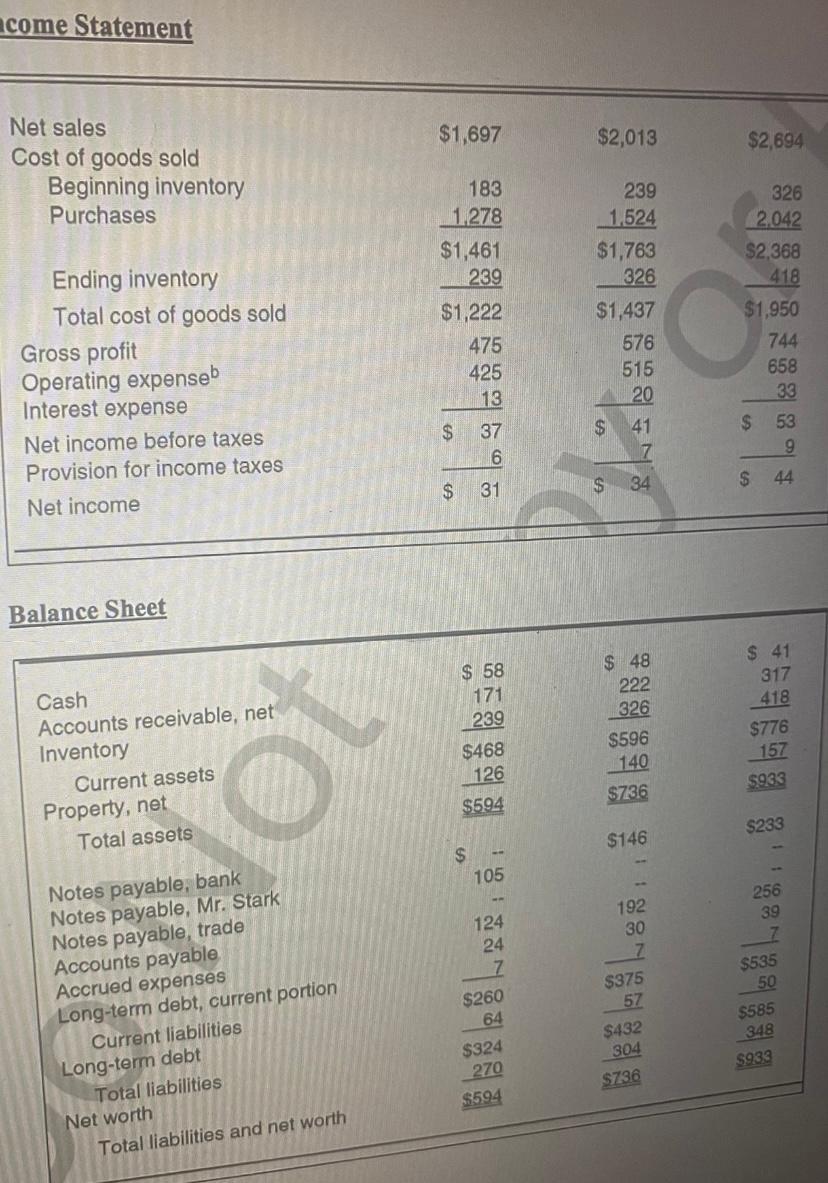

Question: USE YOUR TREND ANALYSIS TO PROJECT THE INCOME STATEMENT UNTIL 2020 (2 YEARS) . ncome Statement $1,697 $2,013 $2,694 Net sales Cost of goods sold

USE YOUR TREND ANALYSIS TO PROJECT THE INCOME STATEMENT UNTIL 2020 (2 YEARS) .

ncome Statement $1,697 $2,013 $2,694 Net sales Cost of goods sold Beginning inventory Purchases 326 2,042 $2,368 418 183 1278 $1,461 1.239 $1,222 475 425 13 Ending inventory Total cost of goods sold Gross profit Operating expenseb Interest expense Net income before taxes Provision for income taxes Net income C 239 1,524 $1,763 326 $1,437 576 515 20 $ 41 7 1919921 $1,950 744 658 33 $ 53 9 $ 37 6 $ $ 44 31 34 $ Balance Sheet $ 58 171 239 $ 48 222 326 $596 140 Cash Accounts receivable, net Inventory Current assets Property, net Total assets OY $ 41 317 418 $776 157 $933 $468 126 $736 $594 $233 $146 $ 105 256 Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt Total liabilities Net worth Total liabilities and net worth $535 124 24 7 $260 64 192 30 7 $375 57 $432 304 $736 50 $585 348 $933 $324 270 $594 ncome Statement $1,697 $2,013 $2,694 Net sales Cost of goods sold Beginning inventory Purchases 326 2,042 $2,368 418 183 1278 $1,461 1.239 $1,222 475 425 13 Ending inventory Total cost of goods sold Gross profit Operating expenseb Interest expense Net income before taxes Provision for income taxes Net income C 239 1,524 $1,763 326 $1,437 576 515 20 $ 41 7 1919921 $1,950 744 658 33 $ 53 9 $ 37 6 $ $ 44 31 34 $ Balance Sheet $ 58 171 239 $ 48 222 326 $596 140 Cash Accounts receivable, net Inventory Current assets Property, net Total assets OY $ 41 317 418 $776 157 $933 $468 126 $736 $594 $233 $146 $ 105 256 Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt Total liabilities Net worth Total liabilities and net worth $535 124 24 7 $260 64 192 30 7 $375 57 $432 304 $736 50 $585 348 $933 $324 270 $594

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts