Question: Using Figure 4-3 from the textbook (also given on slide 16 for Chapter 4), estimate the cost of debt for a firm that traditionally offers

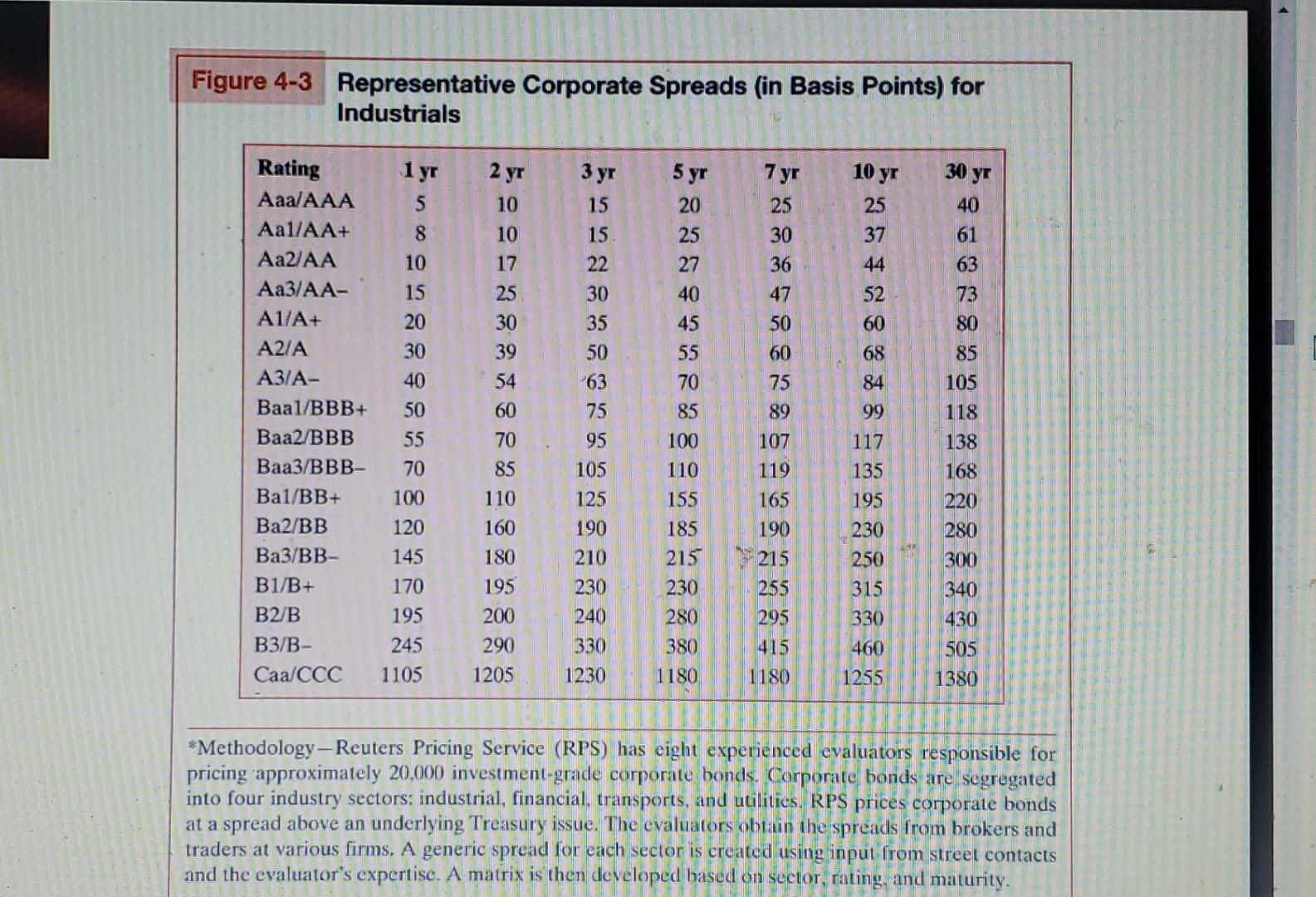

Using Figure 4-3 from the textbook (also given on slide 16 for Chapter 4), estimate the cost of debt for a firm that traditionally offers only 10-year bonds and has a A+ debt rating from S&P. Assume, if necessary, that current Treasury yields are as follows, and answer in percentage points without the percentage sign (.e., 25.8% should be given as 25.8). 1 mo. - 0.03% 3 mo.-0.05% 6 mo. - 0.07% 1 yr. - 0.08% 5 yr. - 0.71% 10 yr. - 1.65% 20 yr. - 2.11% 30 yr. - 2.23% Your Answer: Answer Question 4 (1 point) ALP-PP originally issued its preferred shares at 5.3% of their $25 par value, paying a $1.33 dividend. Those shares are currently trading at $27.0. What is your estimate of this firm's cost of preferred stock? Answer in decimal form to four decimal places, e.g., 26.1% is.2610. Your Answer: Answer Figure 4-3 Representative Corporate Spreads (in Basis Points) for Industrials 1 yr 5 30 yr 40 61 8 10 7 yr 25 30 36 47 50 10 yr 25 37 44 52 60 63 15 68 60 75 84 89 Rating Aaa/AAA Aa1/AA+ Aa2/AA Aa3/AA- ATA+ A2/A A3/A- Baal/BBB+ Baa2/BBB Baa3/BBB- Bal/BB+ Ba2/BB Ba3/BB- B1/B+ B2/B B3/B- Caa/CCC 99 2 yr 10 10 17 25 30 39 54 60 70 85 110 160 180 195 200 290 1205 73 80 85 105 118 138 168 20 30 40 50 55 70 100 120 145 170 195 245 1105 3 yr 15 15 22 30 35 50 63 75 95 105 125 190 210 230 240 330 1230 5 yr 20 25 27 40 45 55 70 85 100 110 155 185 215 230 280 380 1180 107 119 165 190 215 255 295 415 117 135 195 230 250 315 330 460 1255 220 280 300 340 430 505 1180 1380 *Methodology-Reuters Pricing Service (RPS) has eight experienced evaluators responsible for pricing approximately 20,000 investment-grade corporate bonds. Corporate bonds are segregated into four industry sectors: industrial, financial, transports, and utilities. RPS prices corporate bonds at a spread above an underlying Treasury issue. The evaluators obtain the spreads from brokers and traders at various firms. A generic spread for each sector is created using input from street contacts and the evaluator's expertise. A matrix is then developed based on sector, rating, and maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts