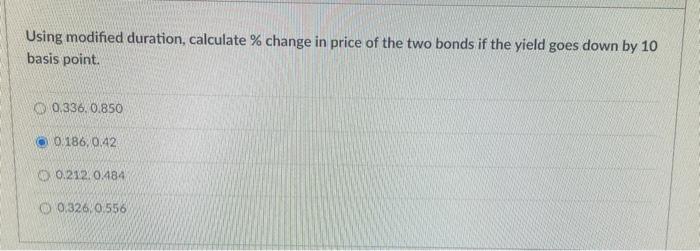

Use this data to answer questions. (assume that each bond pays interest semiannually): Bond A Bond B 6% 7% B Coupon Yield to maturity Maturity (years) 6% 6% 2 5 Par $100.00 $100.00 $104.265 Price $100.00 Using modified duration, calculate % change in price of the two bonds if the yield goes down by 10 basis point. 0.336. 0.850 0.186.042 00.212.0484 O 0326 0.556

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts