Question: Using aggressive mail promotion with low introductory interest rates, Yeager National Bank (YNB) built a large base of credit card customers throughout the continental United

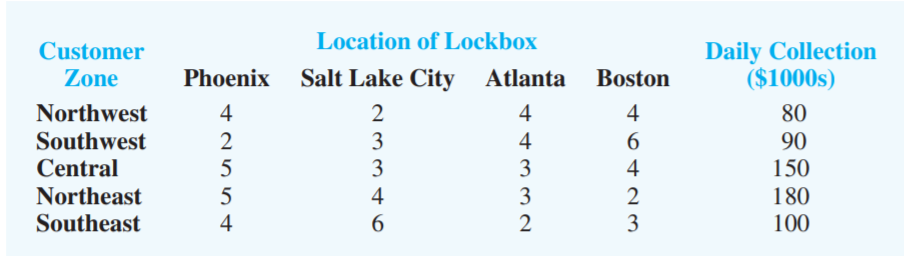

Using aggressive mail promotion with low introductory interest rates, Yeager National Bank (YNB) built a large base of credit card customers throughout the continental United States. Currently, all customers send their regular payments to the banks corporate office located in Charlotte, North Carolina. Daily collections from customers making their regular payments are substantial, with an average of approximately $600,000. YNB estimates that it makes about 15 percent on its funds and would like to ensure that customer payments are credited to the banks account as soon as possible. For instance, if it takes five days for a customers payment to be sent through the mail, processed, and credited to the banks account, YNB has potentially lost five days worth of interest income. Although the time needed for this collection process cannot be completely eliminated, reducing it can be beneficial given the large amounts of money involved. Instead of having all its credit card customers send their payments to Charlotte, YNB is considering having customers send their payments to one or more regional collection centers, referred to in the banking industry as lockboxes. Four lockbox locations have been proposed: Phoenix, Salt Lake City, Atlanta, and Boston. To determine which lockboxes to open and where lockbox customers should send their payments, YNB divided its customer base into five geographical regions: Northwest, Southwest, Central, Northeast, and Southeast. Every customer in the same region will be instructed to send his or her payment to the same lockbox. The following table shows the average number of days it takes before a customers payment is credited to the banks account when the payment is sent from each of the regions to each of the potential lockboxes:

Dave Wolff, the vice president for cash management, asked you to prepare a report containing your recommendations for the number of lockboxes and the best lockbox locations. Mr. Wolff is primarily concerned with minimizing lost interest income, but he wants you to also consider the effect of an annual fee charged for maintaining a lockbox at any location. Although the amount of the fee is unknown at this time, we can assume that the fees will be in the range of $20,000 to $30,000 per location. Once good potential locations have been selected, Mr. Wolff will inquire as to the annual fees.

Formulate an integer linear programming taking into account the annual fees if potential locations were to be selected (variable binary, linking constraints).

Boston Customer Zone Northwest Southwest Central Northeast Southeast Location of Lockbox Phoenix Salt Lake City Atlanta 4 2 4 2 2 3 4 5 3 3 5 4. 3 4 6 2 tant mm 4 6 4. 2 3 Daily Collection ($1000s) 80 90 150 180 100Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts