Question: Using Annual Worth Analysis which alternative should we select? No use of Excel Pleaseee Problem (6): Consider the following three mutually exclusive alternatives. MARR is

Using Annual Worth Analysis which alternative should we select?

Using Annual Worth Analysis which alternative should we select?

No use of Excel Pleaseee

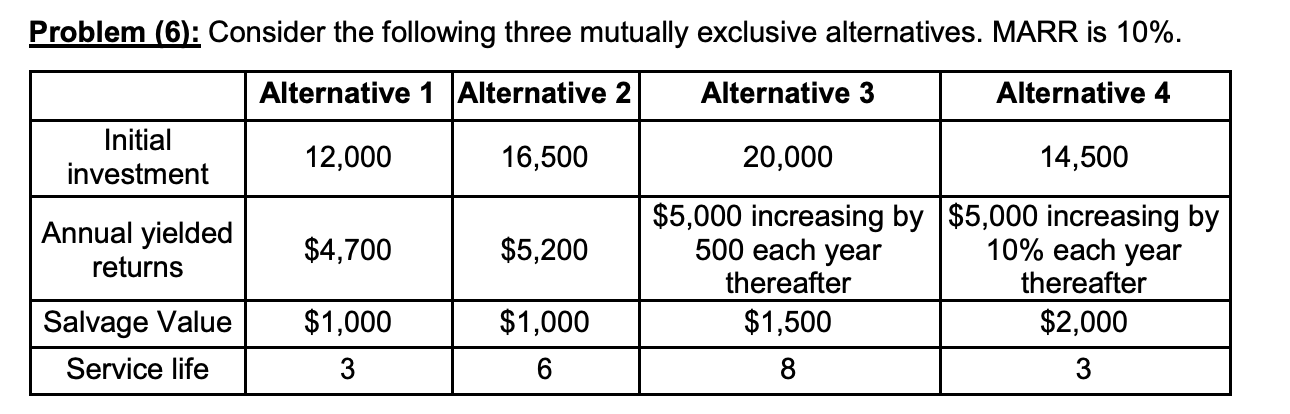

Problem (6): Consider the following three mutually exclusive alternatives. MARR is 10%. Alternative 1 Alternative 2 Alternative 3 Alternative 4 Initial investment 12,000 16,500 20,000 14,500 Annual yielded returns $4,700 $5,200 $5,000 increasing by $5,000 increasing by 500 each year 10% each year thereafter thereafter $1,500 $2,000 3 $1,000 Salvage Value Service life $1,000 6 3 Problem (6): Consider the following three mutually exclusive alternatives. MARR is 10%. Alternative 1 Alternative 2 Alternative 3 Alternative 4 Initial investment 12,000 16,500 20,000 14,500 Annual yielded returns $4,700 $5,200 $5,000 increasing by $5,000 increasing by 500 each year 10% each year thereafter thereafter $1,500 $2,000 3 $1,000 Salvage Value Service life $1,000 6 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts