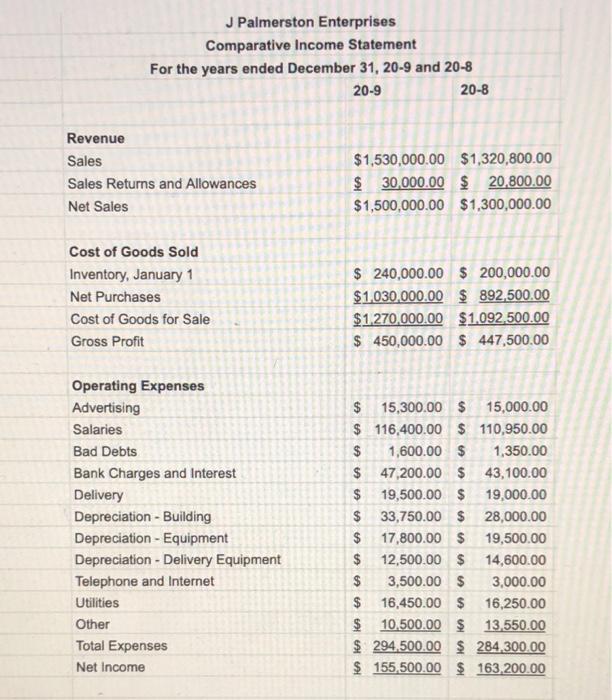

Question: Use those two work sheets, and calculate the following for the year 20-9: (You can use the final numbers for 20-8 as the basis for

Use those two work sheets, and calculate the following for the year 20-9: (You can use the final numbers for 20-8 as the basis for your average):

a. Working capital

b. current ratio

c. quick ratio

d. merchandise turnover

e. Accounts receivable collection period

f. quick ratio

g. debt ratio

h. Rate of return on net sales

i. rate of return on average owner's equity.

Assume that you are interested in buying the business from J Palmerston. What items from your analysis so far would you consider exceptional? What would you consider to be most significant and why is that the case? Assume that you could take the potential capital and invest it, yielding 9% year in interest.

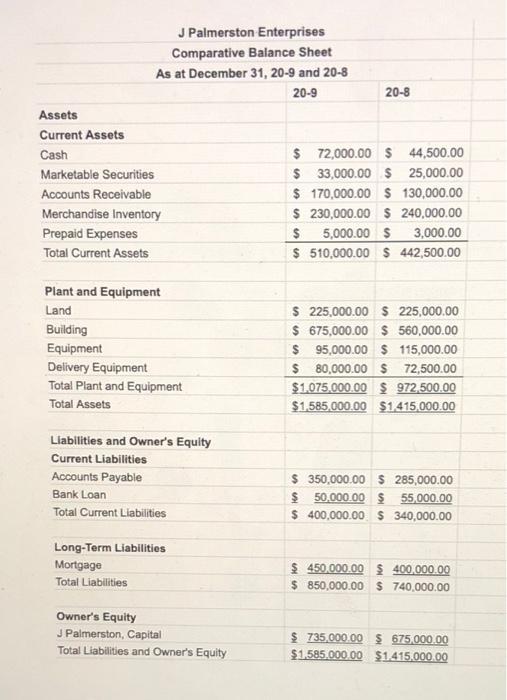

J Palmerston Enterprises Comparative Balance Sheet As at December 31, 20-9 and 20-8 20-9 20-8 Assets Current Assets $ 72,000.00 S 44,500.00 $ 33,000.00 S 25,000.00 $ 170,000.00 $ 130,000.00 $ 230,000.00 $ 240,000.00 3,000.00 $ 510,000.00 $ 442,500.00 Cash Marketable Securities Accounts Receivable Merchandise Inventory Prepaid Expenses 24 5,000.00 S Total Current Assets Plant and Equipment $ 225,000.00 $ 225,000.00 $ 675,000.00 s 560,000.00 $ 95,000.00 $ 115,000.00 $ 80,000.00 S 72,500.00 Land Building Equipment Delivery Equipment Total Plant and Equipment $1.075.000.00 $ 972,500.00 Total Assets $1,585,000.00 $1,415,000.00 Liabilities and Owner's Equity Current Liabilities $ 350,000.00 S 285,000.00 $ 50,000.00 $ 55,000.00 $ 400,000.00 $ 340,000.00 Accounts Payable Bank Loan Total Current Liabilities Long-Term Liabilities $ 450,000.00 $ 400.000.00 $ 850,000.00 S 740,000.00 Mortgage Total Liabilities Owner's Equity J Palmerston, Capital Total Liabilities and Owner's Equity $ 735,000.00 $ 675,000.00 $1.585.000 00 $1415.000.00

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Calculation of Ratios for Year 209 a Working Capital Current Asset Current ... View full answer

Get step-by-step solutions from verified subject matter experts