Question: Using Excel, prepare the Statement of Cash Flows Indirect Method. Your SOCF should be based upon the income statement and the additional information below: Additional

Using Excel, prepare the Statement of Cash Flows Indirect Method. Your SOCF should be based upon the income statement and the additional information below: Additional Information: Increase in Accounts Receivables=$4,000 Increase in Accounts Payables=$16,000 Increase in Income Taxes Payable=$300 Decrease in Prepaid Expenses=$10,000 Decrease in Merchandise Inventory=$14,000 Decrease in Long Term Notes Payable=$20,000 Cash Paid to Purchase Land=$50,000 Cash Paid to Purchase Equipment=$15,000 Cash Paid to Retire Bonds=$25,000 Cash Paid to for Dividends=$10,000 Cash Received from the Sale of common stock=$50,000 Cash at the start of the year=$24,000 Part 2: Direct Method Using Excel and the below information please prepare the complete statement of cash flows using the direct method. Additional Information: Cash Received from Customers=$80,000 Cash Payments for Merchandise=$10,000 Cash Payments for Operating Expenses=$5,000 Cash payments for Interest=$6,000 Cash Payments for Income Taxes=$3,000

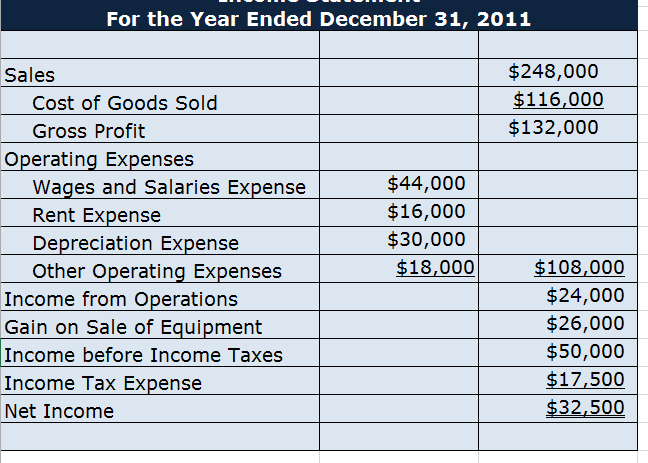

For the Year Ended December 31, 2011 $248,000 $116,000 $132,000 Sales Cost of Goods Sold Gross Profit Operating Expenses $44,000 $16,000 $30,000 Wages and Salaries Expense Rent Expense Depreciation Expense Other Operating Expenses $108,000 $24,000 $26,000 $50,000 $17,500 32,500 $18,000 Income from Operations Gain on Sale of Equipment Income before Income Taxes Income Tax Expense Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts