Question: Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 5678910 Received Todd's payment of principal and interest on

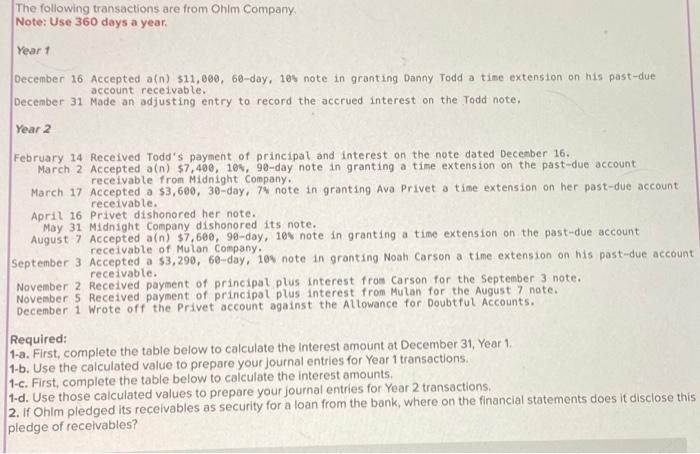

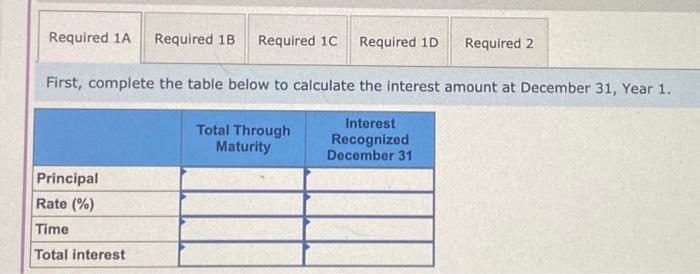

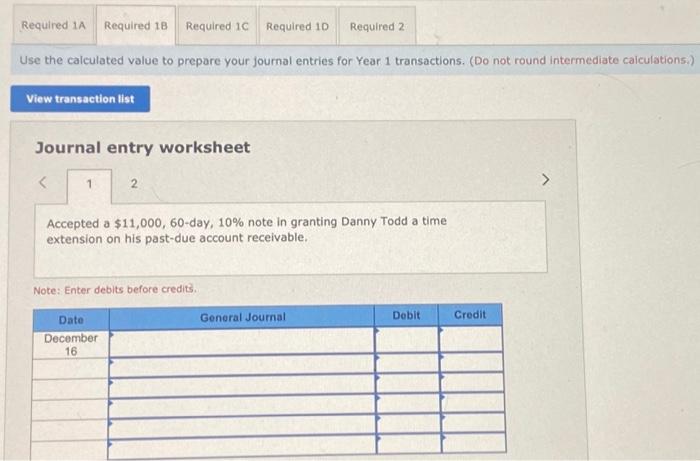

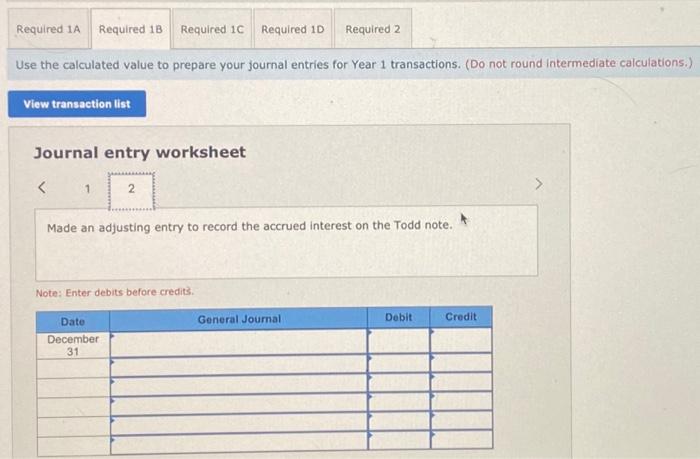

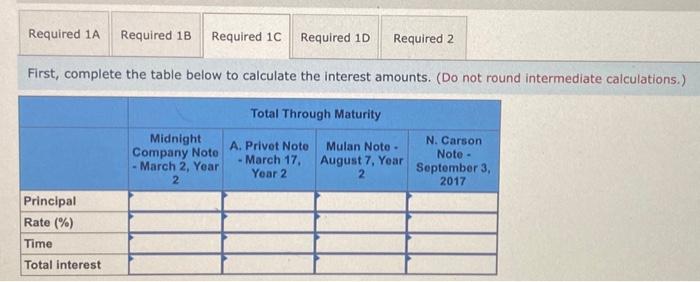

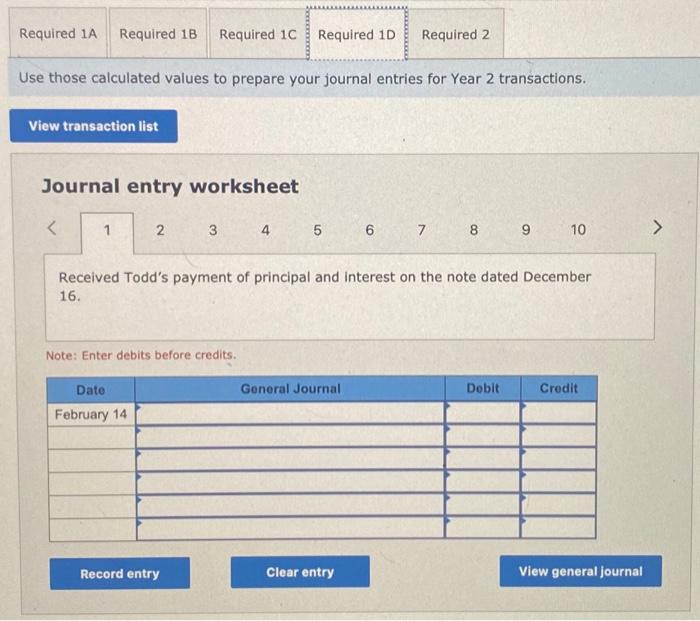

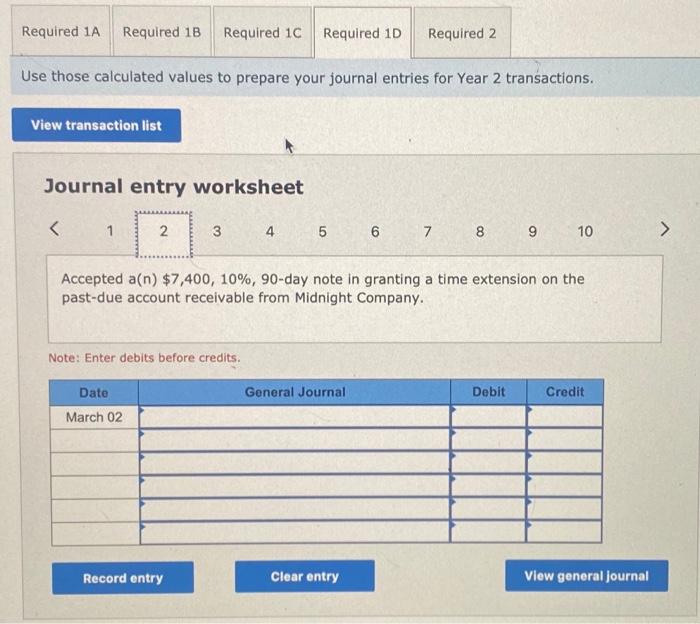

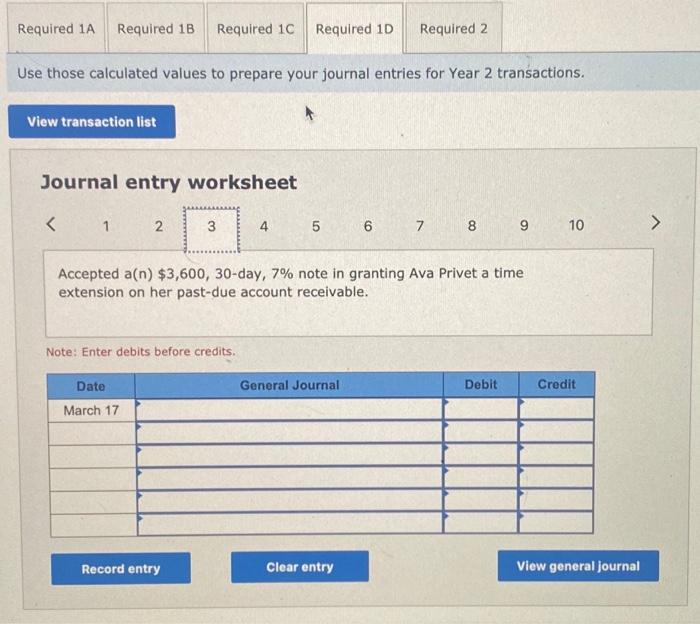

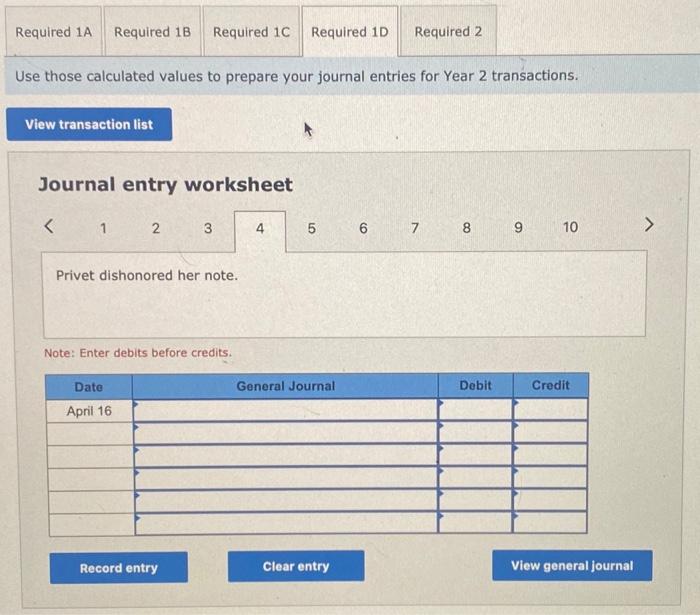

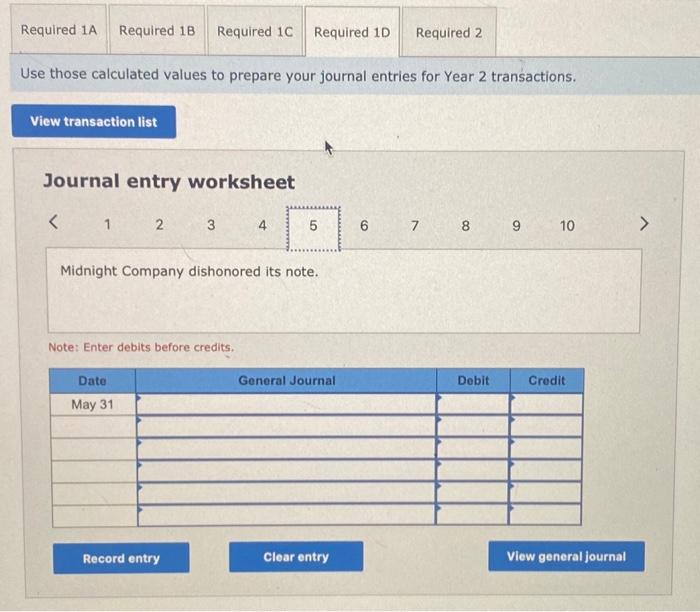

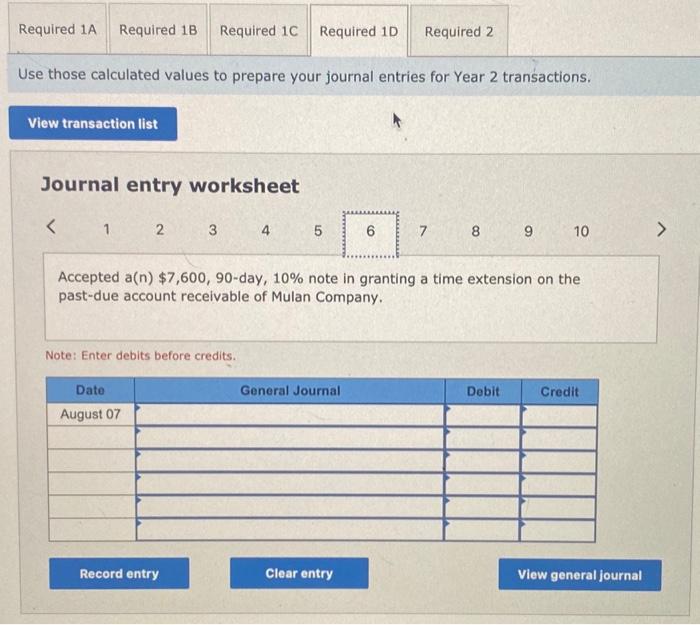

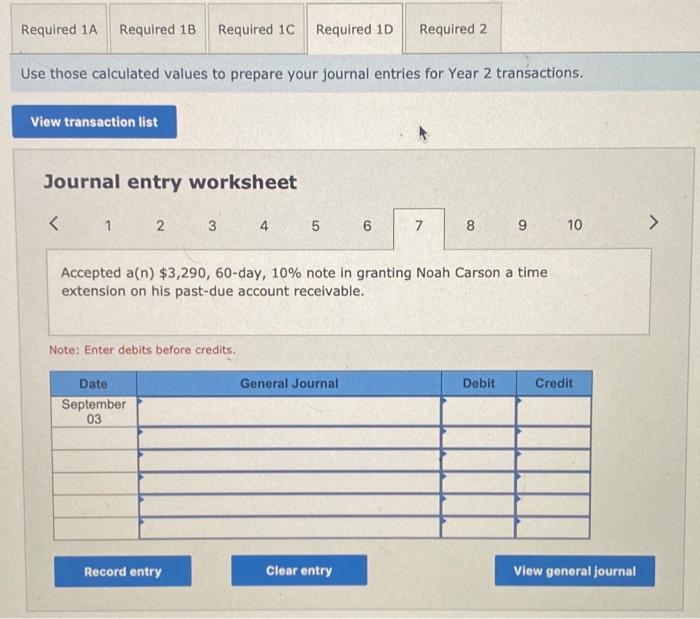

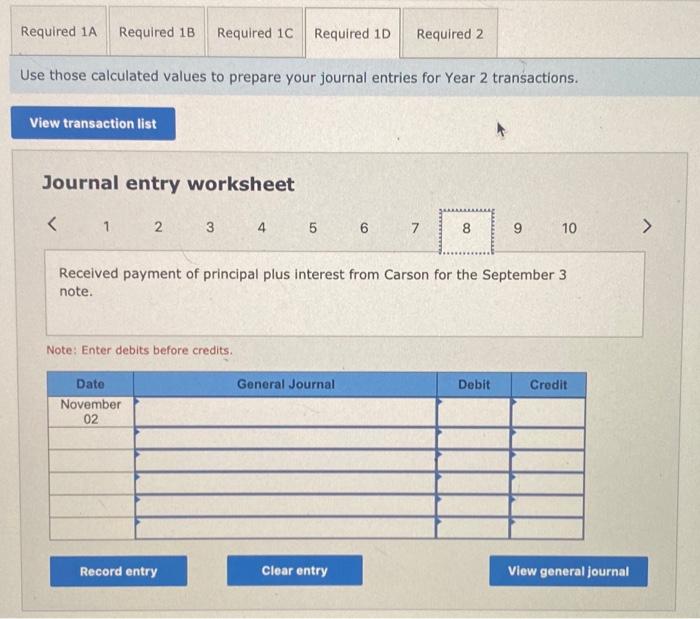

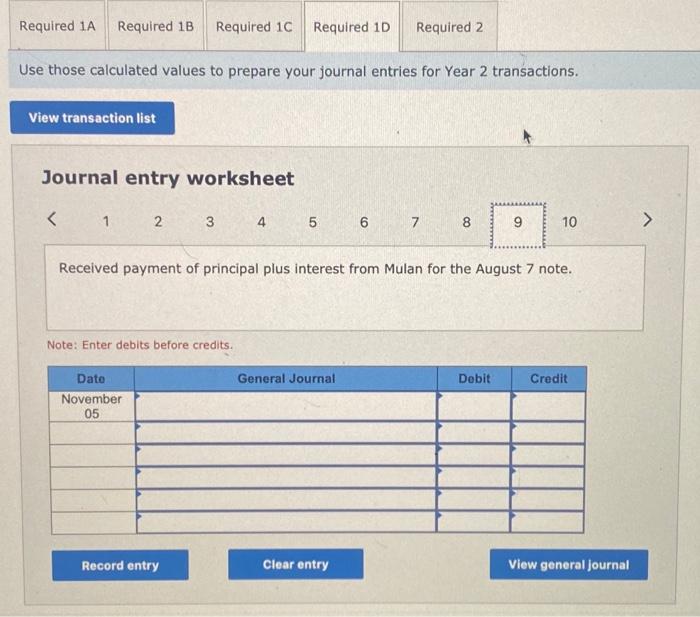

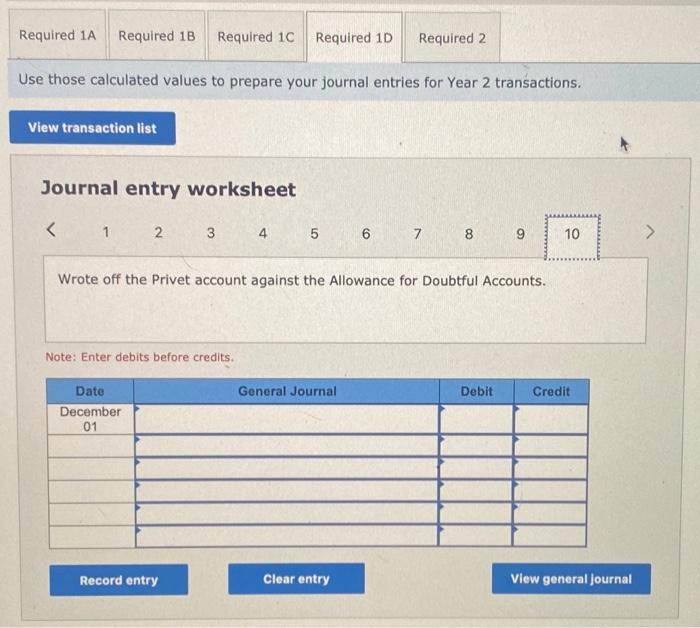

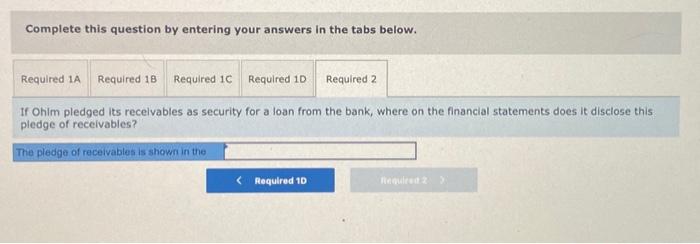

Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 5678910 Received Todd's payment of principal and interest on the note dated December 16. Note: Enter debits before credits. Use the calculated value to prepare your journal entries for Year 1 transactions. (Do not round intermediate calculations.) Journal entry worksheet Accepted a $11,000,60-day, 10% note in granting Danny Todd a time extension on his past-due account receivable. Note: Enter debits before credits. First, complete the table below to calculate the interest amount at December 31 , Year 1. Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 1234578 Wrote off the Privet account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Received payment of principal plus interest from Mulan for the August 7 note. Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 1 Received payment of principal plus interest from Carson for the September 3 note. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. If Ohim pledged its recelvables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 1 5 Accepted a(n)$3,290,60-day, 10% note in granting Noah Carson a time extension on his past-due account receivable. Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Accepted a(n) $3,600,30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Note: Enter debits before credits. Note: Use 360 days a year. Year 1 December 16 Accepted a(n)$11,000,60-day, 1es note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated Decenber 16. March 2 Accepted a(n)$7,400,104,90-day note in granting a time extension on the past-due account receivabte from Midnight Company. March 17 Accepted a $3,600,30 day, 74 note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n)$7,600, 90-day, 10v note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $3,290,60-day, ios note in granting Noah Carson a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Carson for the September 3 note. November 5 Received payment of principal plus interest from Mulan for the August 7 note. December 1 Wrote off the Privet account against the Altowance for Doubtfut Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31 , Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohim pledged its recelvables as security for a loan from the bank, where on the financial statements does if disclose this pledge of recelvables? Use the calculated value to prepare your journal entries for Year 1 transactions. (Do not round intermediate calculations.) Journal entry worksheet Made an adjusting entry to record the accrued interest on the Todd note. Note: Enter debits before credits. First, complete the table below to calculate the interest amounts. (Do not round intermediate calculations.) Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Accepted a(n) $7,600,90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Company. Note: Enter debits before credits. Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 578910 Accepted a(n)$7,400,10%,90-day note in granting a time extension on the past-due account receivable from Midnight Company. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts