Question: Using a credit card statement of pricing and terms, answer the following questions. 1. 1. How many different possible rates could you be charged according

Using a credit card statement of pricing and terms, answer the following questions.

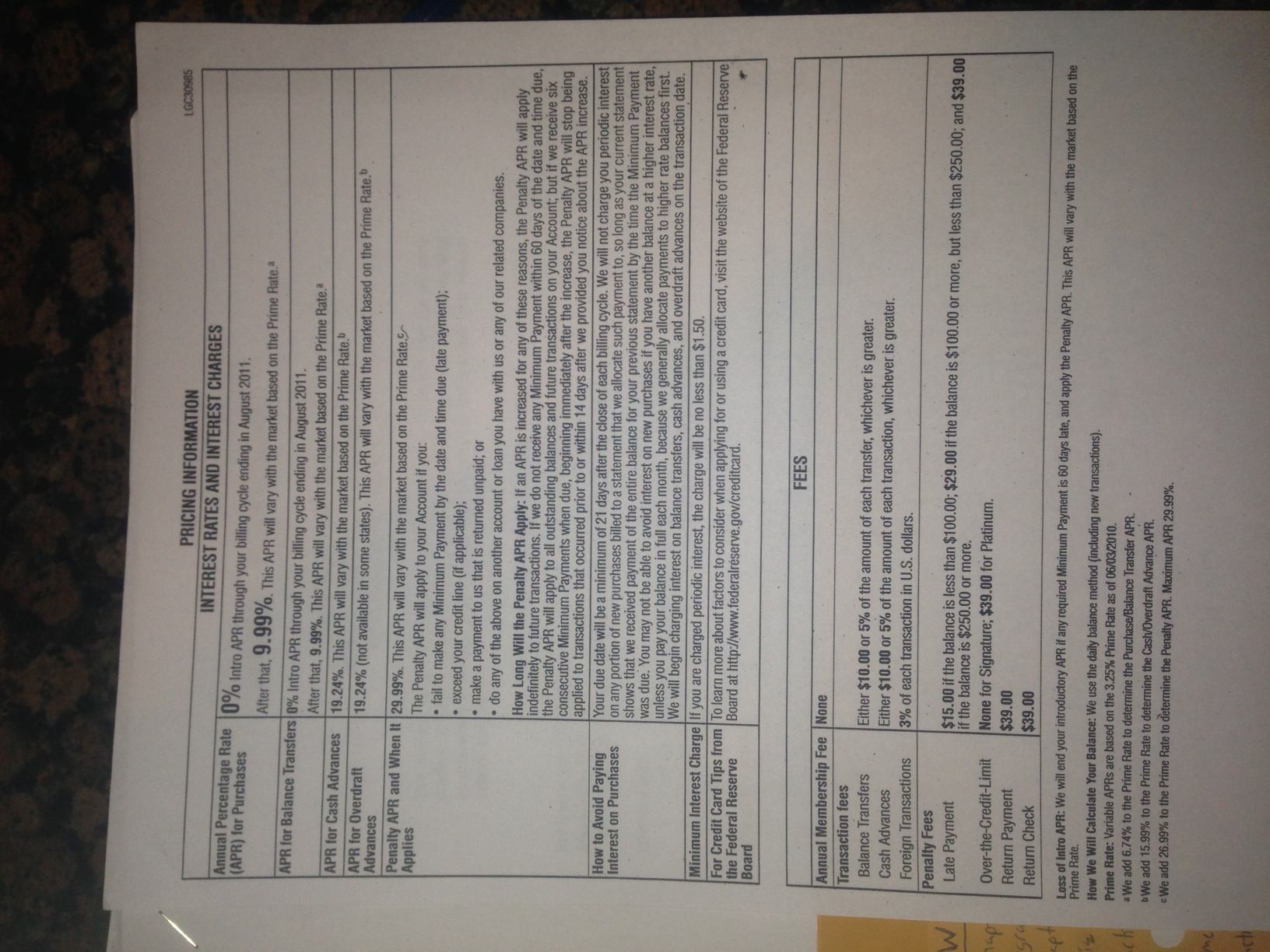

1. 1. How many different possible rates could you be charged according to the contract?

2. 2. Assuming that the interest is compounded daily, what is the effective annual rate for each APR given?

3. 3. If the prime rate changes to 4.3%, what is the EAR that you would have to pay under normal circumstances?

4. 4. If you purchase an item for $100 and are charged the regular rate for one year (assume that you don

Loss of Intro APR: We will end your introductory APR it any required Minimum Payment is 60 days late, and apply the Penalty APR. This APR will vary with the market based on the Prime Rate. How We Will Calculate Your Balance: We use the daily balance method (including new transactions). Prime Rate: Variable APRs are based on the 3.25% Prime Rate as of 06/03/2010. We add 6.74% to the Prime Rate to determine the Purchase/Balance Transfer APR. We add 15.99% to the Prime Rate to determine the Cash/Overdraft Advance APR. We add 26.99% to the Prime Rate to determine the Penalty APR. Maximum APR 29.99%. Loss of Intro APR: We will end your introductory APR it any required Minimum Payment is 60 days late, and apply the Penalty APR. This APR will vary with the market based on the Prime Rate. How We Will Calculate Your Balance: We use the daily balance method (including new transactions). Prime Rate: Variable APRs are based on the 3.25% Prime Rate as of 06/03/2010. We add 6.74% to the Prime Rate to determine the Purchase/Balance Transfer APR. We add 15.99% to the Prime Rate to determine the Cash/Overdraft Advance APR. We add 26.99% to the Prime Rate to determine the Penalty APR. Maximum APR 29.99%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts