Question: Using a Ti-84: I am getting NPV(11.15909878, 0, L1) = 99218.360324 L1 is the cash flows The solved equation says the NPV is 9094.04540 .

Using a Ti-84:

I am getting NPV(11.15909878, 0, L1) = 99218.360324

"L1 is the cash flows"

The solved equation says the NPV is 9094.04540. What am I doing wrong?

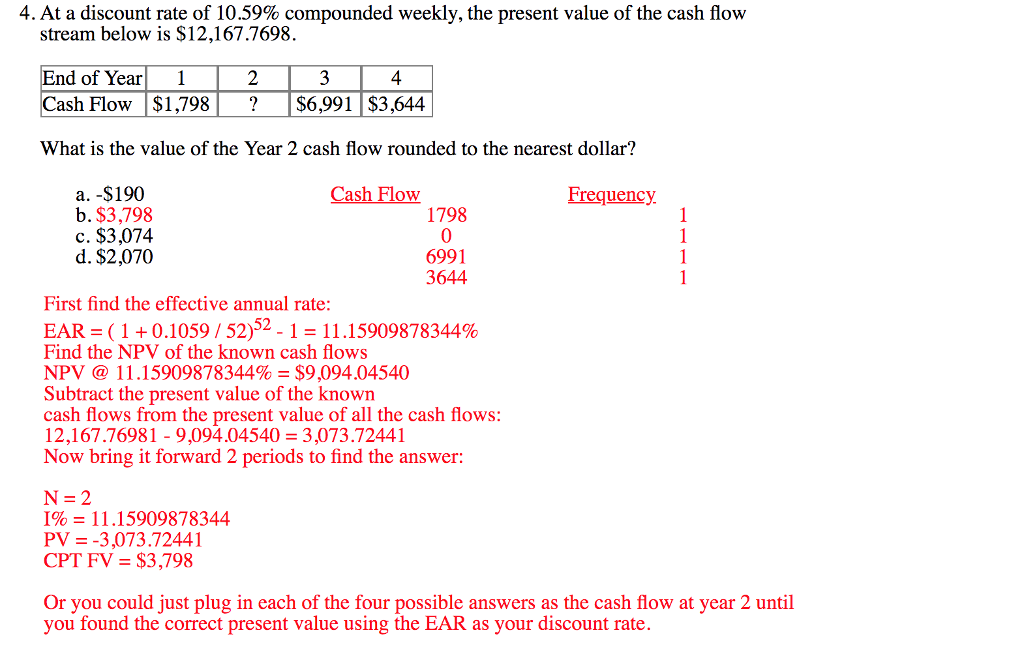

4. At a discount rate of 10.59% compounded weekly, the present value of the cash flow stream below is $12,167.7698 nd of Year1 Cash Flow $1,798$6,991 $3,644 What is the value of the Year 2 cash flow rounded to the nearest dollar? 2 4 a. -$190 Cash Flow Frequency 1798 0 6991 3644 b. $3,798 c. $3,074 d. $2,070 First find the effective annual rate: EARz ( 1 + 0.1059 / 52)52-1-11 . 15909878344% ind the NPV Or the Khowh cash ioWS NPV @ 11.15909878344%-$9.094.04540 Subtract the present value of the known cash flows from the present value of all the cash flows: 12,167.76981 -9,094.04540 3,073.72441 Now bring it forward 2 periods to find the answer: 190-11 . 15909878344 PV -3,073.72441 CPT FV = $3,798 Or you could just plug in each of the four possible answers as the cash flow at year 2 until you found the correct present value using the EAR as your discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts