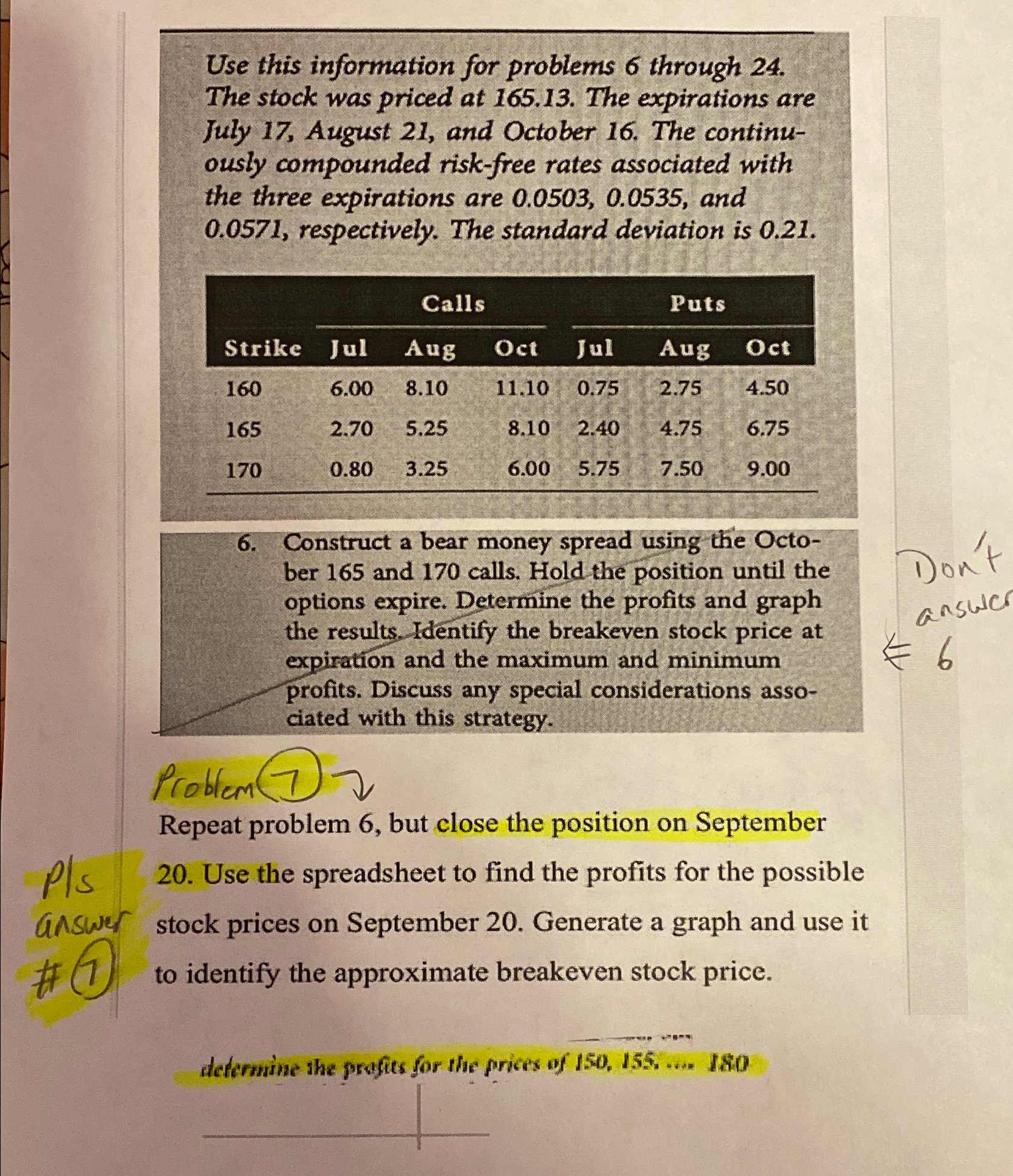

Question: Use this information for problems 6 through 2 4 . The stock was priced at 1 6 5 . 1 3 . The expirations are

Use this information for problems through The stock was priced at The expirations are July August and October The continuously compounded riskfree rates associated with the three expirations are and respectively. The standard deviation is

tableCalls,,PutsStrikeJul,Aug,Oct,,Jul,Aug,Oct,

Construct a bear money spread using the October and calls. Hold the position until the options expire. Determine the profits and graph the results. Identify the breakeven stock price at expiration and the maximum and minimum profits. Discuss any special considerations associated with this strategy.

Problem darr

Repeat problem but close the position on September Use the spreadsheet to find the profits for the possible stock prices on September Generate a graph and use it to identify the approximate breakeven stock price.

dedermine the prefits for the prices of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock