Question: Using A... Can you provide explonations and solutions for (E) A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In

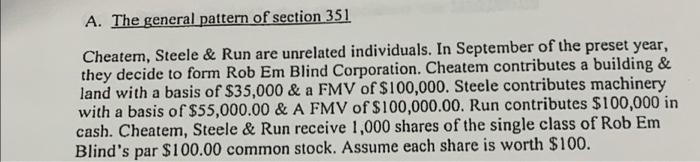

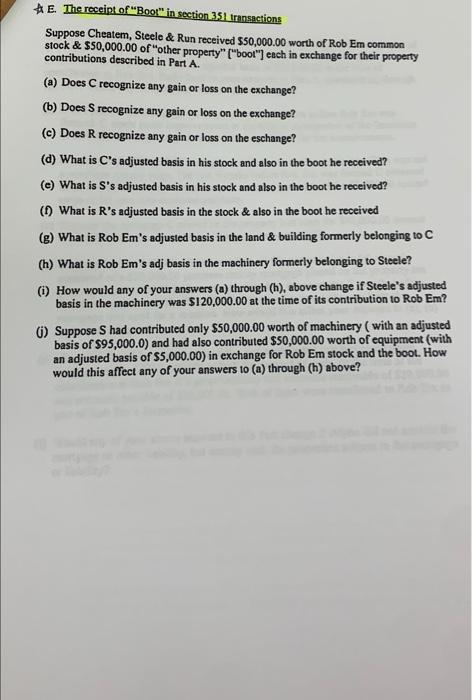

A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In September of the preset year, they decide to form Rob Em Blind Corporation. Cheatem contributes a building & land with a basis of $35,000 & a FMV of $100,000. Steele contributes machinery with a basis of $55,000.00 & A FMV of $100,000.00. Run contributes $100,000 in cash. Cheatem, Steele & Run receive 1,000 shares of the single class of Rob Em Blind's par $100.00 common stock. Assume each share is worth $100. A E. The receipt of "Boot" in section 351 transactions Suppose Cheatem, Steele & Run received $50,000.00 worth of Rob Em common stock & $50,000.00 of other property" ("book") each in exchange for their property contributions described in Part A. (a) Does C recognize any gain or loss on the exchange? (b) Does S recognize any gain or loss on the exchange? (c) Does R recognize any gain or loss on the eschange? (2) What is C's adjusted basis in his stock and also in the boot he received? (e) What is S's adjusted basis in his stock and also in the boot he received? ( What is R's adjusted basis in the stock & also in the boot he received (g) What is Rob Em's adjusted basis in the land & building formerly belonging to C (h) What is Rob Em's adj basis in the machinery formerly belonging to Steele? (0) How would any of your answers (a) through (h), above change if Steele's adjusted basis in the machinery was $120,000.00 at the time of its contribution to Rob Em? (1) Suppose S had contributed only $50,000.00 worth of machinery (with an adjusted basis of $95,000.0) and had also contributed $50,000.00 worth of equipment (with an adjusted basis of $5,000.00) in exchange for Rob Em stock and the boot. How would this affect any of your answers to (a) through (h) above? A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In September of the preset year, they decide to form Rob Em Blind Corporation. Cheatem contributes a building & land with a basis of $35,000 & a FMV of $100,000. Steele contributes machinery with a basis of $55,000.00 & A FMV of $100,000.00. Run contributes $100,000 in cash. Cheatem, Steele & Run receive 1,000 shares of the single class of Rob Em Blind's par $100.00 common stock. Assume each share is worth $100. A E. The receipt of "Boot" in section 351 transactions Suppose Cheatem, Steele & Run received $50,000.00 worth of Rob Em common stock & $50,000.00 of other property" ("book") each in exchange for their property contributions described in Part A. (a) Does C recognize any gain or loss on the exchange? (b) Does S recognize any gain or loss on the exchange? (c) Does R recognize any gain or loss on the eschange? (2) What is C's adjusted basis in his stock and also in the boot he received? (e) What is S's adjusted basis in his stock and also in the boot he received? ( What is R's adjusted basis in the stock & also in the boot he received (g) What is Rob Em's adjusted basis in the land & building formerly belonging to C (h) What is Rob Em's adj basis in the machinery formerly belonging to Steele? (0) How would any of your answers (a) through (h), above change if Steele's adjusted basis in the machinery was $120,000.00 at the time of its contribution to Rob Em? (1) Suppose S had contributed only $50,000.00 worth of machinery (with an adjusted basis of $95,000.0) and had also contributed $50,000.00 worth of equipment (with an adjusted basis of $5,000.00) in exchange for Rob Em stock and the boot. How would this affect any of your answers to (a) through (h) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts