Question: Using Activity Based Costing: 1) Perform the first stage allocation of costs to the activity pools 2) Compute the activity rates for the activity cost

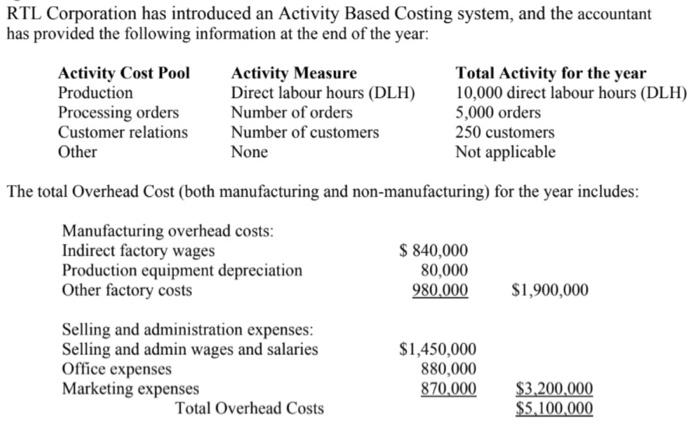

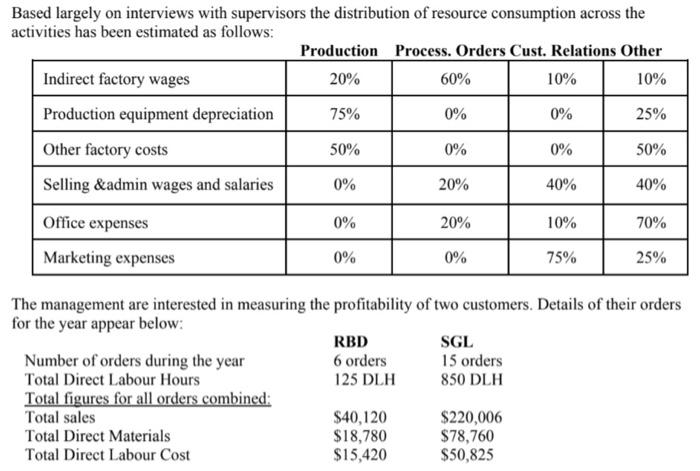

RTL Corporation has introduced an Activity Based Costing system, and the accountant has provided the following information at the end of the year: Activity Measure Activity Cost Pool Production Direct labour hours (DLH) Number of orders Total Activity for the year 10,000 direct labour hours (DLH) 5,000 orders Processing orders Customer relations 250 customers Number of customers None Other Not applicable The total Overhead Cost (both manufacturing and non-manufacturing) for the year includes: Manufacturing overhead costs: Indirect factory wages $ 840,000 80,000 Production equipment depreciation Other factory costs 980,000 $1,900,000 Selling and administration expenses: Selling and admin wages and salaries Office expenses $1,450,000 880,000 Marketing expenses 870,000 $3,200,000 Total Overhead Costs $5,100,000 Based largely on interviews with supervisors the distribution of resource consumption across the activities has been estimated as follows: Production Process. Orders Cust. Relations Other Indirect factory wages 20% 60% 10% 10% Production equipment depreciation 75% 0% 0% 25% Other factory costs 50% 0% 0% 50% Selling &admin wages and salaries 0% 20% 40% 40% Office expenses 0% 20% 10% 70% Marketing expenses 0% 0% 75% 25% The management are interested in measuring the profitability of two customers. Details of their orders for the year appear below: SGL RBD 6 orders Number of orders during the year 15 orders Total Direct Labour Hours 125 DLH 850 DLH Total figures for all orders combined: Total sales $40,120 $220,006 Total Direct Materials $18,780 $78,760 Total Direct Labour Cost $15,420 $50,825

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts