Question: use wage bracket method Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does

use wage bracket method

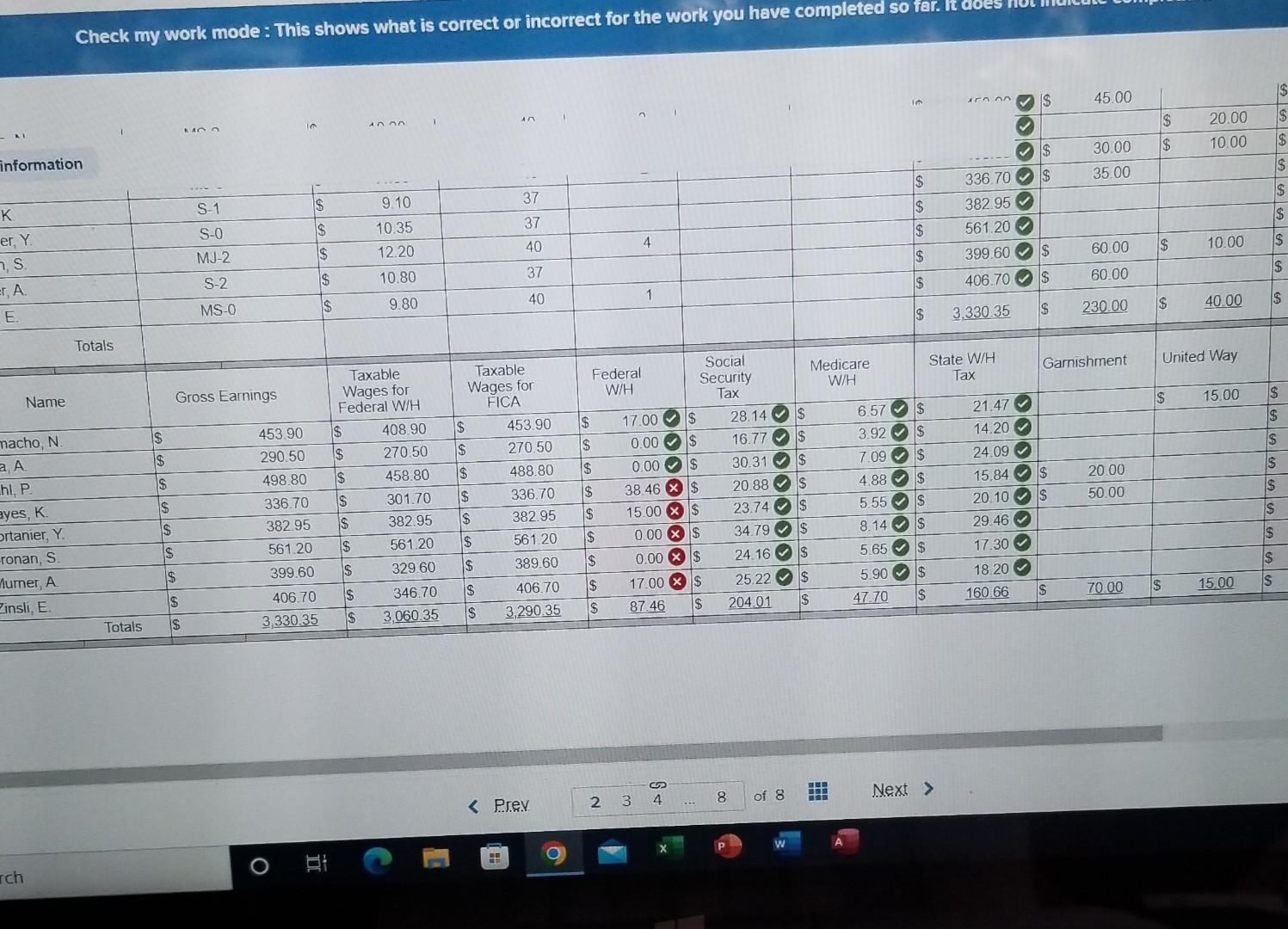

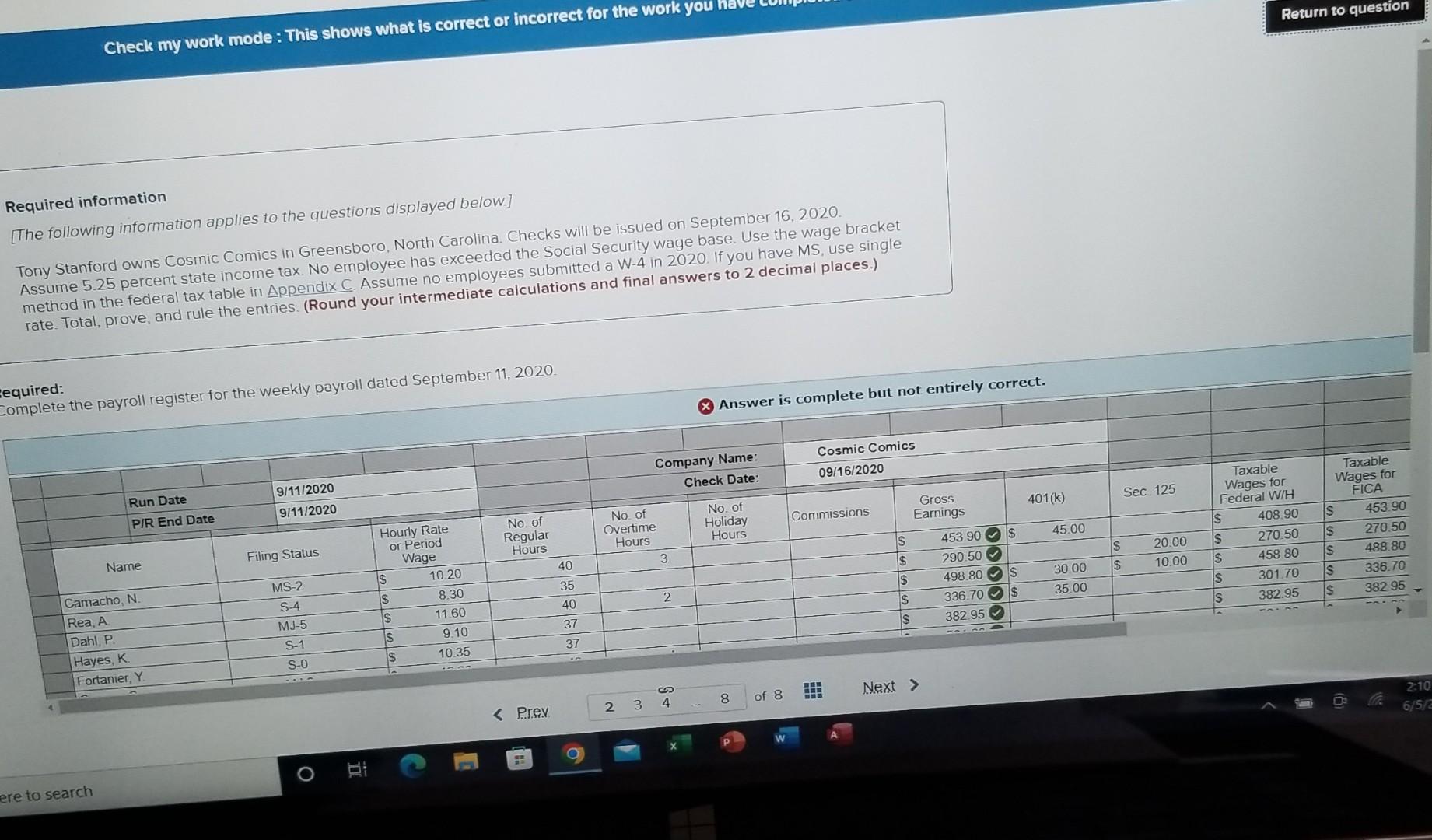

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does 450 00 MD 3 information $ $S K S-1 $ 9.10 37 336.70 $ 382.95 $ $ er, Y. 10.35 37 $ 561.20 12.20 4 40 $ 10.80 1 399.60 $ $ 406.70 S $ $ 3.330.35 State W/H Tax n, S. er, A. E. Name macho, N. a, A. hl, P. ayes, K. ortanier, Y. -ronan, S. Murner, A Zinsli, E. rch Totals LA LA LA LA $ IS S IS S-0 MJ-2 S-2 MS-0 Gross Earnings $ IS Totals IS 453.90 290.50 498.80 336.70 382.95 561.20 399.60 406.70 3,330.35 B $ $ IS Taxable Wages for Federal W/H GA GA GA GA $ 408.90 270.50 458.80 301.70 382.95 561.20 329.60 346.70 S 3,060.35 S S 9.80 $ S SAS $ Taxable Wages for FICA $ $ $ $ $ GAG IS 37 40 S $ $ 453.90 270.50 $ 488.80 336.70 $ 382.95 $ 561.20 $ $ 389.60 $ 406.70 $ 3,290.35 2 100000 $ 60.00 60.00 230.00 Garnishment 20.00 50.00 70.00 21.47 14.20 24.09 15.84 S 20.10 S 29.46 17.30 18.20 160 66 45.00 30.00 35.00 69 $ 20.00 $ 10.00 $ 10.00 $ 40.00 United Way $ 15.00 $ 15.00 $ $ S IS IS IS A GA GA GA GA GA GA GA 69 $ S IS Check my work mode: This shows what is correct or incorrect for the work you Required information [The following information applies to the questions displayed below] Tony Stanford owns Cosmic Comics in Greensboro, North Carolina. Checks will be issued on September 16, 2020. Assume 5.25 percent state income tax. No employee has exceeded the Social Security wage base. Use the wage bracket method in the federal tax table in Appendix C. Assume no employees submitted a W-4 in 2020. If you have MS, use single rate. Total, prove, and rule the entries. (Round your intermediate calculations and final answers to 2 decimal places.) cequired: Complete the payroll register for the weekly payroll dated September 11, 2020. Run Date 9/11/2020 9/11/2020 P/R End Date Hourly Rate No. of Regular Hours Name Camacho, N. Rea, A Dahl, P. Hayes, K. Fortanier, Y. ere to search Filing Status MS-2 S-4 MJ-5 S-1 S-0 I Bi SSSSS or Period Wage 10.20 8.30 11.60 9.10 10.35 33333 453.90 S 290.50 498.80 S S 336.70 382.95 45.00 30.00 35.00 S S Sec. 125 20.00 10.00 Return to question Taxable Wages for FICA 453.90 270.50 488.80 336.70 382 95 Taxable Wages for Federal W/H 408.90 S $ S 270.50 458.80 301.70 382.95 IS IS $ SSSS 2:10 6/5/2 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does 450 00 MD 3 information $ $S K S-1 $ 9.10 37 336.70 $ 382.95 $ $ er, Y. 10.35 37 $ 561.20 12.20 4 40 $ 10.80 1 399.60 $ $ 406.70 S $ $ 3.330.35 State W/H Tax n, S. er, A. E. Name macho, N. a, A. hl, P. ayes, K. ortanier, Y. -ronan, S. Murner, A Zinsli, E. rch Totals LA LA LA LA $ IS S IS S-0 MJ-2 S-2 MS-0 Gross Earnings $ IS Totals IS 453.90 290.50 498.80 336.70 382.95 561.20 399.60 406.70 3,330.35 B $ $ IS Taxable Wages for Federal W/H GA GA GA GA $ 408.90 270.50 458.80 301.70 382.95 561.20 329.60 346.70 S 3,060.35 S S 9.80 $ S SAS $ Taxable Wages for FICA $ $ $ $ $ GAG IS 37 40 S $ $ 453.90 270.50 $ 488.80 336.70 $ 382.95 $ 561.20 $ $ 389.60 $ 406.70 $ 3,290.35 2 100000 $ 60.00 60.00 230.00 Garnishment 20.00 50.00 70.00 21.47 14.20 24.09 15.84 S 20.10 S 29.46 17.30 18.20 160 66 45.00 30.00 35.00 69 $ 20.00 $ 10.00 $ 10.00 $ 40.00 United Way $ 15.00 $ 15.00 $ $ S IS IS IS A GA GA GA GA GA GA GA 69 $ S IS Check my work mode: This shows what is correct or incorrect for the work you Required information [The following information applies to the questions displayed below] Tony Stanford owns Cosmic Comics in Greensboro, North Carolina. Checks will be issued on September 16, 2020. Assume 5.25 percent state income tax. No employee has exceeded the Social Security wage base. Use the wage bracket method in the federal tax table in Appendix C. Assume no employees submitted a W-4 in 2020. If you have MS, use single rate. Total, prove, and rule the entries. (Round your intermediate calculations and final answers to 2 decimal places.) cequired: Complete the payroll register for the weekly payroll dated September 11, 2020. Run Date 9/11/2020 9/11/2020 P/R End Date Hourly Rate No. of Regular Hours Name Camacho, N. Rea, A Dahl, P. Hayes, K. Fortanier, Y. ere to search Filing Status MS-2 S-4 MJ-5 S-1 S-0 I Bi SSSSS or Period Wage 10.20 8.30 11.60 9.10 10.35 33333 453.90 S 290.50 498.80 S S 336.70 382.95 45.00 30.00 35.00 S S Sec. 125 20.00 10.00 Return to question Taxable Wages for FICA 453.90 270.50 488.80 336.70 382 95 Taxable Wages for Federal W/H 408.90 S $ S 270.50 458.80 301.70 382.95 IS IS $ SSSS 2:10 6/5/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts