Question: Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05

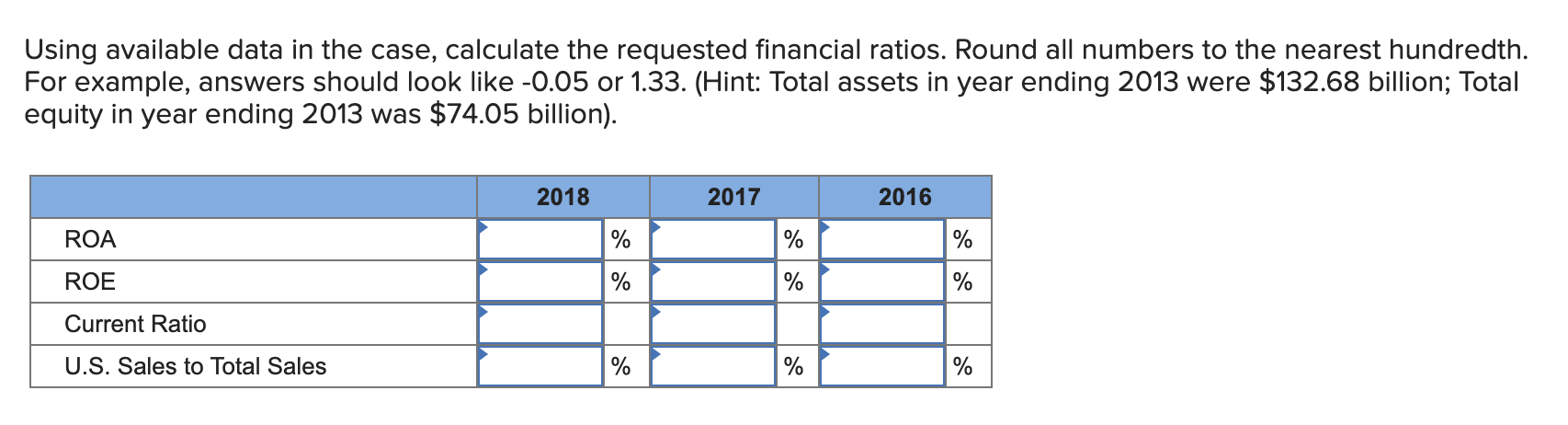

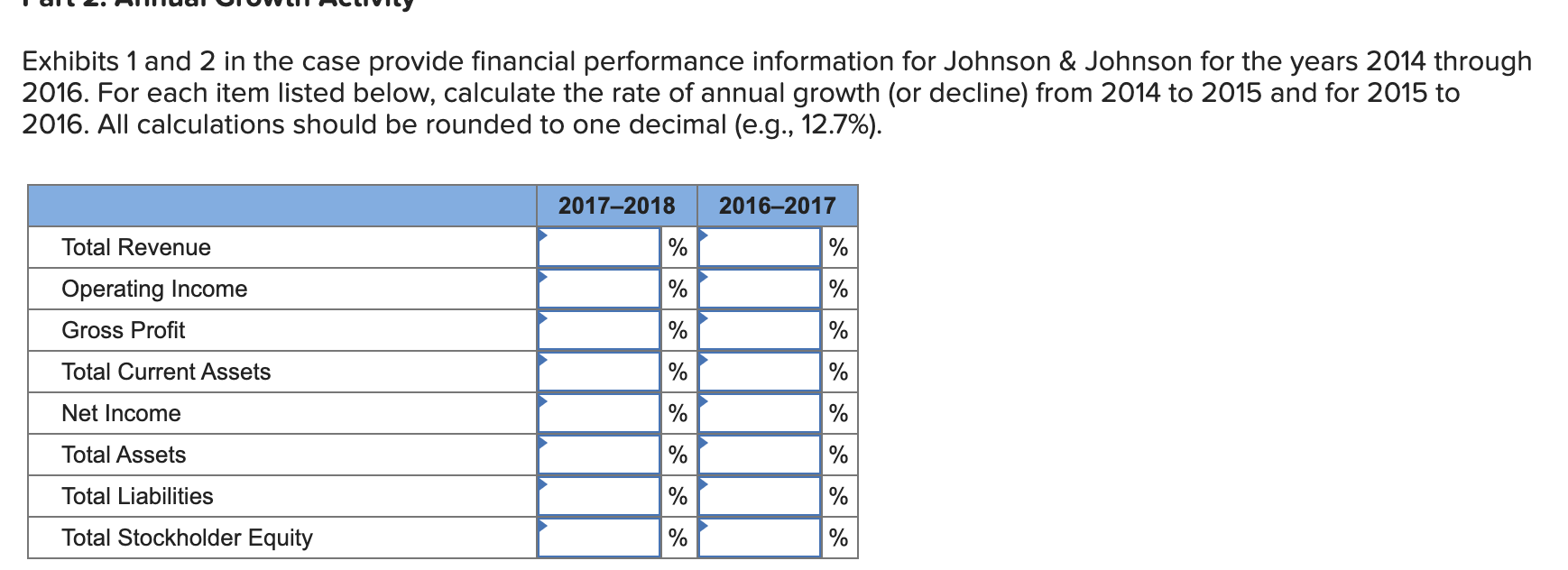

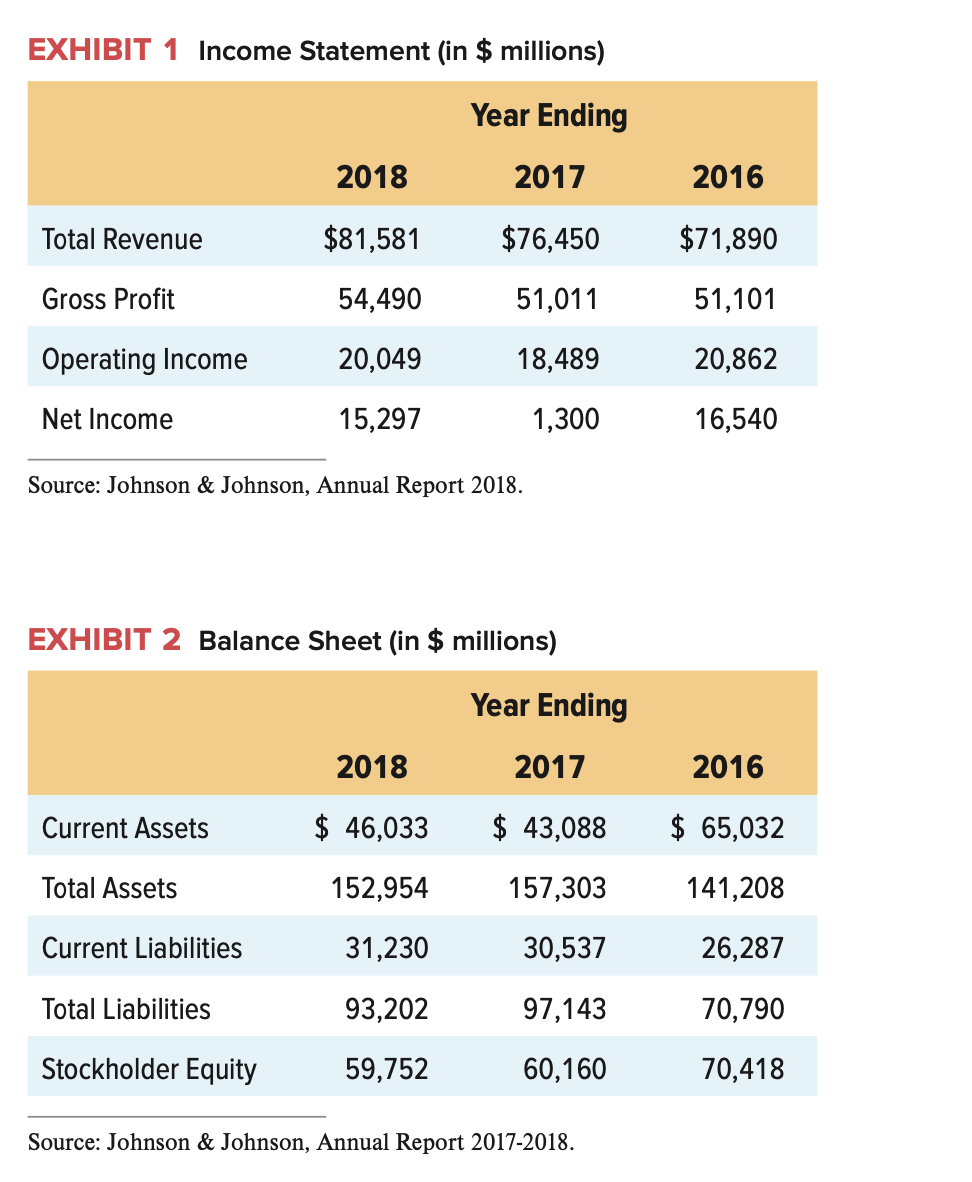

Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33. (Hint: Total assets in year ending 2013 were $132.68 billion; Total equity in year ending 2013 was $74.05 billion). Exhibits 1 and 2 in the case provide financial performance information for Johnson \& Johnson for the years 2014 through 2016. For each item listed below, calculate the rate of annual growth (or decline) from 2014 to 2015 and for 2015 to 2016. All calculations should be rounded to one decimal (e.g., 12.7\%). EXHIBIT 1 Income Statement (in \$ millions) Source: Johnson \& Johnson, Annual Report 2018. EXHIBIT 2 Balance Sheet (in $ millions) Source: Johnson \& Johnson, Annual Report 2017-2018. Using available data in the case, calculate the requested financial ratios. Round all numbers to the nearest hundredth. For example, answers should look like -0.05 or 1.33. (Hint: Total assets in year ending 2013 were $132.68 billion; Total equity in year ending 2013 was $74.05 billion). Exhibits 1 and 2 in the case provide financial performance information for Johnson \& Johnson for the years 2014 through 2016. For each item listed below, calculate the rate of annual growth (or decline) from 2014 to 2015 and for 2015 to 2016. All calculations should be rounded to one decimal (e.g., 12.7\%). EXHIBIT 1 Income Statement (in \$ millions) Source: Johnson \& Johnson, Annual Report 2018. EXHIBIT 2 Balance Sheet (in $ millions) Source: Johnson \& Johnson, Annual Report 2017-2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts