Question: Using a modified discriminant function similar to Altman's, Burger Bank estimates the following coefficients for its portfolio of loans: Z = 1 . 4 x

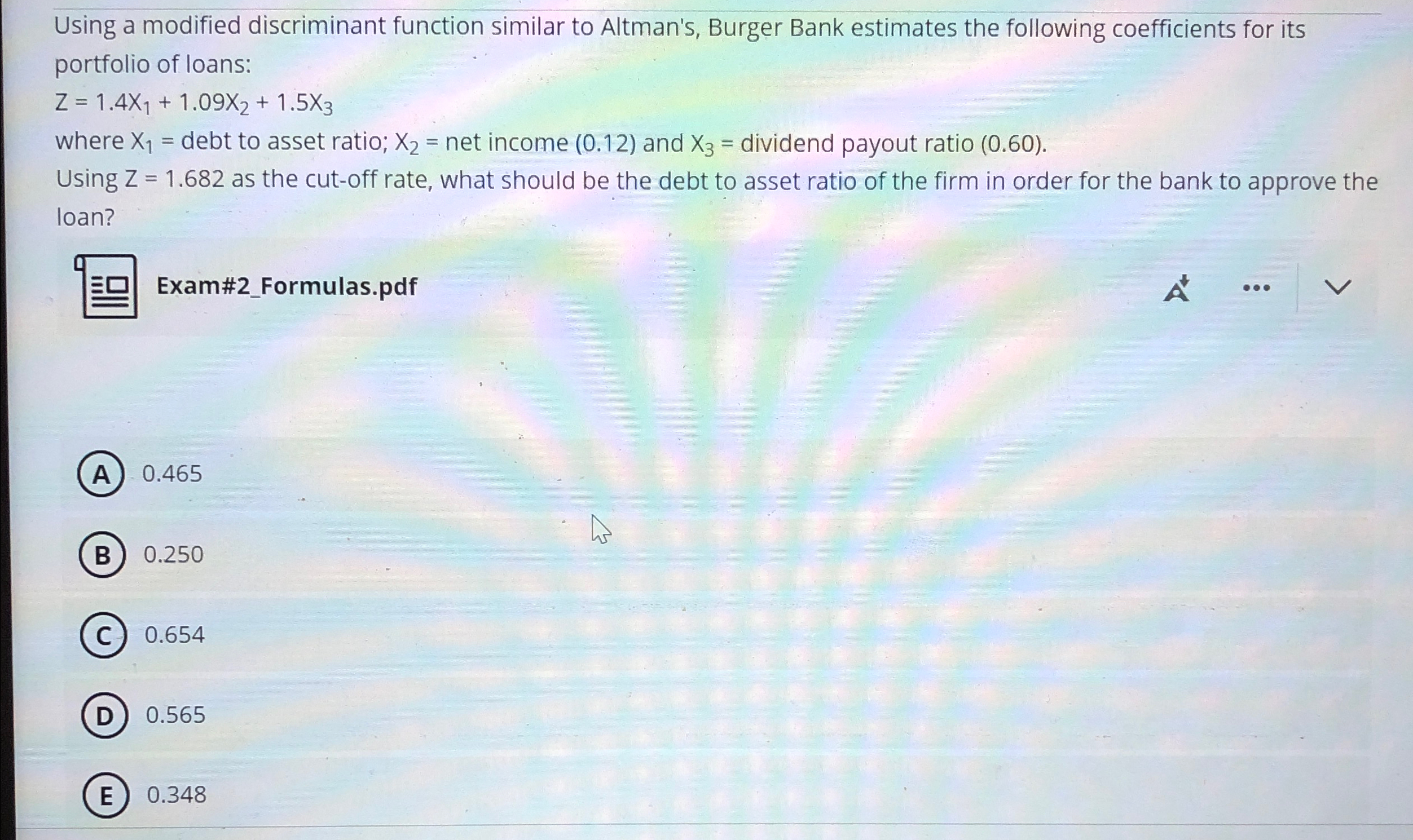

Using a modified discriminant function similar to Altman's, Burger Bank estimates the following coefficients for its portfolio of loans:

where debt to asset ratio; net income and dividend payout ratio

Using as the cutoff rate, what should be the debt to asset ratio of the firm in order for the bank to approve the loan?

Exam#Formulas.pdf

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock