Question: using answers from a) how would you solve F A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In September

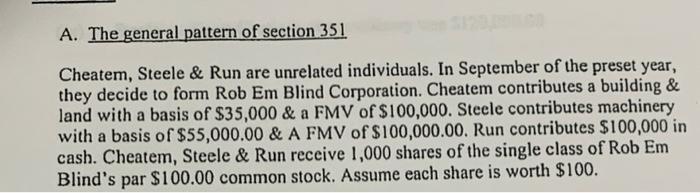

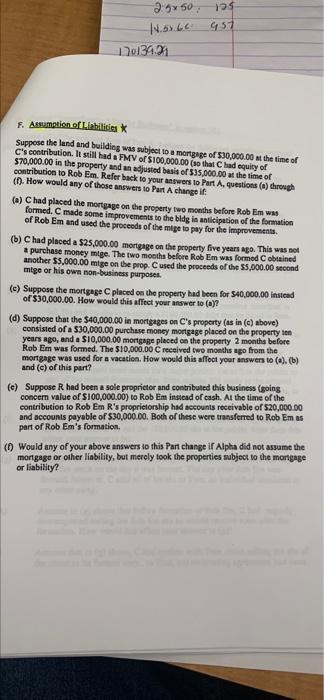

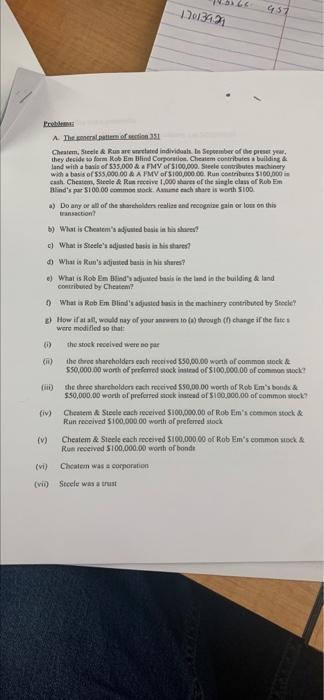

A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In September of the preset year, they decide to form Rob Em Blind Corporation. Cheatem contributes a building & land with a basis of $35,000 & a FMV of $100,000. Steele contributes machinery with a basis of $55,000.00 & A FMV of $100,000.00. Run contributes $100,000 in cash. Cheatem, Steele & Run receive 1,000 shares of the single class of Rob Em Blind's par $100.00 common stock. Assume each share is worth $100. 3950: 195 18.6.66 457 113421 E Amation of Liabilities Suppose the land and building was subject to a mortgage of $30,000.00 at the time of C's contribution. It still had a PMV of $100,000.00 (so that Chad equity of 570,000.00 in the property and an adjusted basis of 535,000.00 at the time of contribution to Rob Em. Refer back to your answers to Part A, questions() through (7. How would any of those answers to Part A change if (a) Chad placed the mortgage on the property two months before Rob Em was formed. C made some improvements to the bldg in anticipation of the formation of Rob Em and used the proceeds of the mage to pay for the improvements. (b) Chad placed a $25,000.00 mortgage on the property five years ago. This was not a purchase money mige. The two months before Rob Em was formed Cobtained another $5,000.00 mtge on the prop. Cused the proceeds of the 55,000.00 second mtge or his own non-business purposes (c) Suppose the mortgage C placed on the property had been for 540,000.00 instead of $30,000.00. How would this affect your answer to (d) Suppose that the $40,000.00 in mortgages on C's property (as in (c) above) consisted of a $30,000.00 purchase money mortgage placed on the property in years ago, and a $10,000.00 mortgage placed on the property 2 months before Rob Em was formed. The $10,000.00 received two months ago from the mortgage was used for a vacation. How would this affect your answers to (-). (b) and (c) of this part? (c) Suppose R had been a sole proprietor and contributed this business (going concern value of $100,000.00) to Rob Em instead of cash. At the time of the contribution to Rob Em R's proprietorship had accounts receivable of $20,000.00 and accounts payable of $30,000.00. Both of these were transferred to Rob Em as part of Rob Em's formation (0) Would any of your above answers to this part change if Alpha did not assume the mortgage or other liability, but merely took the properties subject to the mortgage or liability? 13013401 4057 A Theatest Chesten, Steele & Rusare related individuals. In Sepomber of the preset you they decide to form Rob Em Blind Corporation Cliente contributes building & land with a basis of 535.000 & . FMV 100,000. Steele contributes machinery with a basis of 555,000.00 AA FMV of $100,000.00 Run contributes $100.000 cash. Chester, Steile & Rus receive 1.000 shares of the single class of Robin Blind's par S100.00 common ock. Anume each share is worth $100 a) Do any or all of the shareholders realice and recognize gain or low on this transaction b) What is Chestem's adjusted banke in his shared! c) What is Steele's adjusted basis is his shares? What Run's adjusted basis in his shures? .) What is Rob Em Blind jented basis in the land in the building & lund by ? What a Rab Em Blind's adjusted hansis in the machinery entributed by Steele 2) How it all, would say of your answer to (a) through change if the fute a were modified so that 6) the stock received were so per () the three shareholders each received 550,00.00 worth of common stock $50,000.00 worth of preferred stock instead of $100.000.00 of common stock fill) the three shurcholders cach received 550,00.00 worth of Rob Em's bons & $50,000.00 worth of preferred sock instead of S100,000.00 of common ock? fiv) Cheatem & Steele cach received 100,000.00 of Rob Em's common stock & Run received 100.000.00 worth of preferred stock (v) Cheatem & Steele each received $100,000.00 of Rob Em's common stock Run received 5100,000.00 worth of bond (vi) Chalem was corporation (vid Seele was a trust : A. The general pattern of section 351 Cheatem, Steele & Run are unrelated individuals. In September of the preset year, they decide to form Rob Em Blind Corporation. Cheatem contributes a building & land with a basis of $35,000 & a FMV of $100,000. Steele contributes machinery with a basis of $55,000.00 & A FMV of $100,000.00. Run contributes $100,000 in cash. Cheatem, Steele & Run receive 1,000 shares of the single class of Rob Em Blind's par $100.00 common stock. Assume each share is worth $100. 3950: 195 18.6.66 457 113421 E Amation of Liabilities Suppose the land and building was subject to a mortgage of $30,000.00 at the time of C's contribution. It still had a PMV of $100,000.00 (so that Chad equity of 570,000.00 in the property and an adjusted basis of 535,000.00 at the time of contribution to Rob Em. Refer back to your answers to Part A, questions() through (7. How would any of those answers to Part A change if (a) Chad placed the mortgage on the property two months before Rob Em was formed. C made some improvements to the bldg in anticipation of the formation of Rob Em and used the proceeds of the mage to pay for the improvements. (b) Chad placed a $25,000.00 mortgage on the property five years ago. This was not a purchase money mige. The two months before Rob Em was formed Cobtained another $5,000.00 mtge on the prop. Cused the proceeds of the 55,000.00 second mtge or his own non-business purposes (c) Suppose the mortgage C placed on the property had been for 540,000.00 instead of $30,000.00. How would this affect your answer to (d) Suppose that the $40,000.00 in mortgages on C's property (as in (c) above) consisted of a $30,000.00 purchase money mortgage placed on the property in years ago, and a $10,000.00 mortgage placed on the property 2 months before Rob Em was formed. The $10,000.00 received two months ago from the mortgage was used for a vacation. How would this affect your answers to (-). (b) and (c) of this part? (c) Suppose R had been a sole proprietor and contributed this business (going concern value of $100,000.00) to Rob Em instead of cash. At the time of the contribution to Rob Em R's proprietorship had accounts receivable of $20,000.00 and accounts payable of $30,000.00. Both of these were transferred to Rob Em as part of Rob Em's formation (0) Would any of your above answers to this part change if Alpha did not assume the mortgage or other liability, but merely took the properties subject to the mortgage or liability? 13013401 4057 A Theatest Chesten, Steele & Rusare related individuals. In Sepomber of the preset you they decide to form Rob Em Blind Corporation Cliente contributes building & land with a basis of 535.000 & . FMV 100,000. Steele contributes machinery with a basis of 555,000.00 AA FMV of $100,000.00 Run contributes $100.000 cash. Chester, Steile & Rus receive 1.000 shares of the single class of Robin Blind's par S100.00 common ock. Anume each share is worth $100 a) Do any or all of the shareholders realice and recognize gain or low on this transaction b) What is Chestem's adjusted banke in his shared! c) What is Steele's adjusted basis is his shares? What Run's adjusted basis in his shures? .) What is Rob Em Blind jented basis in the land in the building & lund by ? What a Rab Em Blind's adjusted hansis in the machinery entributed by Steele 2) How it all, would say of your answer to (a) through change if the fute a were modified so that 6) the stock received were so per () the three shareholders each received 550,00.00 worth of common stock $50,000.00 worth of preferred stock instead of $100.000.00 of common stock fill) the three shurcholders cach received 550,00.00 worth of Rob Em's bons & $50,000.00 worth of preferred sock instead of S100,000.00 of common ock? fiv) Cheatem & Steele cach received 100,000.00 of Rob Em's common stock & Run received 100.000.00 worth of preferred stock (v) Cheatem & Steele each received $100,000.00 of Rob Em's common stock Run received 5100,000.00 worth of bond (vi) Chalem was corporation (vid Seele was a trust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts