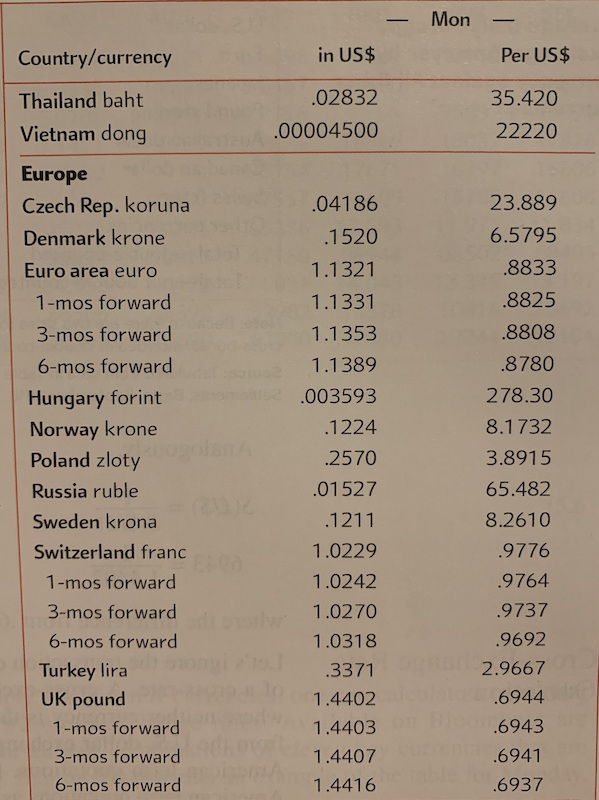

Question: Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the US dollar versus the British Pound using European term quotations.

Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the US dollar versus the British Pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?

fN$=FN( j / $ ) - S(j / $ ) / S ( j / $) x 360/days

Mon Country/currency in US$ Per US$ Thailand baht 35.420 .02832 .00004500 Vietnam dong 22220 .04186 .1520 1.1321 1.1331 1.1353 Europe Czech Rep. koruna Denmark krone Euro area euro 1-mos forward 3-mos forward 6-mos forward Hungary forint Norway Krone Poland zloty Russia ruble Sweden krona Switzerland franc 1-mos forward 3-mos forward 6-mos forward Turkey lira UK pound 1-mos forward 3-mos forward 6-mos forward 1.1389 .003593 .1224 .2570 .01527 .1211 1.0229 1.0242 1.0270 1.0318 .3371 1.4402 1.4403 1.4407 1.4416 23.889 6.5795 .8833 .8825 .8808 .8780 278.30 8.1732 3.8915 65.482 8.2610 .9776 .9764 .9737 .9692 2.9667 .6944 .6943 .6941 .6937

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts