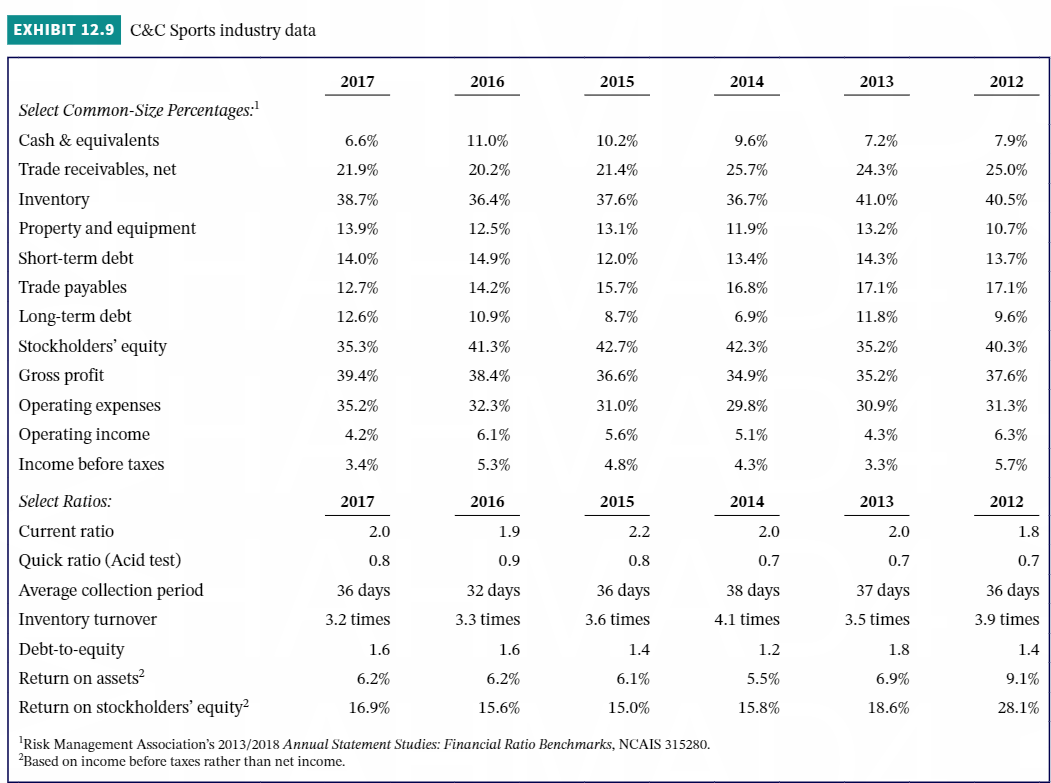

Question: Using Exhibit 12.9 as a guide, compare C&C Sports' performance to the industry averages. What particular observations and recommendations do you have for George Douglas,

Using Exhibit 12.9 as a guide, compare C&C Sports' performance to the industry averages. What particular observations and recommendations do you have for George Douglas, president of C&C Sports?

m C&C Sports industry data Select CommonSize Percentoges:l Cash 8: equivalents Trade receivables, net Inventory Property and equipment Short-term debt Trade payables Longterm debt Stockholders' equity Gross prot Operating expenses Operating income . . 5.6% Income before taxes . . 4.8% Select Ratios: 2015 Current ratio 2.0 1.9 2.2 Quick ratio (Acid test) 0.8 0.9 0.8 Average collection period 36 days 32 days 36 days Inventory turnover 3.2 times 3.3 times 3.6 times Debttoequity 1.6 1.6 1.4 Retum on assets2 6.2% 6.2% 6.1% Return on stockholders' equity2 16.9% 15.6% 15.0% 'st1: Management Association's 2013f20-18 Annual SMment Studies: Financial Ratio Benchmks, NCAIS 315230. 2Based on income before taxes rather than net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts