Question: Using appendix exhibits 14.A1 and 14.A2 as a guide, create YOUR OWN example of how to calculate the present value of a bond by addressing

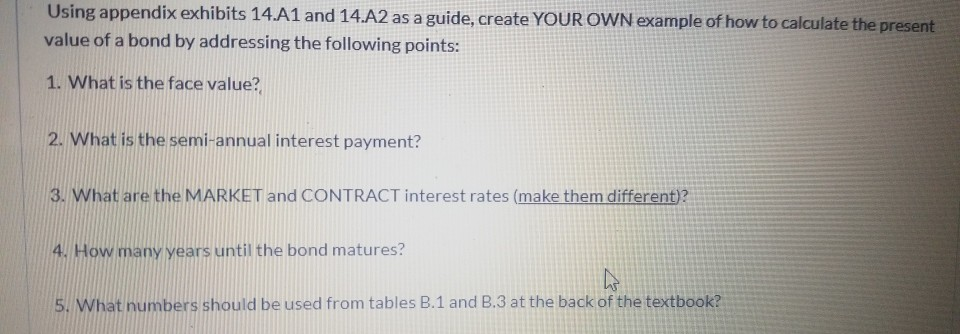

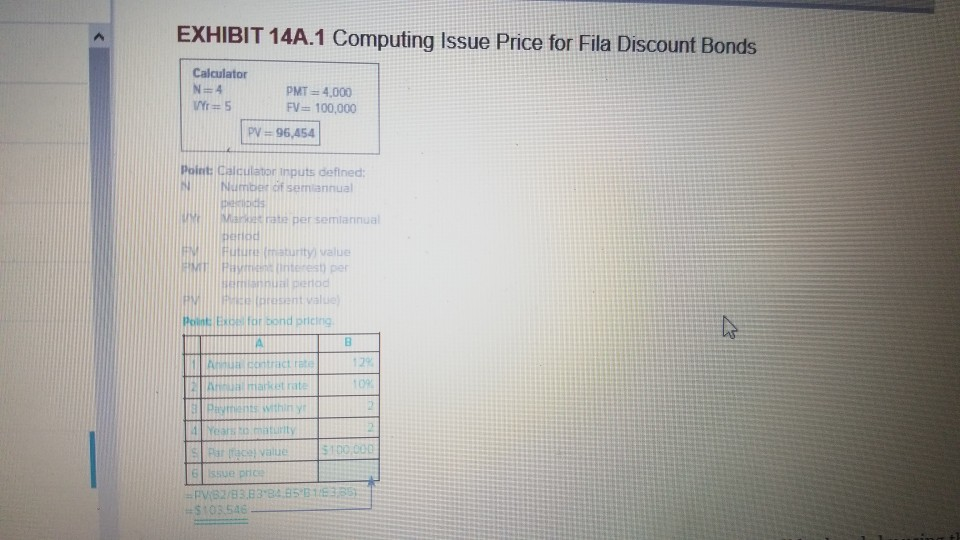

Using appendix exhibits 14.A1 and 14.A2 as a guide, create YOUR OWN example of how to calculate the present value of a bond by addressing the following points: 1. What is the face value? 2. What is the semi-annual interest payment? 3. What are the MARKET and CONTRACT interest rates (make them different)? 4. How many years until the bond matures? w 5. What numbers should be used from tables B.1 and B.3 at the back of the textbook? EXHIBIT 14A.1 Computing Issue Price for Fila Discount Bonds Calculator N=4 PMT= 4,000 V = 5 FV = 100.000 PV = 96,454 Point: Calculator inputs defined: N Number of semiannual What per semiannual Period Future naturity value TIM Pati per emanual benod AM tesent value) Point of cond pricing A B ANCIE 129 A markette 100 W that thiny EINE Place value $100 COD skue price PVB2/83.3 84 8561163357 $105.546 EXHIBIT 14A.2 Computing Issue Price for Adidas Premium Bonds Calculator N=4 I/Y = 5 PMT= 6,000 FV=100,000 PV = 103,546 Present Value Factor Present Value Cash Flow Table Amount $100,000 par (maturity) value. $6,000 interest payments. Price of bond. B. 1 (PV of 1) B.3 (PV of ann.) 0.8227 3.5460 X $100,000 6,000 = $ 82.270 21.276 $103.546

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts